NGI Mexico GPI | Markets | NGI All News Access

Few Signs of Let-Up for Natural Gas Futures Bulls; West Texas Cash Pulls Back

Spurred on by historically low storage levels, a strong start to winter and forecasts that seem to continue ratcheting up the cold risks, natural gas futures bulls picked up the pace Wednesday, taking the front month to levels not seen since the polar vortex-inflected 2013-2014 winter.

In the spot market, impressive early season heating demand prompted double-digit gains across most of the Lower 48, while West Texas prices eased off from early week spikes; the NGI Spot Gas National Avg. surged 57.5 cents to $4.985.

The market was clearly not content to take a breather following Tuesday’s 31.3 cent rally. After a steady climb overnight, December Nymex futures burst higher just before 8 a.m. ET Wednesday, pushing as high as $4.929 before retreating to around the $4.500-4.700 range. The December contract eventually settled 73.6 cents higher at $4.837, the highest front month settlement since February 2014.

Further along the strip, January added 75.1 cents to $4.898; February added 75.1 cents to $4.770; and March climbed 76.0 cents to $4.472.

The gains for natural gas have come despite an overall rise in negative sentiment for energy commodities, according to analysts with Societe Generale, who pointed to recent data showing money managers reducing their long positions in Nymex West Texas Intermediate futures.

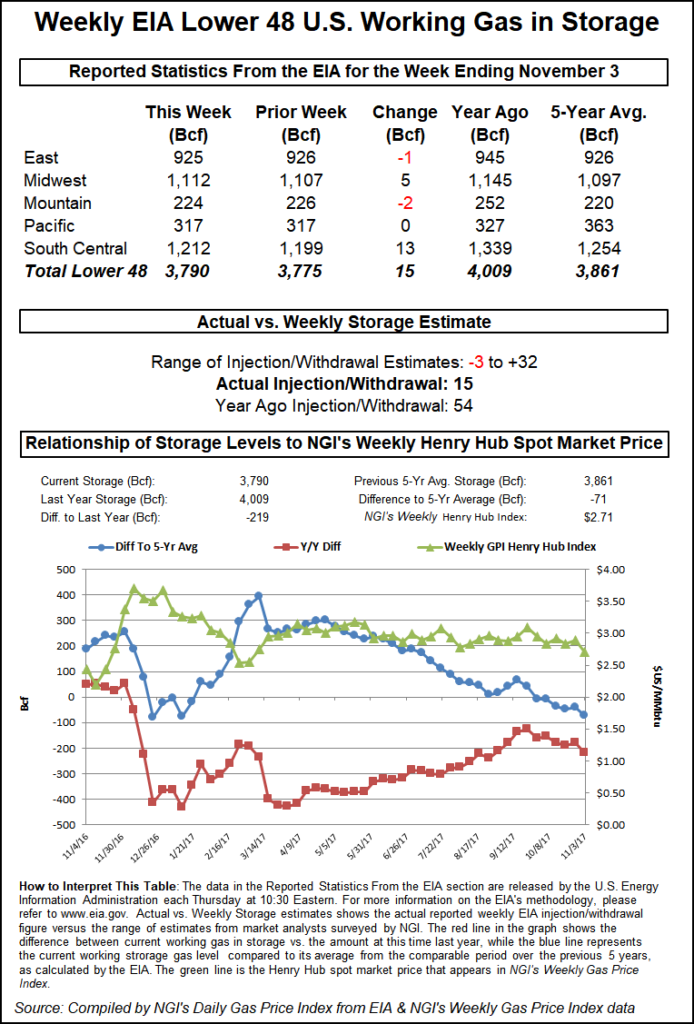

“Despite the widespread sell-off on energy commodities, money managers have found respite in the near-term outlook for natural gas demand,” the Societe Generale team said. “While U.S. natural gas prices rose to the highest level in nearly to years, money managers increased their long positions by 17,273 contracts…Despite production having risen to record levels, traders remain concerned about the market’s ability to meet demand under certain weather scenarios, given the relatively low injection levels year-to-date.

“At just 3.2 Tcf, inventories of natural gas are at their lowest level in at least 10 years, both in absolute terms and adjusted for future expected demand.”

As for the latest forecasts, NatGasWeather noted colder trends in both the midday Global Forecast System model and the afternoon European model.

“The European ensemble was colder for early next week, while also seeing the break Nov. 22-24 being less impressive over the East as cold lingers,” the forecaster said. “It still shows a modest warm-up Nov. 22-24 across the Midwest, and central and southern U.S., but countered by the colder East/Northeast. The European model was also rather cold Nov. 26-28, continuing to see cold shots returning across the central and east-central U.S.

“…If cold shows promise to continue Nov. 29-Dec. 2, as we see it currently teasing, weather sentiment will remain bullish into the foreseeable future,” NatGasWeather said. “Clearly, a crazy day in the natural gas markets…It’s all been due to weather patterns steadily increasing deficits since last spring, aided by a hot summer, and now a cold fall to create the perfect storm despite production continuously setting fresh weekly record highs.”

Speaking of production, the latest may not do much to discourage the bulls. A natural gas liquids (NGL) pipeline disruption impacting the Permian Basin and indications of the winter’s first round of freeze-offs have accompanied a drop in Lower 48 production, according to Genscape Inc. analyst Nicole McMurrer. Genscape’s daily pipe production estimates for Tuesday showed top-day volumes down more than 1.8 Bcf/d from the month-to-date average.

“Total Permian (Texas and New Mexico) gas volumes remain more than 0.9 Bcf/d below the month-to-date average with continued restrictions on a key NGL pipeline limiting gas takeaway,” McMurrer said, noting that El Paso Natural Gas points impacted by the disruption were again posting depressed volumes for Wednesday.

“Our Spring Rock production group also noted the magnitude, rapidity and geography of the Lower 48 production drops coincides with areas that experienced a rapid temperature drop, suggesting we may be seeing the first freeze-offs of the winter,” the analyst said. Several pipelines “from the Midcontinent and Texas to the Northeast” reported operational flow orders “and large negative nomination revisions in areas dealing with extreme temperature departures from normal. As a result, there may be roughly 1.2 Bcf/d of gas freeze-offs occurring.”

Meanwhile, the Energy Information Administration (EIA) is set to release its weekly natural gas storage numbers Thursday, though it won’t be until next week’s report that the market gets an opportunity to assess the impact of this week’s wintry temperatures on inventories.

Estimates this week point to an above average build for the week ended Nov. 9. A Reuters survey showed traders and analysts expecting EIA to report a 33 Bcf injection, with estimates ranging from 20 Bcf to 47 Bcf. As of Wednesday afternoon, nine estimates submitted to Bloomberg showed a median 33 Bcf injection, with a range of 28 Bcf to 42 Bcf. Intercontinental Exchange EIA financial weekly index futures settled Tuesday at a build of 36 Bcf.

Spot Prices Climb On Wintry Weather

With winter off to a roaring start, delivering chilly temperatures to much of the eastern two-thirds of the country, day/day spot price gains of 50 cents or more were commonplace across most regions Wednesday.

“Consumption the past week has been running at typical early or mid-December levels, with more to come,” Genscape analyst Eric Fell said Wednesday. “Cold weather has lifted demand the past seven days to an average 85.3 Bcf/d, about 13 Bcf/d stronger than this time period last year and 18 Bcf/d above the five-year average.”

In the near-term, the cold should lift demand above 93 Bcf/d, a level not reached until last Dec. 7, Fell said.

“A significant storm is taking shape over the lower Mississippi Valley and is expected to impact sections of the central and eastern U.S. with an early-season bout of winter weather through Friday,” the National Weather Service (NWS) said Wednesday.

Wednesday evening and Thursday morning the storm was expected to bring accumulating snow from eastern Missouri across central and southern Illinois, and parts of western Indiana and western Kentucky, NWS said.

“The heaviest amounts, upwards of four-seven inches, are expected over southeast Missouri and southern Illinois,” according to the forecaster. The southern/central Appalachians were also expected to see a mix of snow, sleet and freezing rain Wednesday night and Thursday.

“As the low moves up the East Coast Thursday through Friday, a wintry mix of precipitation will spread across the northern Appalachians/Mid-Atlantic states and into the Northeast,” NWS said. “Precipitation across interior sections will mostly be snow and sleet, with a large swath of up to four-eight inches accumulation by the time the storm departs on Friday. Along the Interstate-95 corridor from Washington, DC, to Boston, precipitation on Thursday may start out as a period of snow, sleet or light freezing rain…before changing over to rain as temperatures slowly warm.”

In import-constrained New England, where cold weather often drives price spikes, Algonquin Citygate jumped $1.625 to eclipse the $10 mark. Further south, Transco Zone 6 NY and Transco Zone 5 both surged above $5.

In Appalachia, Texas Eastern M-3, Delivery added 89.5 cents to $5.090, while Columbia Gas gained 51.0 cents to $4.420.

Meanwhile, locations in takeaway constrained West Texas moved in the opposite direction Wednesday, giving back some of the gains from earlier in the week, when a disruption impacting the DCP Sand Hills NGL pipeline put a dent in Permian output and sent prices soaring throughout the region.

El Paso Permian fell 44.0 cents to $3.385.

El Paso Natural Gas (EPNG) on Wednesday canceled a “warning of strained operating condition” it had sent out over the weekend due to low linepack and supply underperformance in the Permian coinciding with the NGL pipeline disruption.

“Customer response has been sufficient to increase EPNG’s linepack to acceptable levels,” the operator said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |