NGI The Weekly Gas Market Report | Infrastructure | LNG | NGI All News Access

Saudi Arabia Renewing Interest in Russian LNG Sector

Saudi Arabia, which is taking stakes in several Lower 48 export projets, is said to be eyeing plans to become a major player in Russia’s liquefied natural gas (LNG) sector.

On Monday, Energy Minister Khalid al-Falih reportedly said in an interview with Russian news agency TASS that state-owned Saudi Arabian Oil Co., aka Aramco, had extended an offer to join Russian gas producer Novatek’s Arctic LNG 2 project. Aramco also is apparently studying other LNG projects by state-owned Rosneft and Gazprom.

“Aramco is interested in global LNG,” al-Falih reportedly said, “but it also has to be commercially attractive,” which is why it has signed memorandums of understanding (MOU) with various U.S. energy operators.

Last year Saudi-owned Motiva Enterprises based in Houston inked two MOUs that represent billions in potential investments to take advantage of growing U.S. natural gas and oil feedstocks. The MOUs with TechnipFMC and Honeywell UOP were to study at least two petrochemical projects worth an estimated $8-10 billion.

Aramco is is willing to sign an MOU with Novatek, according to the interview. “So, we are hoping that they will agree to Aramco’s offer. It’s a commercial transaction, so it has to be profitable for both companies entering into the agreement. Novatek is a very sure investor and they are looking for the best deal ,and so is Aramco.”

Al-Falih’s comments came a few weeks after reports that Aramco had withdrawn from earlier negotiations with Novatek because of U.S. sanctions against Russia’s energy sector, as well as financial disagreements over any forthcoming Arctic LNG 2 deal.

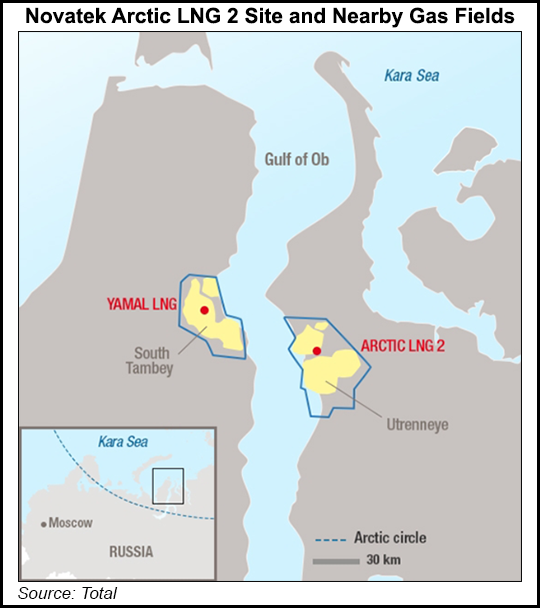

Supermajor Total ASA, second only to Royal Dutch Shell plc in selling LNG, holds a 10% interest in the Arctic LNG 2 project, which is slated to be commissioned between 2022-2023. Arctic LNG is to have three liquefaction/production trains with a total capacity of 19.8 million metric tons/year (mmty).

Cost estimates for the project have recently been estimated at $21-22 billion, though cost overruns for large greenfield LNG projects are often the norm. Two subsidiaries of China National Petroleum Corp. each control a 10% share of the project, while Novatek holds a 70% share.

Saudi Arabia’s interest in LNG project development comes as it tries to diversify its energy sector. In November, Aramco CEO Amin Nasser said that the Saudi gas sector would attract as much as $150 million in investment over the next decade as production grows from 14 Bcf to 23 Bcf.

Aramco is gaining stakes in U.S.-based LNG projects too. Last month Aramco signed a heads of agreement to negotiate buying a 25% stake in Phase 1 of Sempra Energy’s LNG export project in Port Arthur, near Houston. The parties also are finalizing a 20-year sale and purchase agreement or 5 mmty of offtake from the initial phase of the project.

In 2018, 313.8 million metric tons (mmt) of LNG was sold globally, while 99.4 mmt was traded on a spot or short-term basis, according to The International Group of Liquefied Natural Gas Importers (GIIGNL). There were more than 1,400 LNG spot deals in 2018, according to Shell’s LNG Outlook 2019.

An investment by Saudi Arabia in Russian’s LNG sector would strengthen growing bilateral and energy ties between the two countries. It would also help Moscow achieve its goal of vying to become one of the world’s top LNG producers.

When the Arctic LNG 2 project becomes operational Novatek’s total LNG liquefaction capacity will increase to 37 mmty, helping Russian President Vladimir Putin’s LNG plans come to fruition. In May, Putin signed a new national energy security doctrine that makes Russian LNG capacity a national priority.

Russia reportedly plans to expand its LNG capacity to 100 mmty by 2035. However, by the mid-2020s, the world’s No. 1 LNG producer Qatar is expected to have a global leading 110 mmty worth of liquefaction capacity.

Russia’s LNG development will also create headwinds for U.S. LNG exports, both in Europe and in the Asia-Pacific region, which accounts for around two-thirds of global LNG demand, with that amount forecasted to increase amid more LNG procurement from China as well as in South Asia from India, Pakistan, and Bangladesh and in Southeast Asia from Vietnam, Thailand and the Philippines.

Shell’s Stuart Bradford, senior deal lead, said in March Russian LNG projects are well positioned to compete with North American projects to reach new markets in Asia and the Atlantic-basin despite challenges. Russian LNG can offer several location options, including the planned capacity expansion at the Sakhalin plant, the Arctic with Yamal LNG and Arctic LNG 2 projects led by Novatek, and the Baltic coast, with the Baltic LNG project.

However, U.S. projects still enjoy an advantage from lower capital expenditures and support from lower tax schemes than their Russian LNG project counterparts. Bradford said that the commercial arrangements in North America are implemented on basis risks, with gas prices based on the well-established Henry Hub price benchmark.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |