LNG | NGI All News Access | NGI The Weekly Gas Market Report

Four New LNG Export Approvals Brings Canadian Total to 14.5 Bcf/d

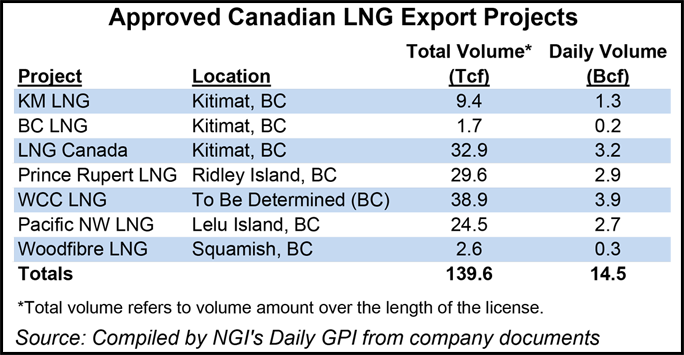

Total Canadian volumes approved for overseas sales of liquefied natural gas (LNG) jumped this week to 14.5 Bcf/d or 5.3 Tcf/year, adding up to 139.6 Tcf over the life of the licenses, when the National Energy Board (NEB) granted export licenses to four projects.

The new decisions added 95.6 Tcf — or 9.9 Bcf/d — to previous authorizations for three other export schemes to load up LNG tankers with 44 Tcf at a rate of 4.7 Bcf/d. All seven projects aim to build terminals on the Pacific Coast of British Columbia and obtain their supplies with horizontal drilling and hydraulic fracturing into largely untapped northern BC and Alberta shale gas deposits.

Recipients of the new 20- to 25-year licenses are:

The NEB previously issued licenses for 32.9 Tcf, or 3.2 Bcf/d, to Shell Canada’s LNG Canada project; 9.4 Tcf, or 1.3 Bcf/d, to the KM LNG scheme currently owned by Chevron and Apache; and 1.7 Tcf, or 200 MMcf/d, to the BC LNG co-operative team of Houston-based LNG Partners and the Haisla Nation coastal native community.

Adding in the 6.77 Bcf/d of U.S. LNG exports which have been approved results in a prospective continental LNG export total of 21.27 Bcf/d or about 7.8 Tcf/year.

None of the seven projects has secured long-term overseas gas-sales contracts to match their authorized export volumes. None has begun building terminals or set dates to start construction. Also still to be completed are gas transportation contracts for service by new pipeline projects, which TransCanada Corp. and Spectra Energy (Westcoast) are in early stages of moving through the regulatory process.

But seven projects — and others in planning and regulatory application stages — have enthusiastic support from BC’s Liberal government as potential pillars of a new provincial industry. The regime’s successful re-election campaign last spring included a pledge to save up LNG royalties and taxes in a provincial “prosperity fund” projected to swell to C$100-billion over the next quarter-century.

Pacific NorthWest president Greg Kist promptly fired off a statement applauding the NEB decision as a “positive step toward establishing a thriving LNG industry on the west coast of British Columbia.” He added a reminder that continuing co-operation is required from federal and provincial energy and environmental regulatory authorities to ensure projects can succeed on an increasingly competitive global LNG market.

The NEB rulings warded off potential interference from the buyers’ side of the Canadian gas market. In granting the new LNG export licenses, the NEB rejected requests by industrial gas consumers for an omnibus inquiry into all the projects to see whether the rising cumulative total of overseas sales hopes over-commits the nation’s resources or has potential to strain Canadian markets.

The decisions, all handed down as nearly identical form letters, said concerns raised by the Chemistry Industry Association of Canada and Industrial Gas Consumers Association of Alberta were unwarranted or addressed by other aspects of the national regulatory regime such as periodic NEB supply and demand overviews.

The new export approvals said the board is “satisfied that the gas resource base in Canada, as well as North America, is large and can easily accommodate reasonably foreseeable Canadian demand, the LNG exports proposed by this Application, and a plausible potential increase in demand.”

The ruling added that the NEB “further accepts [producer and project sponsor assurances] that the incremental cost of adding new production to supply any exported LNG or to satisfy a plausible demand increase is low.”

In the BC capital of Victoria, Natural Gas Development Minister Rich Coleman applauded the NEB rulings. “These export approvals mark a major milestone in our efforts to create jobs and grow our economy by leveraging our abundant supply of natural gas.”

Coleman, who is also BC’s deputy premier, acknowledged that board decisions must be ratified or co-signed by the federal cabinet in order to go into effect. “Now that the NEB has approved the applications, we look forward to a timely decision from the federal government so that we can ensure these companies are positioned to make final investment decisions as quickly as possible,” he said.

Federal cabinet ratification of NEB rulings is ordinarily a formality. But the LNG case could generate some political horse-trading between the Liberal regime in Victoria and the national Conservative government in Ottawa.

The board is also scheduled to award conditional approval this week to a hotly contested oil sands pipeline and tanker export terminal project, Enbridge Inc.’s Northern Gateway proposal. In the heat of the provincial election campaign, the BC Liberals made a show of questioning the environmental risks and economic benefits of the Alberta oil plan. At least privately, the national Conservatives — who support developing overseas markets for Alberta bitumen — could make BC acceptance of Northern Gateway a condition of ratifying the LNG export licenses.

Coleman added that his department’s calculations show that if only five Pacific coast LNG export terminals are built, cumulative additions to BC’s provincial gross domestic product could total C$1 trillion by 2046. The arithmetic relies on overseas gas prices staying double or more the low levels on glutted North American markets by remaining indexed to oil.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |