Shale Daily | E&P | Eagle Ford Shale | NGI All News Access | NGI The Weekly Gas Market Report

Texas-Mexico Pipeline Developer Looks Forward to Gathering Mexican Gas, Too

Howard Midstream Energy Partners LLC (HEP) is offering capacity on a natural gas pipeline planned from Texas into Mexico, but the project is just the beginning of the infrastructure development opportunities resulting from energy reform in Mexico and the country’s need for natural gas, HEP CEO Mike Howard told NGI’s Shale Daily.

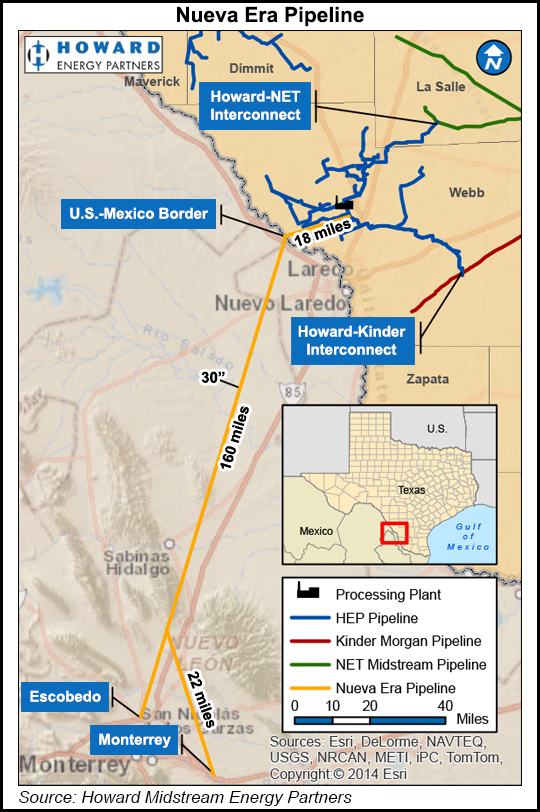

HEP’s planned Nueva Era Pipeline would be a 200-mile, 30-inch diameter line connecting its Webb County Hub in Webb County, TX, to Escobedo, Nuevo Leon in Mexico, and the Mexican National Pipeline System (Sistema Nacional de Gasoductos) in Monterrey. A nonbinding open season runs through July 17. The project is an outgrowth of the border crossing facilities being developed by HEP unit Colombia Pipeline LLC (see Shale Daily,July 3, 2014) and the customer interest expressed in that project.

Expected to be in-service in July 2017, the Nueva Era pipeline, which is to be developed in conjunction with HEP’s Mexican partner, will provide transportation service for up to 600 MMcf/d of gas from South Texas to a power plant at Escobedo, Nuevo Leon, near Monterrey. It will connect producers in South Texas directly with end-users in Mexico, creating access to multiple growing markets.

The first drop-off point of gas from Nueva Era is for the Comision Federal de Electricidad’s Escobedo Plant, which has been long in the making, Howard said. “It’s about a 1,000 MW plant on the north side of Monterrey. The second drop-off point will be into the national pipeline grid… and then off of that pipeline is where you see a lot of these other end-users taking gas.

“Since we are laying [pipeline] all the way to Monterrey, any new expansions…would have access to our pipeline. I would say that while there’s been one power plant talked about on the border near Laredo, the main one and the fastest one is going to be Escobedo, which is in northern Monterrey.

“By expanding transportation services off of our Webb County Hub and developing a new pipeline directly to Monterrey, we can provide northern Mexico’s industrial centers with access to the most competitively-priced gas in the country, while giving South Texas producers access to several new, growing markets,” Howard said.

Nueva Era will serve conventional South Texas production, such as that from the Escondido and Wilcox formations, as well as unconventional gas being produced from the Eagle Ford Shale. “Anything that’s been there historically that had to go through a hub like Agua Dulce or Ship Channel, now you’ll be able to access that gas directly through our Webb County Hub,” Howard said.

“We’ve been on this journey since about 2012 in anticipation of energy reform coming [to Mexico]. Obviously, the thing that gets all the press is the electrical generation market. That’s what obviously is the largest driver, like in the U.S., but there’s a lot of other industries, whether it be steel manufacturing, car manufacturing, cement plants. A lot of foreign investment is coming to Mexico to set up natural gas usage because of their position close to the U.S. and access to natural gas and the new pipelines going in.

“I think the rest of the world, at least the industrialized nations, are looking at Mexico as a good place to invest. We’ve talked to a lot of those individuals that have been looking to expand their plants and products on the Mexican side of the border. Access to cheap natural gas is kind of key to that expansion.”

While most of the focus of the energy industry and press following regulatory and contract reform in Mexico has been on development of the nation’s oil resources, the day for natural gas is coming, Howard said.

“From a natural gas perspective, we think that it’s probably going to be a while before there’s actually drilling for natural gas in Mexico, but we feel like it is coming,” he said. “I don’t think it’s going to be nearly as quick as for oil just because they don’t value natural gas as much as they do oil. It is coming. It’s no secret what we’re doing down there at Howard Energy. We’re preparing to be able to gather natural gas and have that expertise and operations focus in Mexico to be able to gather natural gas in the future, but there’s nothing imminent. We’re still a few years away.

“…[W]hen you look at the state of Texas, we have about 300,000 miles of pipe in Texas, and in all of Mexico they have about 9,000 miles of pipe. I think the prize is that there are going to be large infrastructure requirements in Mexico…”

For HEP, that means gathering systems and related infrastructure.

“It’s just not developed down there,” Howard said. “They don’t have gathering laws. They don’t have a clear understanding of how infrastructure needs to be handled, either by the leaseholder or by infrastructure people like us. It’s kind of a wide-open field. The fact that the country of Mexico is six miles from our assets, we’re just in a prime position to help develop that resource when it gets there.”

San Antonio-based HEP said it expects Nueva Era transportation service rates from the U.S.-Mexico border to Escobedo to be between US$0.13 and US$0.20 per thousand cubic feet, subject to the shipper’s required term, level of service, and volume commitment, and pursuant to all Mexican legal requirements.

HEP has about 700 miles of natural gas pipelines, natural gas liquids processing plants, rail facilities, liquid storage terminals, deep water port facilities, and other related midstream assets.

For Nueva Era Pipeline capacity information, contact Steve Cruse, scruse@howardep.com.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |