Infrastructure | LNG | NGI All News Access | NGI The Weekly Gas Market Report

DOE Bent Rules In Latest Export OK, LNG Advocate Says

The U.S. Department of Energy’s (DOE) latest authorization to export liquefied natural gas (LNG) to non-free trade agreement (FTA) countries bends the agency’s own rules and sends a “troubling” message, an LNG export advocate told NGI.

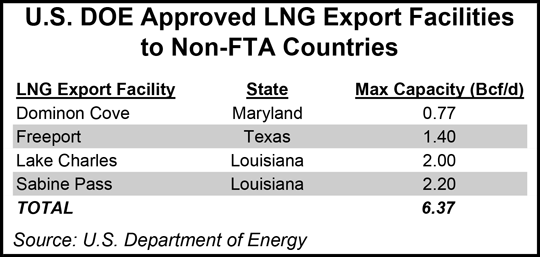

In its most recent export order (see Daily GPI,Nov. 15), DOE granted Freeport LNG Expansion LP and FLNG Liquefaction LLC (collectively known as FLEX) approval to export up to 0.4 Bcf/d when FLEX had been seeking approval to export 1.4 Bcf/d, in addition to a previously authorized 1.4 Bcf/d, from its proposed terminal on Quintana Island in Texas.

DOE said it lopped off the 1 Bcf/d from its approval because “…FLEX has notified FERC that the liquefaction project will have a liquefaction capacity of 1.8 Bcf/d of natural gas — not the 2.8 Bcf/d requested in total. There is no basis for authorizing exports in excess of the maximum liquefaction capacity of a planned facility.”

But what has or has not been authorized at the Federal Energy Regulatory Commission (FERC) shouldn’t matter, according to DOE’s own rules, Center for Liquefied Natural Gas President Bill Cooper told NGI.

“Certainly, I think DOE’s decision to cut back the export volume [in the FLEX application] is troubling,” he said. “I say that because under the rules and regulations promulgated by DOE, there is no requirement that says you have to go in any particular order in which you seek a DOE authorization versus a FERC authorization. So theoretically, you could file at DOE and not file at FERC until you get completely through the DOE process.

“So to somehow predicate the export volumes on what is happening at FERC without knowing if the applicant’s going to try to increase that capacity seems to be outside DOE’s purview.”

Freeport LNG CEO Michael Smith told NGI that while the company is disappointed with the volume for which it was authorized, it can still make a go of its project as planned because it can export volumes to SK E&S LNG LLC (SK) in South Korea, a free trade partner of the United States (see Daily GPI, Sept. 10).

“No. 1, we are thrilled that we did get approval for at least 400 MMcf/d because it does commercialize a three-train project for us…” Smith told NGI.

But like Cooper, Smith is wondering what DOE is up to.

“We asked for 1.4 Bcf and we only got 0.4,” he said. “If we are the last non-free trade [applicant] to be approved, then we’re fine with the order where the government has stopped at around 6.7 Bcf of non-free trade approvals. That’s their right for what is in the public interest. [But] there’s nothing in the order that indicates that.”

Smith said his “gut feel” is that the next applicant in the DOE queue, Cameron LNG, will also be approved. “And if they get approved, how can the Department of Energy say that my entire 1.4 Bcf/d wasn’t in the public interest?”

Smith said others outside of the DOE have suggested to him that the department added up the volumes in the company’s FERC filing representing nameplate capacity of 13.2 million tonnes across three trains, which is 1.8 Bcf/d. “They already approved 1.4, and that’s how they came up with 400 MMcf/d, or 0.4 Bcf,” Smith said.

Because it’s common for LNG trains to produce about 10% above their nameplate capacities, DOE is effectively precluding Freeport from selling its excess capacity into non-free trade countries, Smith said. “So absent of SK [South Korea] being a free trade country, I will have spent about $3.5 to $4 billion per train, and each train is expected to have the capability of 5 million tonnes…I would be precluded from selling it to anyone but free trade countries, and I don’t think that’s fair.”

Smith said the company already has contracts in hand for excess volumes in its train. “…[W]e filed that with the Department of Energy, and we told them that before this was filed. They still gave me an order that I can only sell my nameplate to non-free trade countries. That’s not fair.”

Freeport filed for 1.4 Bcf/d in anticipation of the excess liquefaction capacity but also with thoughts of adding a fourth train to the project down the road, Smith said. “We have elected not to amend any of our filings with FERC for a fourth train, which is still speculative, because it would completely delay our current FERC filings, and it’s something we would expect to potentially do in the future.”

Smith speculated that DOE did not want to approve a volume partially allocated to a speculative train that might not get built when many industry watchers are carefully tallying the total volume of non-FTA exports approved. “And again that’s not in their charter,” he said of the implied decision authority in this scenario.

“They basically nixed our fourth train,” Smith said. “It’s clear that if you haven’t filed with FERC, they’re not going to give you anything other than what you filed with FERC.”

Smith said he had not decided whether to seek a rehearing of the order. The company has 30 days from the order date within which to do so.

There is an order of precedence for considering non-FTA applications established by DOE that gives preference to certain projects that have received approval to use FERC’s pre-filing process (see Daily GPI, Sept. 12). DOE is the agency that overseas exports while FERC has authority over facilities siting and construction. DOE’s order of precedence has tripped up a much smaller LNG export project, that of Carib Energy, a unit of Crowley Marine Corp.

Carib has been awaiting a non-FTA approval for containerized LNG export. In an October filing at DOE, Carib’s lawyers said the DOE’s “order of precedence” for considering non-FTA export applications has disadvantaged Carib relative to other applicants. Carib’s application was next in line based upon the chronological order in which applications were filed. However, the order of precedence gives priority to applications for projects that received by Dec. 5, 2012 approval to use FERC’s pre-filing process, putting Carib at No. 6 in line following the latest Freeport approval (see Daily GPI, Oct. 25).

In the latest turn of events in that case, a Nov. 18 letter to Carib’s lawyers from DOE said the agency “…intends to give further consideration to your request…” to process Carib’s application “next rather than taking up the application in the order of precedence…”

Cooper said the “arbitrary nature” of the non-FTA queue at DOE is “causing a lot of angst for folks that really shouldn’t be held up…I mean everybody whose comment periods have expired.

“…[T]here’s no requirement to go to FERC first or simultaneously with your DOE application, and therefore we don’t know what may happen in the FERC proceeding to increase that capacity. We just don’t know…

“What the signal is [to the industry at large is] I don’t know other than what it says in the order itself. But my argument would be no matter how careful an agency has to be, the agency has to follow its own rules and regulations, and I think this is a bit far afield.”

DOE’s previous non-FTA export approval, it’s fourth, was granted in September to Dominion Cove Point LNG LP, putting the volumetric total of such approvals past the 6 Bcf/d mark (see Daily GPI, Sept. 13).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |