NGI Data | Markets | NGI All News Access

Bulls Unphased by Loose EIA Print as Natural Gas Futures Rise on Potential Return of January Cold

The natural gas futures market managed to shake off a particularly bearish government storage report Friday as forecasts for a potential shift to colder temperatures later this month seemed to inspire some buying after recent declines.

In the spot market, a mild forecast for much of the Lower 48 accompanied continued sub-$3 pricing in most regions, though reports of upcoming maintenance coincided with gains in the Northeast; the NGI Spot Gas National Avg. shed 10.0 cents to $2.700/MMBtu.

The February Nymex futures contract closed out the week above the psychologically significant $3 mark, adding 9.9 cents to settle at $3.044 Friday. March added 9.3 cents to settle at $2.905.

“Weather model guidance has finally begun to pick up on the colder weather risks we expected to develop in the middle third of January, with a weak cold shot now expected to arrive later” in the week ahead and a “stronger one potentially developing into the following week,” Bespoke Weather Services told clients Friday.

Bespoke expects colder trends to gradually creep into forecasts, pointing to shifts in the Eastern Pacific Oscillation and the North Atlantic Oscillation that would “allow for cold to be forced down more across the eastern U.S. Already models are showing a lobe of the tropospheric polar vortex sitting across the Hudson Bay, with just a modest upstream perturbation necessary to force much more cold across the country.

“This could easily come Week 3, as we look for the most cold of the month to be in the final third of January, and models can begin picking up on that” in the week ahead, potentially further boosting prices following Friday’s “extremely bearish” storage report from the Energy Information Administration (EIA), Bespoke said.

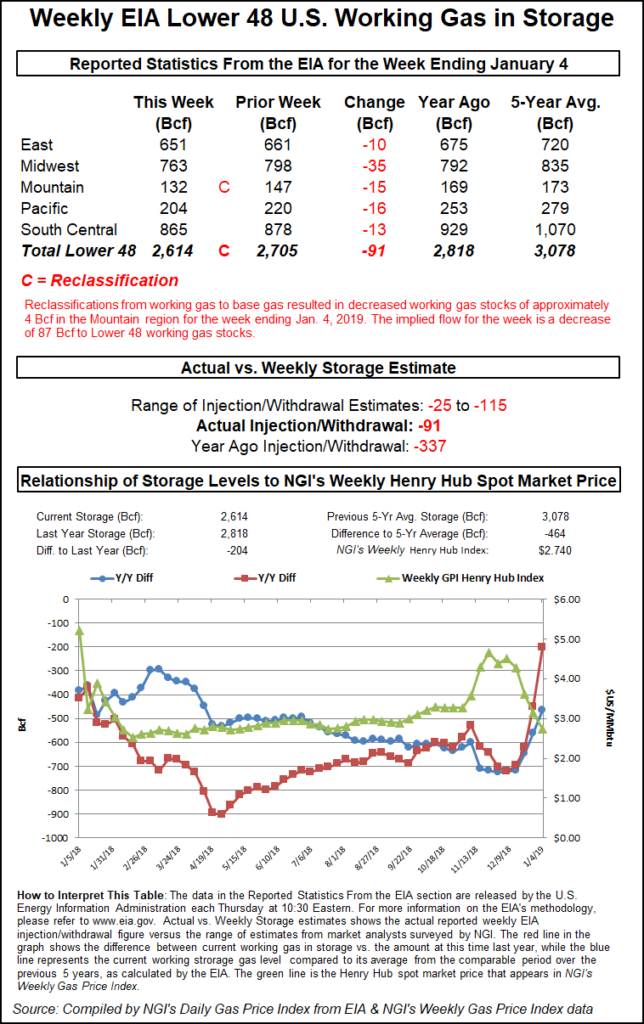

The EIA reported a 20 Bcf withdrawal from natural gas stocks for the week ended Dec. 28, sharply to the bearish side of expectations for what already figured to be a lighter-than-normal pull.

The report, released a day later than usual because of the New Year’s holiday, initially had a relatively muted impact on Nymex futures, despite the 20 Bcf withdrawal coming in much lighter than estimates and the year-ago and five-year-average comparables. Last year, EIA recorded a 193 Bcf withdrawal for the period, and the five-year average is a pull of 107 Bcf.

Estimates ahead of the report pointed to a light withdrawal, but few market participants had pegged a pull as light as the actual number. Responses to major surveys had clustered around minus 44 Bcf to minus 47 Bcf, with estimates ranging from minus 25 Bcf to minus 92 Bcf. Intercontinental Exchange EIA Financial Weekly Index futures had settled Thursday at a 33 Bcf pull.

The 20 Bcf withdrawal for the week made a big dent in the hefty year-on-year and year-on-five-year deficits. Total Lower 48 working gas in underground storage stood at 2,705 Bcf as of Dec. 28, 450 Bcf (14.3%) below last year’s stocks and 560 Bcf (17.2%) lower than the five-year average.

By region, EIA reported a 20 Bcf build in the South Central that caught a number of market observers by surprise, including a 22 Bcf build into salt stocks. The largest weekly withdrawal was in the Midwest region at 20 Bcf, followed by the East, which withdrew 15 Bcf for the week. The Mountain and Pacific regions each withdrew 3 Bcf, according to EIA.

Even after factoring in the typical demand impact of the holidays, Friday’s EIA report stands out as particularly bearish, Genscape Inc. analyst Eric Fell told NGI.

“Because of the significant demand impact of major holiday periods, we like to compare holiday week EIA storage stats to the same holiday weeks in prior years,” Fell said. “When comparing this week versus degree days and the last six Christmas weeks, this year’s stat is loose by over 40 Bcf, or 6 Bcf/d. While degree days for the week were well below normal, two of the last five Christmas weeks were even milder (2014 and 2016), yet had larger withdrawals.”

Analysts with Raymond James & Associates similarly viewed the 20 Bcf withdrawal as bearish, pegging it as 7.1 Bcf/d loose versus last year after adjusting for weather.

Prices gained Friday, but the outlook for winter natural gas prices has shifted dramatically since November.

Just a few weeks ago, low storage inventories, early winter cold weather and high Appalachian coal prices set the stage for potential higher prices and volatility, noted analysts with BofA Merrill Lynch Global Research.

“Since then, temperatures realized above normal in December,” the analysts said. “Extremely mild weather is forecast for the first half of January. The mild weather, paired with uneconomic injections into salt caverns, has eased market concerns and caused prices to quickly crash back below $3.

“As expected, the back of the natural gas curve did not participate in the winter rally due to expectations for above-normal inventories by 2H2019 and risk of storage congestion in 2020,” said the BofA team. “Looking into the months ahead, continued mild weather this winter could bring forward the risk of storage congestion to summer 2019, putting the forward curve at risk of even lower prices.”

Northeast Gains, California Declines

Turning to the spot market, prices were mixed through the middle third of the Lower 48, while reports of maintenance-related constraints coincided with larger increases in the Northeast.

On Friday NatGasWeather was calling for above-normal temperatures across most U.S. regions over the next several days, except for “minor cooling” over the Southeast and West Coast.

“With highs of 40s and 50s across the northern U.S. and 60s and 70s across the southern U.S., demand will again be much lighter than normal the next seven days,” the forecaster said. “There’s expected to be at least some cooling into the East Jan. 9-10, which held colder trends in recent data. Another cold shot is likely into the North and East Jan. 13-14, which also trended a little colder in recent data.

“But again, even though the weather models have added some demand back, the pattern is still not impressively cold, just closer to normal Jan. 10-15.”

In the Northeast, Algonquin Citygate jumped 55.0 cents to $3.260 heading into the weekend, while Tenn Zone 6 200L surged 52.5 cents to $3.430.

Radiant Solutions was calling for slightly cooler temperatures in Boston Monday, with highs in the low 30s, versus highs in the mid-40s over the weekend.

Despite generally bearish weather, maintenance at a Texas Eastern (Tetco) compressor station in Pennsylvania over the weekend presented upside risk for Northeast spot prices, according to Genscape analyst Josh Garcia.

On Saturday (Jan. 5) Tetco was expected to conduct “a one-day outage at its Marietta, PA, compressor station on the southern M3 36-inch line,” Garcia said. “During this outage, deliveries up to Lambertville will be limited to 1,391 MMcf/d, 138 MMcf/d below the 14-day average and 235 MMcf/d below the 14-day max. This presents some upside for Tetco M3 and Transco Zone 6 prices, although Northeast weather has actualized warmer than 30-year norms for the last several weeks, driving bearish movements in prices.”

In the West, prices fell sharply throughout California heading into the weekend. SoCal Citygate dropped 79.5 cents to $5.860, while SoCal Border Avg. tumbled $1.065 to $3.360.

Southern California Gas (SoCalGas) on Friday was calling for demand to ease on its system over the weekend, falling to a projected 3.1 Bcf/d Saturday and Sunday versus demand close to 3.4 Bcf/d on Thursday.

“SoCalGas has issued more system-wide voluntary curtailments to electric generation and has been making last-resort withdrawals from Aliso Canyon amid a cold snap that has elevated demand to winter-to-date highs,” Genscape analyst Joe Bernardi told clients Friday. An announcement from the utility Thursday that it had pulled gas from the highly scrutinized storage field coincided with the “relatively massive storage withdrawals posted recently, which have averaged over 1.0 Bcf/d in the last seven days.

“Previously the last time single-day withdrawals (let alone week-average withdrawals) exceeded this mark was when gas was withdrawn from Aliso Canyon last February,” Bernardi said. “Basis prices have continued to be somewhat elevated but have not yet shown the volatility previously associated with other high-demand events. Many of the highest price spikes have come following a weekend,” presenting potential upside risk for spot prices to start the week ahead.

Bernardi said Genscape’s meteorologists were still expecting continued colder-than-average weather in the region over the next several days, but likely to warm slightly after the weekend.

Further upstream in West Texas, Waha gave up 66.0 cents to $1.725. Prices also fell throughout much of the Rockies and Arizona/Nevada, where a number of locations have recently been trading at a premium to Henry Hub. Kern River tumbled 58.5 cents to $3.225.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |