Shale Daily | E&P | NGI All News Access

U.S. E&Ps Controlling Capex, but Pricing Suffers as Oil, Natural Gas Output Surges

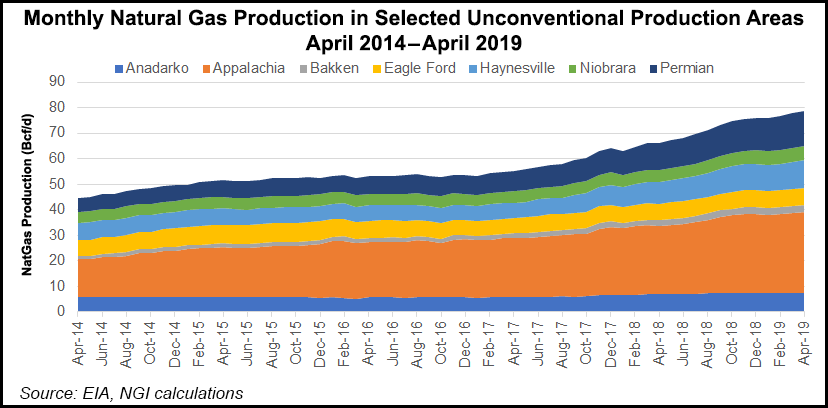

Lower 48 oil and natural gas producers overall defied the odds and held the line on capital spending during the first quarter, but prices remain squeezed as oil, natural gas and liquids production continues to top expectations.

In a look back at the first quarter reports by exploration and production (E&P) operators, analysts with Raymond James & Associates Inc. said they saw three “core themes” permeate the reports: merger and acquisition (M&A) activity, midstream monetizations and better-than-expected production figures.

“The desire to create scale and drive significant operational synergies make M&A increasingly likely in the coming years,” analysts said.

Occidental Petroleum Corp.’s ability to win a bidding war with Chevron Corp. for Anadarko Petroleum Corp. clearly has been the biggest headline in 2019, but other U.S. dealmaking has been in the spotlight over the past year, particularly combinations of Permian Basin operators. These mid-cap mergers are expected to continue.

“On the other hand, selective large-cap E&Ps (i.e., Permian) will likely remain in the conversation when discussing where the majors may go next,” Freeman and his colleagues said. Midstream deal activity also should continue to increase as operators cut back on capital expenditures (capex) and pare the balance sheet.

Notably, more than half of the Raymond James team’s Lower 48 E&P coverage beat on production in 1Q2019 “and almost nobody raised capex,” part of a “newfound conservatism” even as production continues to increase.

“On the flip side, takeaway constraints (see Permian gas) and infrastructure delays are all potential headwinds restraining further production raises. Additionally, second quarter earnings have historically been when most companies make changes to capital budgets so the market will watch closely for companies to maintain capital discipline.”

RBN Energy LLC, which tracks several dozen producers, noted that the S&P E&P stock index has retreated 13% to mid-February levels, during a time when operators released first quarter results.

“That suggests that, despite a 38% quarter-on-quarter increase in pre-tax operating profit of the 44 E&Ps we track, investors found nothing in the first quarter results to dispel the generally negative sentiment that has hung like a dark cloud over the oil and gas industry since late 2014,” RBN’s Nick Cacchione said.

“Nearly two-thirds of our way through the second quarter of 2019, E&P profitability looks to be on the upswing for the oil-weighted and diversified peer groups, with oil prices up 15% so far this quarter over the first quarter,” he said.

“Natural gas prices, however, are about 10% lower, which will hurt profits for the gas-weighted E&Ps and offset some of the oil-related gains for the diversified E&Ps.” He predicted full-year profitability would be challenged to match 2018 results, excluding extraordinary and one-time charges.

“As they stand now, oil prices in 2019 look like they will be about 10% lower than 2018 prices, while natural gas prices are a few percentage points worse than that,” Cacchione said. “This will push cash flows lower and may have a negative impact on capital spending and share repurchases.”

Even if capex is depressed, Lower 48 operators are on course to increase oil production significantly this year, according to Rystad Energy calculations, with growth in the Lower 48 from 1Q2019 through 4Q2019 forecast to increase by around 1.1-1.2 million b/d, or 16%.

“After a paltry first quarter, depressed by weather effects, U.S. shale players have over the past weeks assured investors that they will achieve previously communicated production targets, as well as demonstrate excellent capital discipline and cost control,” Rystad analysts said.

There were temporary challenges early this year, but E&Ps are set to deliver on their original production and capex targets, some “well positioned” to perform above initial expectations.

For the gassy Appalachian E&Ps, downward pressure on strip pricing is expected to lead to even deeper spending cuts as operators try to operate within cash flow and deliver on this year’s plans.

A lack of trust exists among investors who are concerned that Lower 48 E&Ps can continue to keep capex under control, according to Raymond James, and it has driven negative sentiment following the 1Q2019 results.

The “risk/reward was skewed significantly to the downside,” and many investors “expressed skepticism that the industry would ever reach a point of generating meaningful free cash flow.”

Other shareholders shared “a lack of trust that management teams would make the right decision with free cash flow if they generated it…”

The energy sector is near an all-time low of 5% weighting in the S&P 500, versus 15% a decade ago and more than 10% five years ago.

“We heard from many investors that getting more active in the sector isn’t worth the headache given low weighting in respective indexes relative to the volatility,” Raymond James analysts said. “The past several years of consistent energy under performance have only reinforced that view.”

Shareholders want E&Ps to “show me the money…I’ll believe it when I see it,” when discussing capital discipline, free cash flow and shareholder returns.

Beyond the E&P sector, Evercore ISI analysts led by James West said there are signs of stabilization within the oilfield services (OFS) sector.

“Moving past the weather impact in the first quarter, utilization levels within the OFS sector have improved for completion-oriented service lines,” West said. Pricing also has stabilized, partly on improving activity levels and more capital discipline.

Meanwhile, the U.S. land rig count has begun to stabilize as the pace of declines slows.

“We would expect rig count growth will start to emerge in the next few weeks, driven by private operators spending capex as commodity prices have moved higher from the start of the year,” West said. “However, we still believe that the end of 2019 will be impacted by budget exhaustion like the industry experienced in 2018.”

A lot of the onshore rig count decline has been driven by private E&Ps, which quickly responded to the oil price meltdown late last year.

“Now that commodity prices have moved higher in 2019, there is much debate around how private operators will respond,” West said. “These companies are not under the same mandate to maintain capital discipline like public E&P companies…But we still think that the market will closely watch what the privates will do as the year progresses.”

Of the 430 or so rigs operating in the biggest activity center, the Permian, around 140 of late have been operated by privates.

Even with the decline in rigs, dayrates for the top-of-the-line, super specs continue to hold.

“We believe dayrates will continue to hold up, especially as the rig count starts to increase in the next few weeks,” West said. “So far in 2019, average monthly dayrate growth has been 0.50%. In the 1,500-1,999 hp rig category, dayrates have increased approximately $700 point-to-point from the December 2018 average to the April 2018 average. In addition, 1,500 hp rigs continue to take market share.”

Completions activity is picking up, which could mean “slightly better days ahead” for the fracture sand subsector. Still, Evercore’s team is struggling to envision a scenario where pricing recovers materially. Cash from operations should trend higher in 2Q2019, and combined with lower capex “should result in excess cash for paying down debt and funding stock buybacks.”

Evercore’s view matches that of other analysts, who recently said fracture sand providers face a supply and demand imbalance that could pressure prices into the foreseeable future.

For the natural gas liquids (NGL) segment, BofA Merrill Lynch Global Research analysts noted that liquids prices have not participated in the oil price rally to date this year. High stocks have made it difficult for prices to keep pace with oil, forcing NGLs to compete for market share in the petrochemical market.

Realized NGL prices fell to a two-year low of roughly $18/bbl in 1Q2019, and prices are forecast to be even lower for 2Q2019.

“Unfortunately, feedstock price competition determines which of the NGLs are consumed, but does not increase total demand and therefore does not alleviate the broader NGL glut,” analysts noted.

New ethylene crackers scheduled to enter service later this year could consume 330,000 b/d of ethane, according to BofA Merrill Lynch. In addition, 275,000 b/d of propane and butane export capacity on the Gulf Coast is expected online in 3Q2019.

NGL production growth likely will decelerate in 2020 to 380,000 b/d, near the five-year average growth rate but less than the 580,000 b/d expected this year.

Meanwhile, analysts said, planned NGL export capacity additions from the Northeast via Mariner East could re-direct liquids barrels from the Conway hub, “indirectly easing pressure on Gulf Coast liquids.”

However, with no cracker projects in 2020 and the “next wave” of Gulf Coast export capacity additions not coming before the second half of 2020, “the NGL market might have to send a stronger message to producers to help balance the market.”

If NGL prices remain depressed at 1Q2019 levels through 2019, U.S. E&P revenues, excluding hedges, could decline by around 2%, according to BofA Merrill Lynch.

“In an effort to juggle capex and distributions within the confines of cash flow, producers may be forced to limit upstream spending,” analysts said. “Alternatively, producers may reallocate capital to acreage that is less exposed to NGLs. Either way, NGL supply growth likely needs to slow down.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |