Shale Daily | Bakken Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report

North Dakota Natural Gas, Oil Production Declines in April

A $10/bbl oil price drop for Bakken Shale supplies this month has cast a spell of uncertainty and “caution” among major producers, according to the director of North Dakota’s Department of Mineral Resources (DMR).

Oil prices last week have become a “very significant source of concern,” even though in April, the most recent month of complete statistics, oil prices were about $11/bbl above forecasts for state revenues, DMR director Lynn Helms said during a webcast Friday.

“But the $10 drop in oil prices that we have seen in the last 10 days put us right at the revenue forecast numbers. We’ve lost the healthy cushion we had the first three months this year. We’re watching prices very closely, and industry is very concerned.”

Bakken producers are “very cautious and very concerned,” and the industry will likely stay at or slightly below the current numbers of drilling rigs and completion crews, he said.

One operator who plans to reduce its rig count recently told Helms that over the past 12 months drilling and completion efficiencies have improved by 20% and 30%, respectively. “The rigs they have out have gotten so good at drilling that each rig is now turning out three wells per month,” Helms said. The same operator is downsizing from three to two completion crews because of greater efficiencies.

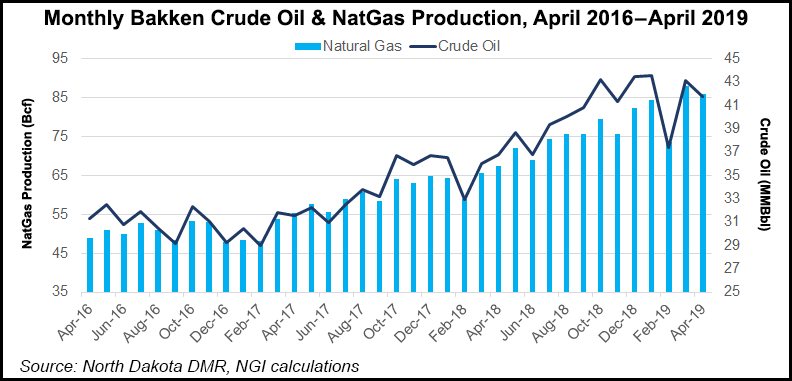

Overall oil production for April was 41.7 million bbls (1.391 million b/d), compared to 43.1 million bbls (1.391 million b/d) in March, and gas production was 85.8 Bcf (2.86 Bcf/d), compared to 87.9 Bcf (2.83 Bcf/d). Sixty-one rigs now are operating in North Dakota, down from 65 in May and 63 in April.

Between 90 and 100 well completions had been forecast for April, but the actual number was only 78, and nearly 1,000 wells remain uncompleted in the state backlog, Helms said.

With the recent drop in oil prices, Helms said he has become less optimistic about end-of-the-year production projections. “Having spent time with half of our operators, the attitude I picked up is that growth will be small and slow, and in the current oil price environment rapid growth is just not possible, and the money is not readily available to overcome all the obstacles, like gas capture and workforce numbers.”

State-imposed natural gas capture goals have dropped nearly 10% below the desired state level of 88%, but there’s more optimism about cutting flaring longer term. “There are definitely impacts on current production from being under the current goal,” Helms said.

He cited two operators that are withholding completions on up to 75,000 b/d of wells because of a lack of gas capture infrastructure available. “The midstream companies are really feeling the pressure.”

North Dakota’s Justin Kringstad, director of the Pipeline Authority, said midstream processing/pipeline capacity should match production in the early 2020s as several projects are under development, but for now the shortfall continues.

“If you look at the impact of that system on the overall transmission dynamics in the region, you notice that production continues to exceed pipeline capacity,” said Kringstad, noting the shortfall in midstream capacity should continue longer term, too.

On gas capture, the connection rate for new wells is getting better, but he said too much congestion in the system prevents all produced gas to be moved to processing plants. “Currently gas production continues to exceed pipe capacity and will do so at least through the end of this year when additional capacity comes online.”

There is more momentum behind building more natural gas liquids (NGL) pipeline infrastructure, said Kringstad. NGL rail shipments recently totaled around 100,000 b/d. “There is substantial pressure to capture more and produce more NGL capacity. NGLs are going to be more supply driven.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |