Bakken Shale | NGI All News Access

Oasis Grows Williston Position by Nearly 50% for $1.52B

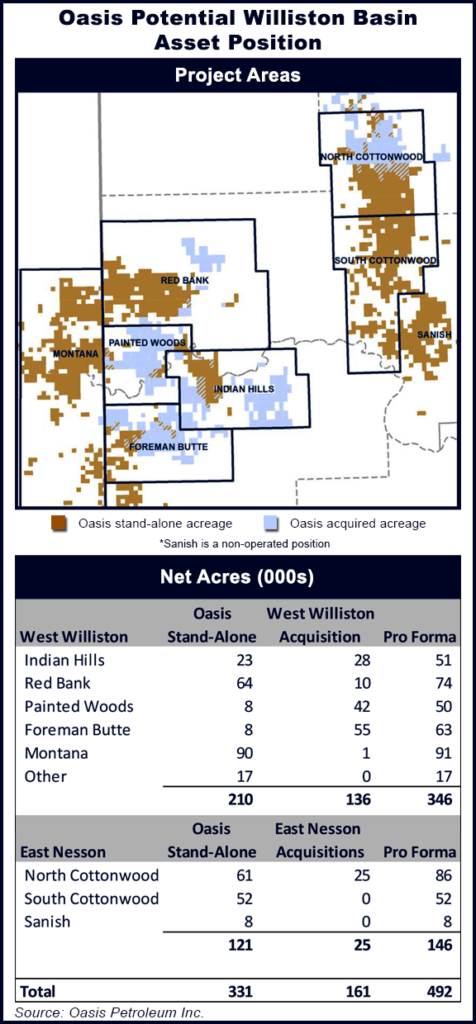

Oasis Petroleum Inc. is acquiring 161,000 net acres in the Williston Basin for nearly $1.52 billion in four separate transactions, which will grow its Williston position to 492,000 net acres with 43,000 boe/d of production and 215.6 million boe of proved reserves.

“These acquisitions add high-quality acreage in the heart of the Bakken and Three Forks play, providing incremental scale to our premier position in the Williston Basin,” said CEO Thomas B. Nusz. “As we enter full development mode, our size and scale will continue to drive growth, efficiencies and shareholder value.”

The acquisitions make Oasis one of the top operators in the Williston Basin and the top Bakken Shale pure play, Nusz said during a conference call to discuss the transactions. Oasis shares were up more than 4% Thursday afternoon.

At the end of June, Oasis had 331,000 net acres in the Williston; in four transactions it is growing its position by nearly 50%. The company will have 399 operated drill blocks offering more than 16 years of inventory assuming 13 rigs running and 172 wells drilled per year.

“We are currently operating 11 rigs, and the sellers are operating two rigs, which we believe keeps acquisition production levels relatively flat through the end of 2013,” Nusz said. “We expect to accelerate development across our overall combined position next year, increasing to 15 to 16 operated rigs by the end of 2014.”

The company has signed an agreement to acquire certain assets, including 136,000 net acres in and around its position in North Dakota in its West Williston project area for $1.45 billion. Of the 136,000 net acres, 91,000 net acres have no depth limitations.

Oasis also signed three other unrelated agreements to acquire assets in East Nesson totaling 25,000 net acres, in the aggregate, for $65 million.

During the conference call Thursday, management said Oasis is gaining large, contiguous blocks that are adjacent to its current operated blocks. After closing, 91% of the company’s acreage will be Oasis-operated, and 86% will be held by production. Working interest of 68% will drive the “high impact” of the company-operated program, Oasis said.

Nusz was asked whether Oasis might begin looking outside of the Williston Basin for future deals, but the CEO indicated that would not be the case.

The four acquisitions are expected to close in early October and are subject to due diligence and conditions. The effective date for the West Williston Acquisition is April 1, 2013. The effective dates for the East Nesson acquisitions are all July 1, 2013.

Oasis also said its borrowing base has been increased from $1.25 billion to $1.5 billion. The company has added four new lenders to its bank group. As of Sept. 4, Oasis had $100 million of borrowings under its revolving credit facility and $5.2 million of letters of credit. As of Sept. 4 the company had cash and cash equivalents of $198.6 million.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |