Utica Shale | E&P | Marcellus | NGI All News Access

Rover’s Rapid Progress Has Analysts Watching For Producer Ramp-Up

With Energy Transfer’s Rover Pipeline project progressing at a rapid pace, the countdown is on for producers to be ready fill that new capacity when it hits the market.

The $4.2 billion, 3.25 Bcf/d Appalachian takeaway mega project is supported by significant producer commitments and is around 95% subscribed, but questions remain about how quickly the basin as a whole will respond to the influx of new capacity Rover will bring.

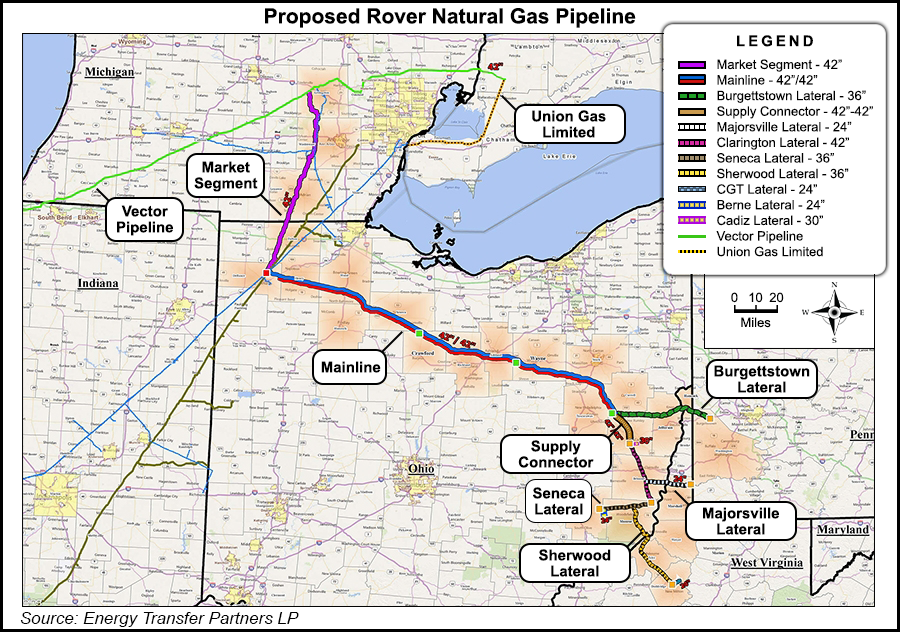

Rover will run east-to-west out of Ohio, transporting Marcellus and Utica shale gas to interconnects with the Midwest Hub in Defiance, OH, with the Vector Pipeline in Michigan and with the Dawn Hub in Ontario, Canada.

The project received its Natural Gas Act certificate from FERC on Feb. 2 and has since stuck to an aggressive timetable of partial service to Defiance, OH, by July and full service to Dawn by November. Last month, Energy Transfer COO Marshall McCrea, no doubt relieved to finally have a Federal Energy Regulatory Commission certificate order in hand, said the company had deployed “a tremendous amount of manpower” to clearing trees for the pipeline.

In early March, FERC cleared Rover to begin construction in most areas along the project path, and this week, the pipeline received another incremental order from Commission staff approving construction at milepost 13.5 of the project’s Majorsville Lateral in an area that had been subject to an environmental condition listed in a prior authorization.

Energy Transfer spokeswoman Vicki Granado said Friday that the company had completed tree clearing work on the project, wrapping up before a federally-mandated seasonal window closed at the end of the month.

“All tree clearing has been completed and construction is actively underway in all four states along the route,” Granado said.

Meanwhile, a local news station released video Thursday taken from a flyover of the pipeline’s path through Richland County, OH. The video appears to show substantial progress in clearing the right of way and preparing the pipe for burial.

Matt Hoza, an analyst with Lakewood, CO-based BTU Analytics, noted Rover’s “impressive progress” to date, but he added that rig counts indicate producers are still guarding against the possibility of a delay.

Friday’s Baker Hughes Inc. rig count showed the Marcellus gaining two rigs to reach 44, with the Utica holding week/week at 22. The basin’s rig count has held relatively steady through the first quarter of 2017 after a sharp rise through the second half of 2016, historical data show.

“Drilling activity has been pretty telling as far as how producers treat the uncertainty around major infrastructure projects,” Hoza told Shale Daily in an email. “I think a lot of producers took note of [Cabot Oil & Gas Corp.’s] situation where they started drilling in anticipation of the Constitution Pipeline coming online only to be left holding the bag.

“This means we haven’t seen the ramp-up in drilling activity that we would need to fill Rover with new gas production. We do expect a lot of gas-on-gas competition, as the pipe comes online and drilling activity ramps up,” he added. “However, since there is a six- to nine-month spud-to-sales time in the Northeast, it will take some time for the effects of that drilling activity to be seen.”

Hoza previously noted that the production response to the 800 MMcf/d REX Zone 3 Capacity Enhancement Project differed from previous Northeast takeaway expansions due to the intervening backlog drawdown, resulting in some pipe-on-pipe competition rather than a near-immediate production ramp-up to fill the incremental capacity.

According to analysts, the major taker on Rover is Oklahoma City-based Ascent Resources, a privately-held exploration and production (E&P) company with roots in the former American Energy Partners LP created by late industry pioneer Aubrey McClendon.

Justin Carlson, vice president of research for East Daley Capital, noted recently that Ascent — with 1.1 Bcf/d committed to Rover — ramped up to four rigs in Ohio in March after running one to two rigs previously.

According to Carlson, the company is currently outputting around 600 MMcf/d that is limited by available space on its commitments to the Rockies Express Pipeline (REX) and Dominion Transmission. The company would be on track to fill its more than 2 Bcf/d of capacity commitments by 2021 if it runs five rigs starting next year, the firm said.

“Right now I don’t know that they have enough rigs to fill all that capacity,” Carlson told Shale Daily. “I don’t know how many” drilled uncompleted wells “they have in inventory…but their growth curve definitely starts to fill into their Rover capacity by 2020.”

Carlson said he expects Ascent to add more rigs to start to fill more of their committed capacity “because now they have it and they might as well fill it sooner. If they don’t fill it they have to resell it.”

The question then becomes “if they resell it will the market be there to support it, because you have an awful lot of pipeline capacity coming online,” he added. “Is there enough production out there available for them to resell into once the new capacity comes online?”

With Rover, the competing Nexus Gas Transmission pipeline and TransCanada’s recent discount tempting Western Canadian producers to move gas east on its Mainline, the Dawn Hub is on the verge of seeing a flood of new available gas in the near future.

“The differential to Dawn will disappear,” Carlson said when asked about the potential price impact from the proposed capacity on Appalachian production traveling to Ontario. “It’s sort of a chicken or an egg scenario, where if you don’t make the commitment, the differential doesn’t disappear, and if you make the commitment, the differential disappears. You have to make that commitment, because otherwise you’re getting in-basin prices forever…You’ve got to buy some capacity out in order to assure that any incremental production you have above and beyond that capacity gets a better price.”

He added, “Owning capacity out of the Marcellus is a big deal, because it’s constrained.”

Antero Resources Corp., another major taker on Rover at 800 MMcf/d, has successfully followed a strategy centered around firm transportation commitments and hedging to ride out what has at times been brutal in-basin pricing.

“We believe our firm transport and hedge book will continue to be competitive advantages for Antero, as uncertainty around both Northeast basis differentials and overall gas pricing is likely to continue,” CFO Glen Warren said during a 4Q2016 earnings conference call.

Management said Antero is prepared to ramp up into the new Rover capacity once it’s online, though CEO Paul Rady said the E&P company would also be “prepared if it opens later.”

NGIDirector of Strategy and Research Patrick Rau described the risk/reward balance that E&P companies must navigate in committing to a project like Rover.

“E&Ps tend to get paid by developing their reserves (i.e. moving them into the proved category). If gas has no pipeline takeaway capacity, then it is considered stranded gas, and therefore not proved,” Rau said. “So E&Ps do have a potential incentive to underwrite those pipelines that is different from those of end-users.

“However, pipelines are expensive, and pipelines can ruin basis differentials, thereby reducing the net present value of building that pipeline,” he added. “I’m not going to say something cheesy like E&Ps are darned if they do, darned if they don’t. But it kind of applies.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |