NGI The Weekly Gas Market Report | Infrastructure | LNG | NGI All News Access

LNG Canada Given Green Light by Shell, Partners

Shell Canada Energy Ltd. said Tuesday it has taken a final investment decision (FID) on LNG Canada, a major natural gas export project in Kitimat, BC.

The Royal Dutch Shell plc unit, which holds a 40% stake in the project, said the liquefied natural gas (LNG) export project would be online and shipping to Tokyo Bay by the mid 2020s. Initially, the project is to consist of two liquefaction trains that together would provide 14 million metric tons/year of LNG. There also is an option to expand to four trains in the future.

Construction is to begin “immediately” in Kitimat, executives said. Shell’s 40% share of the project’s capital cost, estimated at $30 billion-plus, is within its current overall capital investment guidance of US$25-30 billion per year.

“We believe LNG Canada is the right project, in the right place, at the right time,” said CEO Ben van Beurden. “Supplying natural gas over the coming decades will be critical as the world transitions to a lower carbon energy system.

“Global LNG demand is expected to double by 2035 compared with today, with much of this growth coming from Asia, where gas displaces coal. LNG Canada is well positioned to help Shell meet the growing needs of customers at a time when we see an LNG supply shortage in our outlook.”

The project is expected to deliver Shell an integrated internal rate of return of 13%, while cash flow is expected to be significant over its lifespan, van Beurden said.

“We believe LNG Canada is an attractive investment opportunity in a strong joint venture, with companies that have deep LNG industry experience,” said Shell’s Maarten Wetselaar, who directs the Integrated Gas and New Energies unit. He discussed the project during a conference call. “In the last two years, LNG Canada has improved its competitiveness, reduced execution uncertainty and gained significant stakeholder support.

“Together with our joint venture participants and contractors, we look forward to working with the local community, First Nations, government and the LNG Canada team to build and operate this game changing project for Canada’s energy industry.”

LNG Canada is being built in a relatively remote area, which means a higher cost. However, there is substantial infrastructure in the region, he said, including an airport to allow crews to be transported in and out easily. A work camp is to be set up, and facilities would be in place to make construction move smoothly.

Even though the initial costs could be higher than building a facility along the U.S. Gulf Coast, with its huge gas supplies, workforce advantages and extensive pipeline supply systems, Wetselaar said there are advantages that Shell and its partners thought made it a “dreamfield” project rather than just a greenfield facility.

For one thing, he said, LNG Canada would hold advantages over U.S. Gulf Coast export facilities because of its relatively short shipping distance to North Asia.

LNG supply from Kitimat would be able to reach Tokyo Bay in about “half the time” it takes a U.S. Gulf Coast cargo to reach an Asian port, he said. From Kitimat, it would take about 10 days. For a Gulf Coast cargo, it takes about 24 days, which includes traversing the Panama Canal.

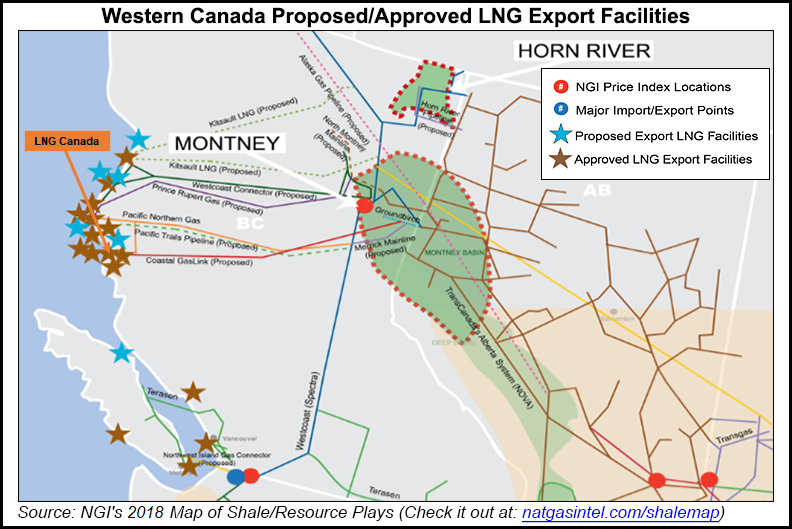

LNG Canada also would be advantaged with access to low-cost gas from BC’s vast resources, particularly the Montney formation, as well as abundant Western Canada supplies that are looking for a home, Wetselaar said.

Shell has working interests in the Groundbirch play in BC, which holds an estimated 9 Tcf of recoverable reserves at least. Groundbirch can be produced for about $2/MMBtu, Wetselaar said.

Besides its equity gas position in Canada, Shell could take advantage of the AECO market, which would allow it “to buy gas if it’s cheaper than what we produce.” Canada “has more supply than the local market can handle,” with exports to the United States in retreat. “Canada gas is significantly lower than Henry Hub gas,” giving LNG Canada another leg up on Gulf Coast supply.

The export facility would be constructed on a “large, partially developed industrial site with an existing deepwater port, roads, rail and power supplies,” he noted.

The project was planned and designed by working closely with local communities, First Nations and governments to ensure sustainable development was considered in every aspect of the project. For example, the project has been designed to achieve the lowest carbon intensity of any LNG project in operation today, aided by the partial use of hydropower, according to Shell.

The positive FID follows announcements last Friday when two Asian partners in LNG Canada disclosed they would foot their bills for the proposed Pacific coast terminal. In regulatory filings, PetroChina Co. and Korea Gas Corp. approved their share costs for the Kitimat project. PetroChina is a 15% owner, while Korea Gas has a 5% interest. Petronas holds a 25% stake and Mitsubishi Corp. has a 15% interest.

Total project investment, for the export terminal plus BC natural gas drilling and a TransCanada Corp. supply pipeline, Coastal GasLink, has been forecast to grow eventually into the C$30 billion to $40 billion range ($24-32 billion).

The BC government had given LNG Canada until November to accept an offer last March of a forecast C$6 billion ($4.8 billion) in provincial sales, income and carbon tax cuts as incentives to build the terminal.

In conjunction with the LNG Canada FID, TransCanada Corp. said it would proceed with the Coastal GasLink pipeline project, which would traverse 670 kilometers (420 miles) of BC woods, muskeg swamps and mountains to connect the Kitimat terminal to northern gas fields.

The project is to use jumbo pipe, 48 inches in diameter, to move gas from the Montney formation near Dawson Creek, BC, to the Kitimat terminal. Initially, the pipeline would have 2.1 Bcf/d of capacity and could be expanded to carry up to 5 Bcf/d.

Construction of the pipeline, now estimated by TransCanada to cost C$6.2 billion ($4.8 billion), is to begin early next year, with in-service in 2023. Pre-development costs to date are C$470 million.

“The magnitude of the work undertaken over the past six years has been extensive,” TransCanada CEO Russ Girling said. “It demonstrates the commitment of our teams, our partners, BC communities and Indigenous groups to work together toward a single goal of fostering an LNG industry off Canada’s west coast that will help maximize the value of our important natural gas resources in a sustainable and responsible way.”

The pipeline is underpinned by 25-year transportation agreements with renewal provisions by the LNG Canada partners. All 20 aboriginal reserves along the Coastal GasLink route have signed cooperation and benefits agreements.

Most of the construction is planned for 2020-2021. The final cost of the project is be recovered in future pipeline tolls.

To foot the bill for the pipeline, TransCanada intends to prowl for joint venture (JV) partners.

“Once constructed, Coastal GasLink will become a critical component of British Columbia’s natural gas pipeline infrastructure, connecting our abundant, low-cost natural gas resources to global markets,” Girling said. “Solid underlying market fundamentals, combined with robust commercial support for the project, position us to prudently fund Coastal GasLink over its multi-year construction along with our existing C$28 billion near-term capital program in a manner consistent with our long-established strong financial profile.”

Coastal GasLink first was proposed in 2012 after LNG Canada selected TransCanada as its pipeline partner of choice. Since then, the pipeline team has completed environmental and field studies, received regulatory approvals, and conducted consultation and engagement programs with local communities and Indigenous groups. The pipeline has all required permits in hand to begin construction.

The pipeline project is expected to employ 2,000-2,500 people during construction and generate about C$20 million a year in ongoing property tax benefits to BC communities, TransCanada noted.

“Our team has demonstrated that we have the knowledge and expertise to move this important project forward safely and responsibly, with the full understanding that our success comes from the close working relationships we have developed with our Indigenous and local BC communities,” Girling said. “It is time to build this pipeline. We are ready to do that and want to express our deepest gratitude to those communities and First Nations groups who have supported our project over the past six years.”

In conjunction with the massive undertaking, a JV between Fluor Corp. and JGC Corp. also was cemented on Tuesday to provide the engineering, procurement, fabrication and construction. Fluor said it would book its US$8.4 billion share of the about $14 billion contract value in 4Q2018.

According to Fluor, more than 4,500 workers would be employed at the peak of construction of the liquefaction facility. The JV plans to “focus on hiring locally and then throughout British Columbia and Canada.” Site activities already have begun, the company said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |