NGI All News Access | Infrastructure | M&A

Anadarko Drops Down Midstream Assets to MLP for $4B

Anadarko Petroleum Corp. said Thursday that it would sell all remaining midstream assets to its master limited partnership (MLP), Western Gas Partners LP (WES), for $4.015 billion in a dropdown that’s part of a broader transaction to simplify the corporate structure.

The company said Western Gas Equity Partners LP (WGP) would acquire WES in a tax-free unit-for-unit merger. WES would then survive as a partnership with no publicly traded equity to operate all of the midstream assets, owned 98% by WGP and 2% by Anadarko. The new combined entity would become a single publicly-traded partnership.

“This will enhance the read-through value of Anadarko’s midstream ownership through increased liquidity and a less complex structure,” CEO Al Walker said. “Further, it supports our durable strategy of returning value to Anadarko’s shareholders, as we expect to continue prioritizing the use of cash and free cash flow to repurchase shares, reduce debt and increase the dividend over time.”

Anadarko would receive roughly $2 billion in cash and take the new equity of Western Gas to cover the balance of the asset sale price. WES incentive distribution rights and general partner units would b eliminated. WES unitholders would receive 1.525 WGP common units for each WES common unit in the exchange, representing a 7.6% premium to WES’ Wednesday closing price.

In the United States, Anadarko works in the Denver-Julesburg (DJ) and Permian basins, as well as the deepwater Gulf of Mexico. Management also has a growing interest in the Powder River Basin, where the company has properties.

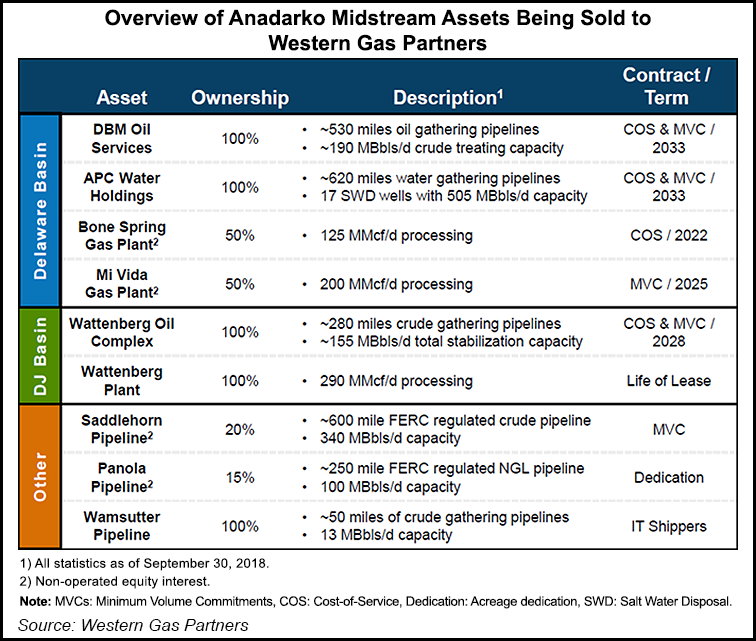

The assets Western Gas is acquiring are mainly located in the Permian’s Delaware sub-basin and the DJ Basin. They include DBM Oil Services, APC Water Holdings, the Bone Spring Gas Plant and the MiVida Gas Plant in the Delaware. In the DJ Basin of northeast Colorado, WES would acquire Anadarko’s DJ Basin Oil System and the Wattenberg Plant. Other assets include equity stakes in the Saddlehorn Pipeline in Colorado, the Panola Pipeline in Texas and the Wamsutter Pipeline in Wyoming.

Both the sale and merger are expected to close in 1Q2019. Anadarko’s share price continued climbing on Wednesday. It was up more than 1% in morning trading a day after the stock got a bump from a favorable outcome in Colorado, where voters rejected a potentially devastating measure aimed at limiting oil and gas drilling in the state.

Anadarko joins several other companies, including Williams, Enbridge Inc., Dominion Energy Inc. and Antero Resources Corp. in making plans to simplify their corporate structures after a decision by the Federal Energy Regulatory Commission earlier this year that eliminated the tax benefits of MLPs.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |