Rigs Falling Again, But Domestic Crude Production Decline? Wait For It…

The long-falling count of rigs pursuing U.S. crude oil, had slowed its pace a week ago but gathered speed again in the latest Baker Hughes Inc. census released Friday for the week ending May 29.

The U.S. rig count fell by 10 units overall, and the oil-directed rig category gave up 13. The natural gas category added three rigs. Given the large-scale producer retreat from the oil patch, a production decline is sure to follow, “…but no one knows when,” Barclays analysts said in a note Wednesday.

“Production should still grow year/year this year, despite the rapid reduction in rig count. Operators are talking about new efficiencies, productivity gains, and cost reductions that have lowered breakevens as much as $10/bbl.

“Activity is now focused in core areas where companies continue to drill their prime acreage, spending less and likely adding more volume per well. Even so, the magnitude of the decline in drilling and completion activity means that month/month production declines are likely this year.

“The steep decline in prices caused some producers to shift strategy, continuing to drill wells but defer completions until prices rise and/or well costs come down. As an example, deferred completions have added more than 300 wells to the backlog in the Bakken since last year. The contango has collapsed, and most producers have achieved cost reductions of at least 10%, so improved economics should cause some producers to increase activity again, whether through new drilling or working through their well backlog at a faster pace.”

In the latest Baker Hughes count, the Williston Basin, home to the Bakken Shale, lost one rig to land at 77 running. The oily Eagle Ford Shale gained three rigs, though, and the Permian Basin only gave up one. Texas saw a net loss of our rigs, far smaller than in weekly counts from earlier this year.

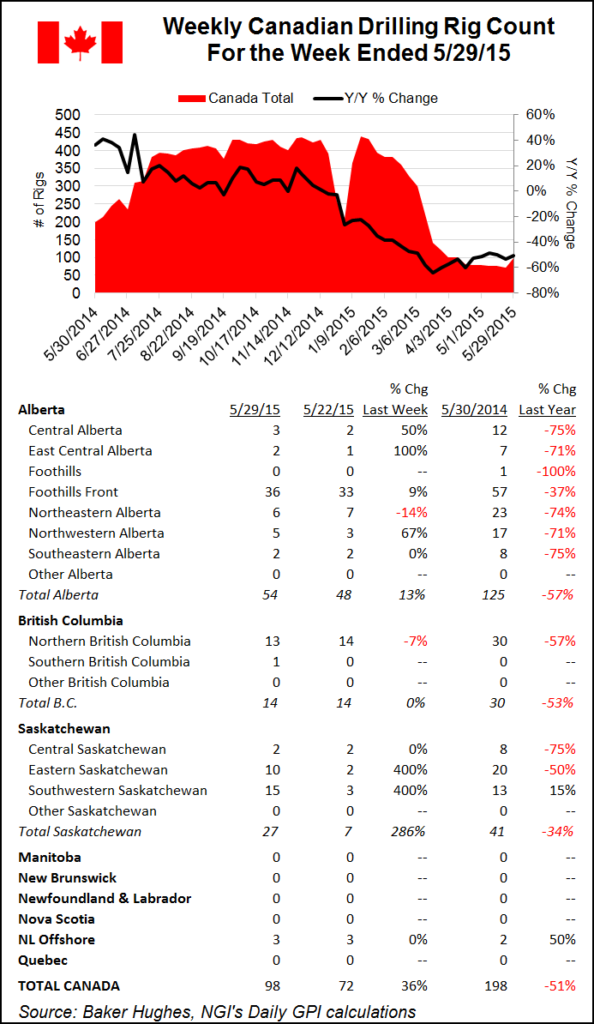

The story was quite different north of the border. Canada’s oil patch added 20 rigs, and gas-directed activity increased by six rigs. The increase was thanks to Saskatchewan, where the rig count jumped from seven the previous week to 27 in the latest count, a 286% increase.

“The Canadian rebound is likely the combination of ending of the winter breakup season, and slightly higher oil prices in recent weeks. But the end of breakup is probably the biggest driver,” said Pat Rau, NGI director of strategy and research.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |