NGI The Weekly Gas Market Report | LNG | Markets | NGI All News Access

Spot Imports Accounted for 30% of Global LNG Imports in 2018, Says IGU

The continued increase in Henry Hub-priced U.S. liquefied natural gas (LNG) exports and a general rise in spot cargoes last year marked the most significant change in global imports in more than a decade, according to the International Gas Union (IGU).

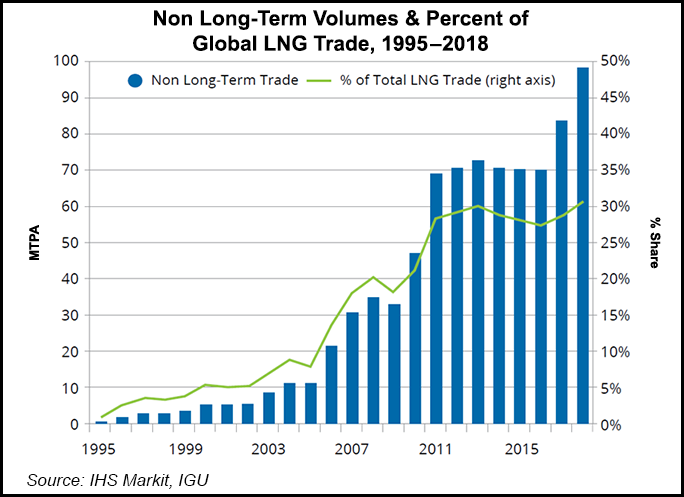

“The share of spot LNG imports reached just over 30% of total LNG imports in 2018, amounting to some 126 bcm [billion cubic meters] — an increase of 65 bcm since 2016, or 10.5%,” IGU said in its 2019 Wholesale Gas Price Survey, which was released last Friday.

IGU, which began compiling the now annual surveys in 2007, said the series has “confirmed the significant changes in wholesale price formation mechanisms during a period of key developments and upheaval in the global gas market.” The surveys consider different types of price formation mechanisms on the world stage.

Spot imports accounted for slightly more than 30% of total LNG imports last year, an increase of 10.5% (65 bcm) since 2016, according to the report.

Gas-on-gas competition rose by half a percentage point to 47% between 2017 and 2018, IGU said.

“That largely reflected the increasing share of spot LNG cargoes in LNG imports and rapidly growing U.S. consumption, that more than offset the declining share in pipeline imports, as a result of reduced European pipeline imports and increased China pipeline imports.

“The oil price escalation share declined by a quarter of a percentage point to 19%, with the loss in LNG imports being partly offset by gains in pipeline imports and domestic production in China.”

The global gas trade is set to more than double over the next 20 years to around 900 bcm from 400, about as much in trade by 2040 as the combined consumption of the United States and Canada today, BP plc CEO Bob Dudley said recently. Speaking at the 19th International Conference & Exhibition on Liquefied Natural Gas in Shanghai, industry experts said rising LNG supply and demand is injecting enthusiasm into the market.

In the shorter term, the ongoing U.S.-China trade war could drag down the LNG sector, according to analysts at ClearView Energy Partners. Chinese tariffs on LNG are set to increase to 25% for cargoes arriving June 1 and beyond from the 10% tariff in place since last year. LNG volumes to China “tailed off significantly as the 10% tariff went into effect in September,” analysts said Monday.

“At this juncture, both sides appear to prefer letting trade negotiations continuing unofficially simmering, rather than ending them formally. Those circumstances may not change even if, as we expect, the office of the U.S. Trade Representative follows through on President Trump’s threat to impose 25% tariffs on the balance of Chinese goods exports…in any case, we reiterate that neither ongoing impasse nor a weak, dubious deal that leaves tariffs in place looks particularly positive for U.S. operators or energy in general.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |