Regulatory | LNG | NGI All News Access

Dominion Cove Point Approved for Global LNG Exports

The U.S. Department of Energy (DOE) on Wednesday conditionally authorized Dominion Cove Point LNG LP to export domestically produced liquefied natural gas (LNG) from the Cove Point LNG Terminal in Calvert County, MD, to countries that do not have a free trade agreement (FTA) with the United States.

Subject to environmental review and final regulatory approval, the facility is conditionallyauthorized to export at a rate of up to 0.77 Bcf/d for 20 years. This is the fourth such approval issued by DOE and follows the August approval for Lake Charles Exports LLC to export up to 2 Bcf/d (see Daily GPI, Aug. 8). DOE has now authorized up to 6.37 Bcf/d of LNG exports to non-FTA countries.

Dominion Cove Point previously received approval to export LNG from the facility to FTA countries in October 2011 (see Daily GPI, Oct 12, 2011). Environmentalists are fighting the project, which still needs approval from the FERC (see Daily GPI, July 12, 2013).

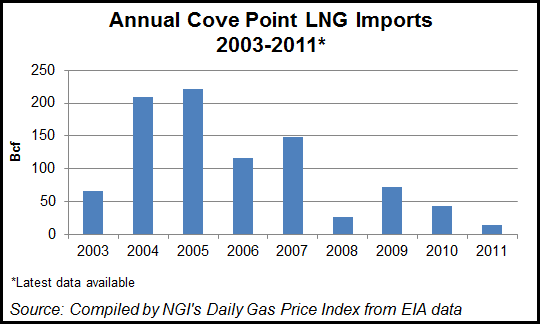

Thanks to the U.S. shale boom, which has pushed gas prices lower, LNG imports into the Cove Point terminal have dried up in recent years. According to Energy Information Administration (EIA) data, after peaking in 2005 with 221.7 Bcf of LNG imports at the facility, Cove Point took in only 14 Bcf in 2011, the last year for which data is publicly available.

The export project is expected to cost $3.4-3.8 billion, according to the company, which filed its facilities application in March with the Federal Energy Regulatory Commission. Pending receipt of regulatory approval and permits, construction is scheduled to begin in 2014, with an in-service date of 2017.

Capacity is fully subscribed with 20-year terminal service agreements (see Daily GPI, April 2). Pacific Summit Energy LLC, a U.S. affiliate of Japanese trading company Sumitomo Corp., and GAIL Global (USA) LNG LLC, a U.S. affiliate of GAIL (India) Ltd., each have contracted for half of the marketed capacity.

The existing regasification terminal has connections to the pipeline grid, LNG storage capacity and an updated pier. Construction will chiefly entail adding liquefaction capability. According to Dominion Cove point, the facility will have access to Appalachian gas, including from the Marcellus Shale, as well as gas from the Gulf of Mexico, Midcontinent, Rockies and Canada. Affiliate Dominion Transmission Inc. is said to operate the largest underground gas storage system in the country as well as the Dominion South Point trading hub.

Federal law generally requires the approval of natural gas exports to countries that have an FTA with the United States. For countries that do not have an FTA with the United States, the Natural Gas Act directs DOE to grant export authorizations unless the department finds that the proposed exports “will not be consistent with the public interest.”

With the volume of non-FTA exports surpassing the 6 Bcf/d mark, the stakes will be getting higher on Capitol Hill, wrote analysts at ClearView Energy Partners LLC in a note Wednesday.

“…[E]ach successive approval is likely to draw greater attention from stakeholders and Capitol Hill, especially now that total volumes have crossed the 6 Bcf/d lower bound considered by the EIA and NERA [Economic Consulting] studies [see Daily GPI, Dec. 6, 2012],” ClearView said.

“…[W]e would suggest that as many as three additional projects could win conditional approval before any year-end pause: an extension to the FLEX project (0.4 Bcf/d); Sempra’s Cameron project (1.7 Bcf/d) and Jordan Cove (1.2 Bcf/d) for total approved or conditionally approved volumes of 9.67 Bcf/d.”

U.S. Senate Energy and Natural Resources Committee Chairman Ron Wyden was also watching the export volume tally.

“With today’s approval, the United States is now squarely in the range that experts are saying is the most likely level of U.S. natural gas exports,” he said. “If DOE approves exports above that range, the agency has an obligation to use most recent data about U.S. natural gas demand and production and prove to American families and manufacturers that these exports will not have a significant impact on domestic prices, and in turn on energy security, growth and employment.”

DOE said it conducted “an extensive, careful review” of Dominion Cove Point’s application. The department considered the economic, energy security and environmental impacts, as well as public comments for and against the application and nearly 200,000 public comments related to the associated analysis of the cumulative impacts of increased LNG exports. DOE determined that exports from the terminal at a rate of up to 0.77 Bcf/d for a period of 20 years was not inconsistent with the public interest.

DOE granted the first authorization to export LNG to non-FTA countries in May 2011 from the Sabine Pass LNG Terminal in Cameron Parish, LA, at a rate of up to 2.2 Bcf/d (see Daily GPI, May 23, 2011), and the second authorization in May 2013 from the Freeport LNG Terminal in Quintana Island, TX, at a rate of up to 1.4 Bcf/d (see Daily GPI, May 20). On Wednesday DOE said it would continue to process the non-FTA LNG export applications currently pending on a case-by-case basis in the order of precedence provided in August (see Daily GPI, Aug. 8):

However, since then, Energy Secretary Ernest Moniz has said differences in processing may dictate some differences in the schedule. On Wednesday, DOE, perhaps anticipating the unease expressed by Wyden, said it “would continue to monitor any market developments and assess their impact in subsequent public interest determinations as further information becomes available, including the EIA’s ‘Annual Energy Outlook’ at the end of 2013.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |