Regulatory | Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

Natural Gas Shippers Win Toll Cut on TransCanada’s Mainline

Natural gas shippers have won a C$1.14 billion ($910 million) toll cut on TransCanada Corp.’s cross-country Mainline after a 10-month dispute over pipeline finance before the National Energy Board (NEB).

The NEB ordered the Calgary-based gas and oil transportation conglomerate to make a “compliance filing” by Jan. 31 that enacts a rate reduction package devised by the Canadian Association of Petroleum Producers (CAPP).

Toll cuts of 17-36% are forecast, with the value of the benefits varying across segments of the Mainline from Alberta and British Columbia (BC) to Ontario, Quebec and export connections to the United States.

CAPP shippers, which account for four-fifths of Canadian gas output, sought the savings as rebates of toll over-collections since 2014. The funds sit in the Long Term Adjustment Account (LTAA), a self-insurance device created by a toll settlement between TransCanada and Mainline shippers.

Settlement forecasts underestimated pipeline revenues. Under the CAPP toll reduction formula, benefits of the LTAA repayment will start immediately and last through 2020.

During the lengthy NEB case, TransCanada proposed to preserve almost all of the LTAA as a nest egg to tap for the mainline if cross-country gas traffic and toll income dropped.

The board’s verdict said TransCanada’s “approach — to return only approximately 3.9% of the $1.1 billion LTAA balance each year to shippers in the 2018 to 2020 period — represents an unreasonably large intergenerational cross-subsidy.”

The NEB found that “from 2015 to 2017, shippers paid tolls that generated revenues significantly above the Mainline’s costs. TransCanada’s approach results in the majority of that significant overpayment being returned to shippers in 2021 and thereafter, and would not be fully returned to shippers until after 46 years.”

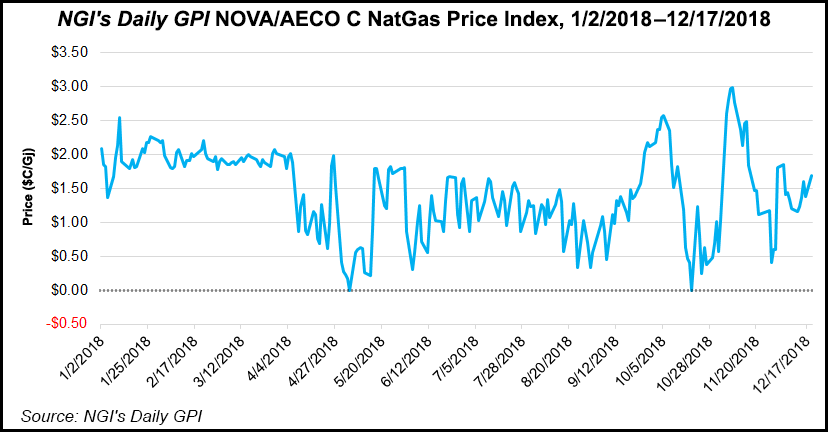

Gas supply gluts and poor prices in Alberta and BC drove shipper demands for prompt repayment of the LTAA treasure chest. NEB records showed a 31% drop in year-to-date price averages to C$1.42/GJ ($1.19/MMBtu) in 2018 from C$2.06/GJ ($1.73/MMBtu) in 2017.

The LTAA repayment is the third toll cut on TransCanada’s Mainline since 2016. The first two rate reductions were achieved as negotiated discounts.

In the latest deal, announced early this month, shippers committed to new deliveries of 630 MMcf/d for C93 cents/GJ (78 cents/MMBtu). Gas began flowing in November 2017 under the first discount deal, which cut the rate to Ontario for 1.4 Bcf/d by 46% to C77 cents//GJ (65 cents/MMBtu) from C$1.42/GJ ($1.19/MMBtu).

The NEB described its order for the third TransCanada toll cut as a contribution to reviving the industry’s health. “Returning the entire LTAA balance to shippers in the 2018 to 2020 period will help toward the overall competitiveness of the Mainline’s services, and will promote increased utilization to the benefit of the Mainline and its shippers.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |