Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Dallas Fed Reports Dwindling Support in Region for Oil, Natural Gas Activity, Prices to End of Year

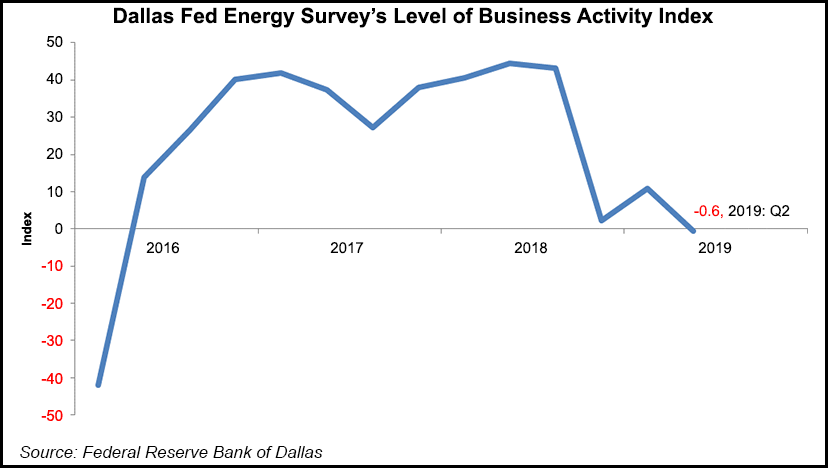

Following three years of growth, Energy sector activity across Texas, parts of New Mexico and Louisiana was flat during the second quarter, and business activity overall has contracted, according to the latest survey by the Federal Reserve Bank of Dallas.

The quarterly survey by the Dallas Fed, as it is known, tabulated results and comments from oil and gas executives headquartered in the Eleventh District, which includes Texas, southern New Mexico and northern Louisiana. The survey, conducted from June 12-20, had 161 respondents, including 101 exploration and production (E&P) executives and 60 from oilfield services (OFS) operators.

“Results from this quarter’s survey indicate a further slowdown in the oil and gas sector, with employment and business activity essentially unchanged from last quarter,” said Dallas Fed’s Michael Plante, senior research economist. “Increasing pessimism and a surge of uncertainty suggest a potentially challenging near-term outlook, especially for oilfield service firms.”

The business activity index, which is the survey’s broadest measure of conditions among Eleventh District energy firms, fell to minus 0.6 in the second quarter. Positive readings generally indicate expansion, while readings below zero generally indicate contraction.

The near-zero reading indicates activity levels were largely unchanged from the prior quarter, with E&Ps and OFS operators driving the decline.

Executives appeared “more pessimistic about future conditions,” with the company outlook index plunging 28 points to minus 4.5. For the OFS sector, the index slumped 38 points to minus 15.7.

“The dimming outlooks coincided with a surge in uncertainty, as the aggregate uncertainty index jumped 31 points to 50, the highest level since the index was introduced in 2017,” researchers said.

In response to the survey, one E&P executive said “the biggest impact has been the rapid and accelerating lack of investor interest in both conventional and unconventional oil and gas. The securities of oil and gas companies now sell at a fraction of what they once commanded. Huge losses in these shares hamper new exploration. It looks like another round of bankruptcies and mergers.”

During the second quarter, oil and natural gas production increased but at a slightly slower rate. The oil production index edged down sequentially to 17.4 from 21.1, while the natural gas production index fell to 13.4.

The capital expenditures (capex) index also declined sequentially from 1Q2019 to minus 6.1 from 5.0, indicating a slight pull back in E&P spend.

Executives responded to a series of special questions posed by the Dallas Fed economists regarding capex changes for 2019, cost inflation for completion services and initiatives undertaken on water use in oilfields.

“Many firms are under pressure to maintain capital discipline for various reasons, and we asked a special question to see how budgets for 2019 may have been revised since the start of the year,” Plante said. “By and large, companies are maintaining budget discipline, with most reporting either no change or slight adjustments up or down.”

OFS firms also reported seeing their operating margins decline.

“The equipment utilization index fell 13 points to 3.4, and the operating margins index dropped from minus 6.6 to minus 32.8 in the second quarter,” researchers said. “Input costs rose, with the index inching higher, from 25.0 to 27.1. At the same time, the prices received for services index dipped further into negative territory, from minus 1.7 to minus 12.1.”

The employment index across the reporting area also declined sequentially. The aggregate index fell to minus 2.5 from 6.0, “suggesting a turnabout for hiring in the quarter. Meanwhile, the aggregate employee hours worked index edged down from 9.7 to 3.1.”

Expectations for oil and gas prices are down from first quarter expectations too. Said one E&P executive said, “The erratic nature of energy prices makes it very hard to invest currently. It also makes hedging a very difficult decision.”

On average, respondents expect West Texas Intermediate (WTI) oil prices will be about $57.14/bbl by the end of the year, with Henry Hub natural gas prices averaging $2.67/MMBtu.

“This is lower than expectations from the first quarter survey, in which respondents expected WTI oil prices to be $60.19/bbl by year-end 2019 and Henry Hub natural gas prices to be $2.96/MMBtu,” economists noted.

For reference, WTI spot prices averaged $53.20 during the survey collection period, and Henry Hub spot averaged $2.42.

Asked about whether they have undertaken initiatives regarding water use/management, roughly one-quarter (26%) said they had invested in water infrastructure, while 16% stated they were involved in water recycling/reuse.

“Fifteen percent have worked with landowners or local governments to deal with water management issues, and 11% have instituted plans to reduce water use,” economists noted. “Overall, a greater percentage of exploration and production firms — 46% — have taken initiatives related to water management compared with 28% of service firms.”

Said one E&P executive, “We have always endeavored to operate responsibly and be respectful of the rights of our landowners, with an overall view to not waste and not have a detrimental impact on the land.”

Meanwhile, the Railroad Commission of Texas (RRC) earlier this month said requests for drilling permits fell in May from a year ago. The RRC issued a total of 1,050 original drilling permits in May, versus 1,243 in May 2018.

The latest monthly total included 931 permits to drill new oil/gas wells, 17 to re-enter plugged well bores and 102 to recomplete existing well bores. Of the permits requested, 218 were for oil wells, 71 for natural gas, 675 oil or gas, 69 injection, five service and 12 other permits.

During May, RRC staff processed 735 oil, 153 gas, 40 injection and one other completion compared with May 2018’s 739 oil, 134 gas, 57 injection and six other completions.

Total well completions processed for 2019 as of mid-June were 4,173, down from 4,450 recorded during the same time period in 2018.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |