Marcellus | NGI All News Access

Unconventional Gas Production Hits New Record in Pennsylvania

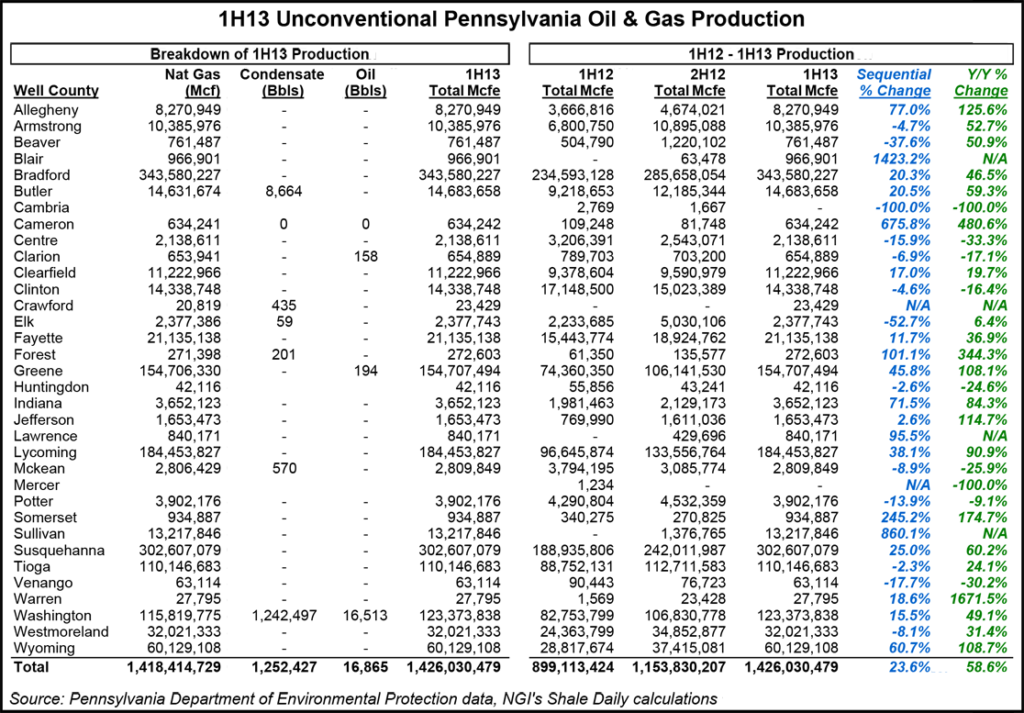

A biannual production report posted by the Pennsylvania Department of Environmental Protection (DEP) shows the state’s stable of unconventional gas wells produced a record 1.42 Tcf during the first six months of 2013.

The latest production figures — most of which are from wells targeting the Marcellus Shale, but also include wells targeting the Utica Shale and other formations — are a 58.5% increase over production from 1H2012, when the DEP reported unconventional wells produced 894.8 Bcf (see Shale Daily, Aug. 24, 2012).

Production during the first six months of 2013 was also 23.5% higher than 2H2012, which had totaled 1.15 Tcf (see Shale Daily, March 6).

“The amount of clean-burning natural gas being safely produced in the Commonwealth is nothing short of staggering,” said Marcellus Shale Coalition CEO Kathryn Klaber. “The United States is the world’s top natural gas producer, and Pennsylvanians should be very proud that we’re playing a critical and growing role in this historic transformation.”

According to the DEP, the well that produced the most natural gas during the first half of 2012 was Southwestern Energy Production Co.’s Campbell Ercole Demento No. 4H well. Located in Bradford County’s Stevens Township, the well produced 14.1 Bcf of natural gas. Cabot Oil & Gas Corp.’s T Flower No. 2 and T Flower No. 1 wells recorded the second- and third-highest production, at 5.49 and 4.13 Bcf, respectively. Cabot’s wells are in Susquehanna County’s Springville Township.

Operators also reported producing 1.25 million bbl of condensate and 16,865 bbl of crude oil from January to June. Combined with natural gas, unconventional wells in Pennsylvania produced 1.43 Tcfe.

Range Resources Appalachia LLC’s Carns Donald Unit No. 19H well, located in Washington County’s Smith Township, produced the most condensate (16,904 bbl) during that time frame. Meanwhile, Chesapeake Appalachia LLC’s Guy Avolio 8H well, in Washington County’s County’s Independence Township, produced the most crude oil (5,125 bbl). The well also produced the most crude oil during 2H2012 (6,507 bbl).

Bradford County topped the list of natural gas producing counties with 343.58 Bcf in 1H2013. Susquehanna County was second with 302.61 Bcf, followed by Lycoming (184.45 Bcf), Greene (154.71 Bcf), Washington (115.82 Bcf) and Tioga (110.15 Bcf) counties.

Three counties saw tremendous production growth over the preceding half-year report for 2H2012. Blair County production grew 1,423.2% (from 63,478 Mcfe to 966,901 Mcfe); Sullivan County grew 860.1% (from 1.38 Bcfe to 13.22 Bcfe); and Cameron County grew 675.8% (from 81,748 to 634,242 Mcfe).

The DEP’s Office of Oil and Gas Management has annual oil and gas production reports dating back to 2000 available for download from its website. The first Marcellus-only report covered a 12-month period from July 2009 to June 2010. Subsequently, the DEP released Marcellus-only reports that covered 2H2010, 1H2011 and 2H2011.

Beginning with the 1H2012 report, the DEP began reporting all unconventional production without a breakdown by shale/tight gas and oil plays. The agency has also published a conventional well production report for the full-year 2012. The DEP said the changes were mandated by Act 13, the state’s omnibus Marcellus Shale law (seeShale Daily, Feb. 15, 2012).

Pennsylvania’s Oil and Gas Act requires unconventional well operators to submit production reports to the DEP twice a year — by Aug. 15 for the first six months of a year, and by Feb. 15 for the second half of a year, and for the full preceding year.

Spokeswoman Lisa Kasianowitz told NGI’s Shale Daily that DEP was still waiting for 13 smaller operators, who collectively own 50 wells, to report their production figures for 1H2013. The largest, Dallas-based Hunt Marcellus Operating Co. LLC, has 14 wells. She said about five operators only have one well apiece.

“These are small operators, but nonetheless we still want their data to have a full comprehensive report,” Kasianowitz said Monday. “The regulations state, one well or more, they have to submit production data.”

Last year, the DEP received a wave of criticism from energy analysts over the way it handled production reports when the initial release omitted data from Chesapeake Energy Corp., Talisman Energy Inc. and SWEPI LP due to problems with their submissions; several smaller producers were not represented because they were late in reporting.

The production from Chesapeake, the state’s top producer, was originally left out due to technical problems, while Talisman’s numbers were omitted after it submitted its production figures in gallons, not the required barrels (see Shale Daily, Aug. 22, 2012). SWEPI, a subsidiary of Royal Dutch Shell plc, was also originally left off the report due to reporting errors.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |