SandRidge Scuttles GOM Business, Returns Focus to Midcontinent

SandRidge Energy Inc., still in recovery mode following months of management turmoil and shareholder revolts, agreed Tuesday to sell a briefly held portfolio of Gulf of Mexico (GOM) properties back to an original owner to return its focus to the U.S. onshore.

Riverstone Holdings LLC, already a substantial stakeholder in SandRidge, said affiliate Fieldwood Energy Inc. would buy the GOM business for about $1.2 billion in in cash and liabilities — about what SandRidge paid for the business two years ago.

SandRidge executives surprised the industry in early 2012 when they agreed to buy GOM operator Dynamic Offshore Resources LLC for $1.28 billion, a producer originally financed by The Carlyle Group and Riverstone (see Daily GPI, Feb. 3, 2012; Feb. 6, 2008). (Riverstone held close to 11% of SandRidge’s outstanding shares at the end of 2012.)

By casting off the GOM business, SandRidge is returning to basics, CEO James Bennett told analysts during a conference call. The sales proceeds, expected to be in hand by the end of March, would be poured back into the Midcontinent by adding more rigs and a bigger budget.

Midcontinent output this year should increase by 26% in 2014, well ahead of a preliminary forecast last November to increase output by 12%, Bennett said.

“Given our status as a premier operator in the Midcontinent, where we have established competitive advantages including infrastructure networks, sub-surface knowledge and a best-in-class cost structure, we have elected to further focus our efforts into developing this area,” Bennett said. “Based on our confidence in the asset base, we will increase the pace of development in our six county de-risked focus area where we have over a decade of drilling locations.”

Selling the GOM business also would give SandRidge a liquidity base of more than $2 billion, a particularly valuable prize for a company that has been flailing financially and operationally. Founder Tom Ward was ousted last year following a shareholder squabble (see Shale Daily, March 22, 2013). The board continues to face litigation related to transactions set up during Ward’s tenure (see Shale Daily, July 8, 2013).

Capital spending previously allocated to GOM development instead will be directed to the Midcontinent business, where SandRidge plans to add three more rigs before the end of June. Thirty additional wells (gross) would be added to the budget as well.

“The company now expects to exit 2014 with 29 rigs operating in its Midcontinent acreage, where it continues to discover, delineate and develop new, high rate-of-return opportunities,” said Bennett.

Once the offshore sale is completed, SandRidge expects to produce 29.3 million boe in 2014, including 1.0 million boe from the GOM through 1Q2014, versus pro forma 2013 estimated output of 22.4 million boe. Capital expenditures for this year are budgeted at $1.475. Output from the Midcontinent assets alone is expected to be about 23.2 million boe, representing 37% growth from 2013 levels.

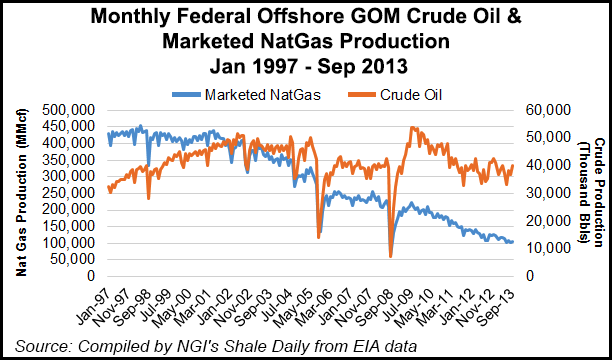

The GOM assets had proved reserves of 29 million bbl of liquids and 168 Bcf of natural gas at the end of 2013. Over the past month, the assets have produced 23,500 boe/d, 48% weighted to natural gas. SandRidge’s 2% overriding stake in the sold GOM portfolio would be for deep Miocene prospects in Green Canyon Block 65, the Bullwinkle area, as well as in South Pass Block 60.

Motley Fool’s Matt DiLallo said Tuesday the Dynamic purchase may at first appear to have been a “massive blunder” by SandRidge, which Ward at the time called a bargain. That was because BP plc’s Macondo well blowout at the time “was still depressing prices” for GOM properties, DiLallo said.

“While the company’s quick exit doesn’t suggest it got much when it purchased Dynamic, SandRidge was actually able to extract a fair amount of value from its purchase. It cut back investment in the properties, allowing production to naturally decline, and instead used the offshore oil properties as a cash cow to fund some of its Mississippian [Lime] drilling.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |