Markets | E&P | NGI All News Access | NGI The Weekly Gas Market Report

EIA Sees Natural Gas Prices Rising

U.S. natural gas production and prices will be higher in 2014, but overall consumption will remain flat at or near 70 Bcf/d, according to the Energy Information Administration (EIA) Short-Term Energy Outlook issued on Wednesday.

Prices are forecast to close in on $4.00/MMBtu while production will top 70 Bcf/d.

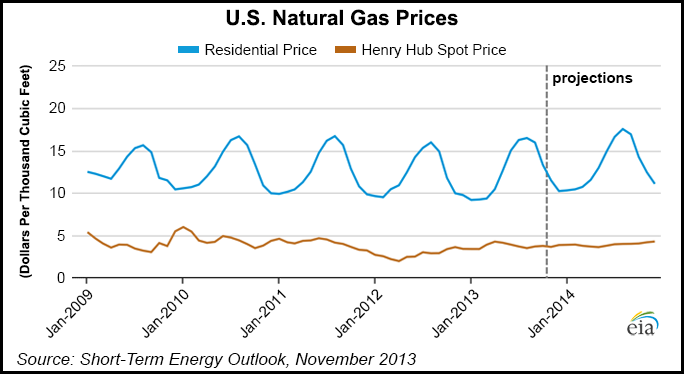

Gas prices were $3.68/MMBtu at the Henry Hub in October, up 6 cents from September, after declining from April through August this year, EIA noted. Prices began increasing in September in anticipation of winter heating demand, and EIA now is calling for Henry Hub prices to increase on average to $3.68/MMBtu this year and $3.84/MMBtu in 2014, versus 2012’s average price of $2.75.

Analysts also see prices increasing into 2014. BNP Paribas earlier this week said U.S. gas prices should average $3.55/MMBtu in 4Q2013, $3.90/MMBtu in 1Q2014, and $4.20/MMBtu by 4Q2014 (see Daily GPI, Nov. 11).

According to EIA, marketed natural gas production will increase from 69.2 Bcf/d in 2012 to 70.3 Bcf/d in 2013 and to 71.0 Bcf/d in 2014.

“EIA boosted its forecast for U.S. marketed natural gas production by 0.4% this year and nearly 1% for next year, as domestic natural gas output reached record levels during the past several months despite lower gas prices,” said EIA head Adam Sieminski. “Gas from the Marcellus Shale has been the main driver of this production growth [see related story].”

U.S. pipeline gross imports, which have fallen during the past five years, are projected to continue to decline by 600 MMcf/d this year and by 100 MMcf/d in 2014.

After averaging 69.7 Bcf/d in 2012, gas consumption this year is seen averaging 70.1 Bcf/d and in 2014, at 69.6 Bcf/d. “Colder winter temperatures in 2013 and 2014 (compared with the record-warm temperatures in 2012) are expected to increase the amount of natural gas used for residential and commercial space heating.”

Liquefied natural gas imports, meanwhile, should “remain at minimal levels of around 400 MMcf/d in both 2013 and 2014.”

In the electric generation sector, projected year/year increases in gas prices have led to declines in gas-fired generation to 22.1 Bcf/d from 25 Bcf/d in 2012. They should average about 21.9 Bcf/d in 2014, according to the report.

“In the past several months, natural gas production has hit record high levels, even as prices declined this summer,” said EIA. The Marcellus Shale has been the “main driver” of growth. “Very strong growth in the Marcellus Shale (and to a smaller extent, the Eagle Ford Shale) has more than outpaced declines in the Gulf of Mexico and the Haynesville Shale.”

In 2014, Brent crude oil prices are forecast to average $103/bbl, while West Texas Intermediate is expected to average $95/bb, keeping the average discount to Brent at about $8-9/bbl.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |