NGI Mexico GPI | Infrastructure | NGI All News Access

Mirage Energy Seeks to Address Mexico Pipeline Capacity, Storage Constraints

Mirage Energy Corp. is working to address two of the main impediments to a competitive natural gas market in Mexico: a lack of access to cross-border pipeline capacity for private sector shippers, and a lack of natural gas storage capacity generally.

The San Antonio, Texas-based gas storage and transportation firm is developing the 250-mile Concho-Progreso cross-border pipeline system that will connect the Agua Dulce hub and Banquete header in South Texas to Mexico’s Sistrangas national pipeline grid. However, there is a twist.

“Our pipeline reserve capacity is being offered to private commercial shippers only,” Mirage CEO Michael Ward said earlier this month at the LDC’s US-Mexico Natural Gas Forum in San Antonio.

This is significant, given that state power utility Comisión Federal de Electricidad (CFE) and national oil company Petróleos Mexicanos (Pemex) still hold nearly all of the cross-border import capacity into Mexico.

Industry sources often cite this fact as a barrier to entry for private-sector shippers within Mexico, where the formerly state-dominated hydrocarbon and power segments were liberalized under the 2013 constitutional energy reform.

“We’re trying to give marketers an alternative to having to rely on CFE and Mex Gas or PMI capacity releases,” Ward continued, referring to Pemex subsidiaries Mex Gas Supply SL and PMI Comercio Internacional SA de CV.

A milestone for Mexico’s formerly state-dominated gas market occurred in early 2017, when Sistrangas operator Cenagas awarded a total of 220,741 MMBtu/d to three firms in the inaugural auction for gas import capacity formerly held by Mex Gas Supply.

One of those firms was BP EnergÃa Mexico, the Mexico gas marketing and trading arm of BP plc.

That auction “was a game changer,” BP’s Orlando Alvarez, who oversees all of the company’s gas trading and marketing activity in North America, said at the San Antonio event. “It introduced a lot of interest, investment started pouring in, and the rest is history.”

The auction coincided with the first phase of Pemex’s marketing contract release program, through which the operator ceded 32.2% of its contracted trading volumes to third parties.

Authorities approved the second and final phase of the contract release program in September, although interest has been tepid.

“There is less interest without a doubt,” David Rosales, general director of energy ministry Sener’s natural gas and petrochemicals, said. He recently spoke with NGI’s Mexico GPI. “This is because the availability of gas is less…The system has little availability because the users, although they would like to, can’t find marketers with capacity, but this situation will improve as new pipelines enter operation.”

Storage Solutions Considered

The Progreso pipeline also runs within 14 miles of the depleted Brasil natural gas reservoir, where Mirage is proposing a gas storage project that would connect to the Sistrangas via the Progreso pipeline. Mirage has completed the necessary pipeline, well design and reservoir engineering at the site, as well as a technical feasibility report.

The Brasil field “sits right in the middle of all the major pipelines” on the Sistrangas system, Ward said, “so you have good access in and out of the system.” The project’s first phase envisions working storage capacity of 25 Bcf.

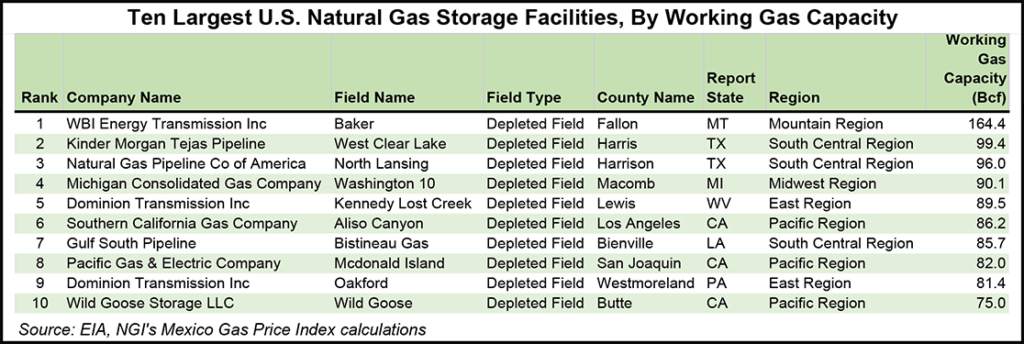

If fully developed, the Brasil field could store up to 786 Bcf, “which would make it the largest natural gas storage facility on the North American continent.”

That title is currently held by WBI Energy Transmission Inc.’s Judith River facility at the depleted Baker gas field in Montana, which has a working gas capacity of 164.4 Bcf.

Underground gas storage is not yet a reality in Mexico, which relies on the Altamira and Manzanillo liquefied natural gas import terminals for system balancing. The energy ministry in March published its public policy for natural gas storage, which calls for 45 Bcf of storage inventory by 2026.

Authorities nominated the depleted Jaf dry gas field as the construction site for the first 10 Bcf. However, the transition team of President-Elect Andrés Manuel López Obrador, who takes office Dec. 1, has not indicated whether the energy ministry will give the order to proceed with the tender.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |