NGI The Weekly Gas Market Report | E&P | NGI All News Access

AMLO to Suspend Mexico Bid Rounds Until Current Projects Start Producing

Mexican President-Elect Andrés Manuel López Obrador (AMLO) said Wednesday he will suspend oil and gas bid rounds until the 107 contracts awarded through rounds under the current government begin producing.

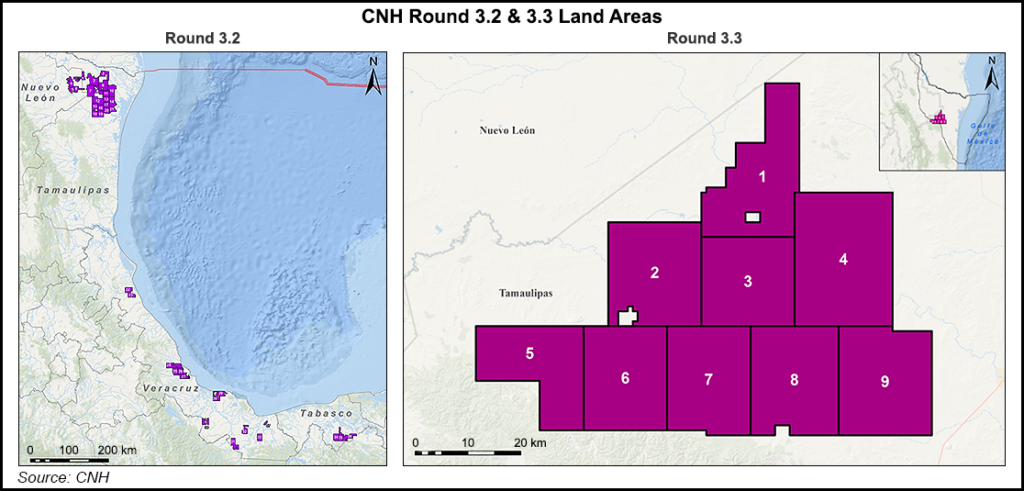

The declaration, made at a press conference in Tamaulipas state, is the clearest signal yet that bid rounds 3.2 and 3.3, currently scheduled for February 2019, will be postponed.

Local paper El Economista quoted López Obrador as saying that the 2013-14 constitutional energy reform passed under his predecessor, Enrique Peña Nieto, has failed to live up to promises of attracting foreign investment and reversing a steady production decline that has continued uninterrupted since 2004.

Proponents of the reform, which allowed competition from the private sector in the electricity and hydrocarbon segments, have argued that it followed 75 years of state control over both and that it must be given more time to work.

Tamaulipas is home to immense deposits of prospective unconventional natural gas reserves, which analysts and national hydrocarbons commission CNH have cited as essential to restoring domestic gas output.

López Obrador, meanwhile, has pledged to ban hydraulic fracturing, a promise that he partially walked back at the Tamaulipas event. The president-elect said that his words were meant as a non-binding “invitation” for companies not to use the drilling technique, which has been employed for decades in Mexico and around the world.

López Obrador reiterated a previous assurance that his government would respect the validity of contracts that have already been signed.

Talos, Hokchi Expedite Projects

In related news, Talos Energy announced Wednesday that it will join forces with Hokchi Energy in order to more quickly develop shallow water offshore blocks that each won through the bid rounds.

Under an agreement reached by the firms, which is pending approval from CNH, Talos will assign Hokchi a 25% participating interest (PI) interest in Block 2, which was awarded to the consortium of Talos, Sierra Oil & Gas, and Premier Oil plc, in Mexico’s Round 1.1 auction in 2015.

Hokchi, in turn, will assign Talos a 25% PI in Block 31, which Hokchi won in the Round 3.1 shallow water auction in March 2018. If the deal is approved, Hokchi will be the operator of both blocks.

“On both of our Mexico assets, we are taking action to facilitate quicker, more robust investment and shorter cycle time to production, and potentially a more material level of production,” said Talos CEO Tim Duncan. “The swap with Hokchi is a great way to pool resources between two operators that have a proven track record in offshore Mexico.”

Talos said that exploration drilling at Block 2 is set to begin in 2Q2019 and that “soon thereafter Talos plans to participate in two wells in Block 31.”

The announcement follows a meeting between López Obrador and oil and gas trade group, AMEXHI (Asociación Mexicana de Empresas de Hidrocarburos), of which Talos is part.

At the meeting, López Obrador assured companies that his administration would honor contracts awarded through the bid rounds, and that the public and private sectors would collaborate to reverse a nearly 15-year trend of declining oil and gas output.

He warned, however, that, “we expect results.”

“A lot of people have seen that statement as a veiled threat,” GMEC energy consultancy managing director Gonzalo Monroy told NGI’s Mexico GPI, citing the majorities held in both chambers of congress by López Obrador’s Morena coalition.

López Obrador’s energy advisers have said they will ask congress to modify the reform’s secondary legislation to give national oil company Petróleos Mexicanos (Pemex) more autonomy.

The president-elect has stated his intention for Mexico’s oil output to increase to 2.4 million b/d by 2024 from 1.8 million b/d currently. The goal is unrealistic, Monroy said, “because the fields are not there and the discoveries are not there.”

Critical Production Fields

By far the largest discovery since the reform was made in 2017 by the Talos-Sierra-Premier consortium at the Zama-1 exploration well, which was the first private sector-operated offshore well in Mexico’s history.

Talos has said it plans to drill the first appraisal well at Zama in 4Q2018.

Citing analysis by Wood Mackenzie, Talos said in a September presentation that projects awarded through Mexico’s Round One tenders are expected to provide one-third of Mexico’s oil output by 2024, and that Zama alone is predicted to supply nearly 10% of the total.

Talos currently holds a 50% PI in Block 2, while Hokchi is the 100% working interest operator of Block 31. Hokchi is a subsidiary of Pan American Energy, itself a 60:40 joint-venture between BP plc and Bridas Corporation.

Hokchi is named for the eponymous shallow water field off the coast of Tabasco state, for which CNH in May approved a $2.5 billion development plan.

The objective of the development is to produce 147.8 million bbl oil and 45.5 Bcf of natural gas, Hokchi said in May, with a recovery factor of 37%.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |