Markets | E&P | NGI All News Access | NGI Data

Traders Take Storage Data in Stride, Focus on Weather

The physical natural gas market for Friday delivery was well scrambled in Thursday’s trading.

Points in and around the eastern metropolises of Boston, New York and Philadelphia suffered double-digit dollar losses Thursday for gas delivery Friday, and locations proximate to the Midwest and Northern Plains saw declines of $2 or more. Gulf locations were seen about 50 cents higher, and the Midcontinent, Rockies and California generally firmed.

The Energy Information Administration reported a withdrawal from storage of 107 Bcf. Typically the report would be a market-mover. The 107 Bcf was about in line with market expectations, and a futures market that screamed higher on the open by more than 25 cents on continued supportive weather outlooks saw little impact from the report and continued to work its way lower settling just a few pennies higher. At the close, February futures had added 4.1 cents to $4.730 after trading as high as $4.947. March gained 2.9 cents to $4.579, and March crude oil tacked on 59 cents to $97.32/bbl.

Forecasters aren’t calling for any immediate end to the onslaught of cold air from the polar vortex, but they admit that the cold will come in pulses, with some moderation in temperatures between pulses. “Bitterly cold air is again settling southward from the Arctic into a large part of the eastern states. Unlike the outbreak from early January, this time the cold will have more staying power,” said AccuWeather.com meteorologist Alex Sosnowski.

“Into the first part of next week, the polar vortex will hover just north of the United States border, causing waves of frigid air to blast into the Midwest and much of the East. While temperatures will briefly rebound in between the reinforcing waves of cold air, the rebounds will be much less pronounced from the Midwest to New England and may be barely noticeable in the northern tier states.

“The combination of the cold and open waters of the Great Lakes will lead to rounds of lake-effect snow and whiteout conditions. A total of three waves of arctic air will blast across the Midwest and Northeast into next week. The next blast of arctic air will reach the Upper Midwest by Wednesday. Temperatures may stay below freezing in Minneapolis, Chicago, Milwaukee, Detroit and Cleveland through the end of the month, where highs most days will be in the teens.

“In Boston, Pittsburgh, Philadelphia, New York City and Indianapolis, temperatures may only surpass the freezing mark on one or two days through Jan. 31, [and] the persistent cold will cause a renewed buildup of ice on rivers in the Northern states. Ice jams could again become a problem during the coming weeks. At least two of the cold waves will reach into the South.

“In much of the South, temperatures will not be as low as that of the first week of January. However, many areas over the interior will have multiple nights where the temperature spends multiple hours well below freezing. Temperatures will dip to near freezing during a few nights along the upper Gulf Coast,” Sosnowski said.

A temperature rebound of sorts is predicted for the Eastern Seaboard into the weekend. AccuWeather.com predicted that the Thursday high in Boston of 20 would slide to 18 by Friday but jump to 36 on Saturday. The seasonal high in Boston is 36. New York City’s high on Thursday of 21 was anticipated to ease to 18 also on Friday but make it up to 30 by Saturday. The normal high, however, for New York this time of year is 38. In Philadelphia the high on Thursday was expected to be 22, but by Friday highs were only forecast to reach 19. On Saturday Philadelphia’s high was forecast to reach 33, which is 7 degrees below the normal late January high.

Longer-term forecasts continued colder overnight. In its morning six- to 10-day forecast, WSI Corp. is calling for sharply below normal temperatures for the eastern two-thirds of the country. Colorado and points west are expected to be normal to above normal. “[Thursday’s] forecast continues to trend colder across the Midwest in through the Ohio Valley and southern Plains early under a highly anomalous arctic air intrusion, [and] confidence is considered near to slightly above average standards due to good agreement between the latest model guidance solutions.”

WSI said the risk to this forecast is for upside accumulation of heating degree days (HDD) “over much of the East early in the period under what could end up being the coldest air mass of the 2013-2014 winter season.”

Gas for Friday delivery into the Algonquin Citygates plunged $44.13 to $34.17, and at Iroquois Waddington next-day deliveries dropped $48.50 to $26.43. At Tennessee Zone 6 200 L gas came in at $34.12, down $46.20.

Gas on Tetco M-3 Delivery swan-dived $50.27 to $35.25, and gas bound for New York City on Transco Zone 6 shed $35.22 to $48.80. At Transco-Leidy Friday packages were seen at $4.40, down 67 cents, and on Dominion next-day deliveries fell 15 cents to $5.23.

Midwest prices were off a couple of dollars. Gas on Alliance dropped $2.23 to $6.83, and at the Chicago Citygates next-day parcels changed hands at $6.53, down $2.46. On Northern Natural Ventura, Friday packages came in at $6.94, down $2.17. Gas at Demarcation fell 44 cents to $5.450.

Prices at Gulf locations bucked the downtrend and managed healthy gains. On Columbia Gulf Mainline next-day gas gained 52 cents to $5.44, and on ANR SE gas added 40 cents to $5.28. Deliveries to the Henry Hub jumped 63 cents to $5.54, and on Tennessee 500 L Friday packages added 37 cents to $5.37. Gas on Tetco E LA was up by 45 cents to $5.34.

Freeze-offs continue to be a problem, especially for producers in the East caught in the path of the polar vortex. Industry consultant Genscape reported that total well freeze-offs Thursday reached 1,426 MMcf, up from Wednesday’s 929 MMcf and Tuesday’s 392 MMcf. Hardest hit Thursday were Northeast Pennsylvania at 550 MMcf and Arkansas at 275 MMcf. West Virginia lost 158 MMcf and Ohio was down by 142 MMcf. Oklahoma saw production losses of 155 MMcf.

Pipelines are also having their fair share of difficulties.

“This was the really the first good, hard, cold weather test that we’ve had in a good while as a test of our whole system…We work all year to get ready for these sorts of things,” said Bruce Ruhlin, managing director of gas control and planning for Columbia Gas Transmission Corp. (TCO). “We did perform pretty well during this cold spell, I thought. It’s always a good test for us, and I thought we came through pretty well.” Problems in the TCO storage and transmission system during the cold snap were minor.”

The current bout of extreme cold, coming so soon after the first polar vortex and so early in the winter, and forecasts of continued cold extended across the next few weeks, could be problematic for TCO (see related story).

“We’re concerned that that will lead to continued heavy pull from these storage fields, and we will be losing storage deliverability without periods of rest or pressure recovery for those fields,” Ruhlin said.

Texas Eastern issued a blanket notice for its M2 and M3 market zones, stating that “due to the continued cold weather and high demand, Texas Eastern (TE) requires all delivery point operators in Market Area Zones M2 and M3 to keep actual daily takes out of the system less than or equal to scheduled quantities regardless of their cumulative imbalance position. All receipt point operators in Market Area Zones M2 and M3 are required to keep actual daily receipts into the system greater than or equal to scheduled quantities regardless of their cumulative imbalance position.”

TETCO singled out restrictions at several key Appalachia area points for Friday, including all non-primary firm nominations at Clarington, Ohio, and excess IT and secondary nominations sourced from the Leidy Line as well as delivery downstream of Chester Junction on the Philadelphia Lateral.

Tennessee Gas Pipeline (TGP) said it “anticipates very limited flexibility due to higher pipeline capacity utilization and significantly colder weather in the Zone 0 this week.” It issued an operational flow order (OFO) for Friday in order to prevent imbalances on that part of its pipeline. Zone 0 includes all of TGP’s operations in Texas, and extends to the Natchitoches Compressor Station in western Louisiana. The company said its OFO would remain in effect until further notice.

The cold has also impacted the power sector with grid operator PJM Interconnection citing the continuing frigid weather that is putting stress on generating resources, asking the public Thursday in the Baltimore Gas & Electric and Pepco regions to conserve electricity Thursday and Friday. Demand response providers already have been asked to reduce electricity use.

“The prolonged, extremely cold weather is causing high demand for electricity. As a result, PJM and its members are managing a very tight power supply. The prolonged cold requires some generating units to operate more often and for more hours than normal. It also stresses generator components. Any resulting unplanned shutdowns can further tighten power supplies.

“PJM and its members are doing everything possible to avoid taking other steps affecting the public. PJM is communicating about the situation with state government officials throughout the region.”

PJM asked the public to lower thermostats and postpone use of major electric appliances. The critical periods, PJM said, were 3-7 p.m. Thursday and 6-9 a.m Friday.

The frigid weather and high natural gas prices were straining eastern power networks. The New York ISO (NYISO) grid operator on Wednesday asked the Federal Energy Regulatory Commission to waive the $1,000/Mwh cap on cost-based power generation bids it can accept. On Thursday PJM Interconnection, the mid-Atlantic grid operator was filing a similar petition. NYISO and PJM said the waivers were necessary because of the extreme winter weather and the high prices for natural gas. NYISO cited a $120/MMBtu price on Transco Zone 6 NY on Tuesday and said it expected the current super cold to last through Jan. 24-25, but asked for the waiver privilege to run through the coldest part of the winter through Feb. 28. A PJM spokesman said the details of its petition would be in its filing was arriving at FERC late Thursday. The waiver would allow the ISOs to pay generators who could document higher costs.

Next-day power prices in the area have a way to go before reaching $1,000/MWh. IntercontinentalExchange reported that Thursday next-day real time peak power at the New England ISO Massachusetts fell $58.78 to $332.94/MWh, and deliveries to the PJM West Hub dropped $103.38 to $302.40/MWh.

In its Thursday morning report, Genscape pegged demand in the East as slightly lower than early January. “Appalachia demand increased to over 19 Bcf/d, although not as high as the demand on Jan. 7th at 20.8 Bcf/d by the previous arctic blast. However, the impact on demand with this cold front is the affected region is more widespread and lower temperatures are more prolonged compared to the previous cold front. Demand in the Appalachia and New England will continued to be elevated in the coming few days.”

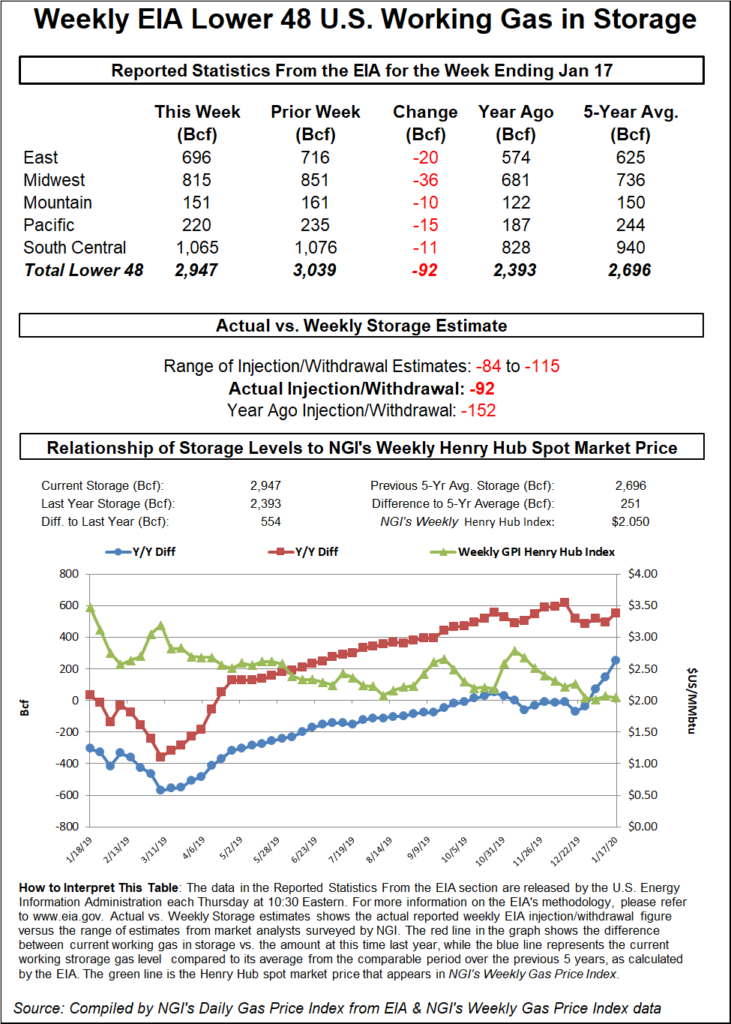

Given the tsunami-like impact of recent cold weather, Thursday’s Energy Information Administration storage report seemed almost a nonevent. Expectations for the week ended Jan. 17 were for a below-average withdrawal. Last year 168 Bcf was withdrawn and the five-year average stands at 181 Bcf. Analysts were expecting a pull of around 100 Bcf to be reported.

IAF Advisors of Houston was looking for a withdrawal of 101 Bcf, and Bentek Energy calculated a pull of 94 Bcf using its flow model. A Reuters poll of 23 traders and analysts revealed an average 110 Bcf with a range of 90-150 Bcf. Energy Metro Desk‘s survey showed an average 103 Bcf and after missing last week’s 287 Bcf by a country mile, John Sodergreen, the editor, said “in the end, we think that the bias is heading to the low side of the -103 Bcf Consensus’ final tally.”

Inventories now stand at 2,423 Bcf and are 598 Bcf less than last year and 369 Bcf below the five-year average. In the East Region 67 Bcf was withdrawn and in the West Region 15 Bcf was pulled. Inventories in the Producing Region fell by 25 Bcf.

The Producing region salt cavern storage figure grew by 2 Bcf from the previous week to 213 Bcf, while the non-salt cavern figure fell by 27 Bcf to 674 Bcf.

The EIA in this storage report debuted a new feature, which tracks the implied flow of gas. For the week ended Jan. 17, the implied flow in each region matched the net change in inventories.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |