Shale Daily | Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Riverstone, Goldman Paying $1.6B for Permian-Focused Lucid II Gas Processing Assets

Riverstone Holdings LLC and Goldman Sachs Group Inc. are flexing their financial muscle in the Permian Basin, agreeing to pay $1.6 billion for a portfolio of natural gas processing properties in the Delaware sub-basin of New Mexico.

Dallas-based Lucid Energy Group and its financial sponsor EnCap Flatrock Midstream agreed to sell Lucid Energy Group II LLC to investment divisions of Riverstone and Goldman.

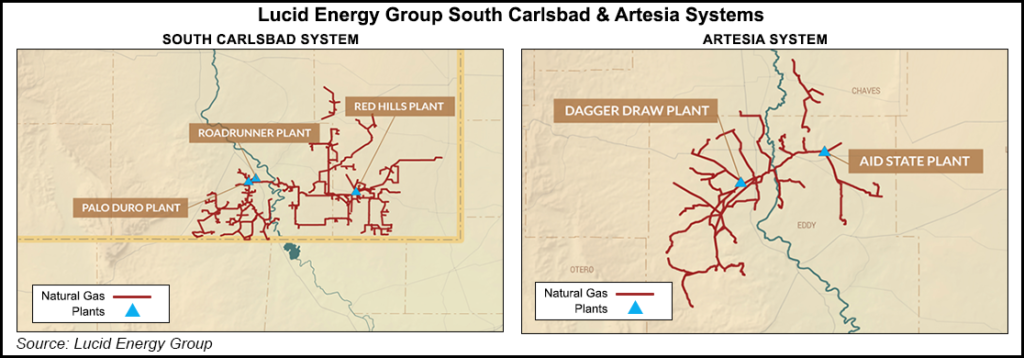

The Lucid II assets to be sold, the South Carlsbad Natural Gas Gathering and Processing System and the Artesia Natural Gas Gathering and Processing System, include about 1,700 miles of gas gathering pipelines and 585 MMcf/d of processing capacity. An additional 200 MMcf/d is under construction and scheduled to be in service by mid-year.

“The South Carlsbad system has tremendous growth potential,” said Lucid CEO Mike Latchem. He said Riverstone and the Goldman Sachs Merchant Banking Division “bring the right combination of financial strength and strategic experience we need to continue our pace of growth in Lucid II.”

Lucid II serves several regional producers in the Permian, which together have made long-term dedications and production volume commitments from about 450,000 acres spanning New Mexico’s Eddy and Lea counties.

Formed in late 2015, Lucid II acquired Delaware-focused Agave Energy Co. in September 2016. That purchase led Lucid II to expand its portfolio, and since then has increased its South Carlsbad processing by 750%, added about 210 miles of gathering pipelines and quadrupled customer commitments for South Carlson and Artesia.

Riverstone’s “firsthand knowledge of the Delaware Basin, experience as energy investors and access to capital uniquely qualify us to sponsor Lucid II’s continued growth,” said Riverstone partner Baran Tekkora. “In a short period, Mike Latchem and the Lucid II team built an essential infrastructure platform that is backed by growing commitments from industry-leading operators in a highly economic area.”

EnCap managing director Morriss Hunt, who also is on the Lucid II board, said EnCap would continue to create value through its ongoing ownership of Lucid Energy Group I, which operates in the Permian’s Midland sub-basin.

Lucid Energy Group is the largest privately held natural gas processor in the Permian Basin with more than 1 Bcf of processing capacity in operation or under construction and pipeline assets exceeding 2,400 miles in operation.

Jefferies LLC acted as financial adviser to Lucid II in connection with the transaction and was the sole provider of the committed debt financing. Vinson & Elkins LLP served as legal counsel to Lucid II. EnCap Flatrock Midstream was represented by Thompson & Knight LLP.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |