NGI The Weekly Gas Market Report | Infrastructure | M&A | NGI All News Access

In ‘Strategic’ Natural Gas Combo, Dominion to Buy Scana for $7.9B

Dominion Energy Inc. said Wednesday it plans to buy Scana Corp., a South Carolina-based public utility, in an all-stock deal described as a “strategic combination” of its natural gas businesses — a merger that equates to $7.9 billion in stock, but with an overall value of about $14.6 billion.

Richmond, VA-based Dominion said it would offer Scana shareholders 0.669 shares of common stock for every share of their common stock, the equivalent of $55.35/share, based on the volume-weighted average stock price for the last 30 trading days. Upon closing, Scana shareholders would own about 13% of the combined company.

Dominion also proposed completing a $180 million purchase of the Columbia Energy Center, a 540 MW, combined-cycle, natural gas-fired power plant in Gaston, SC. The South Carolina Electric & Gas Co. (SCE&G), a Scana subsidiary, announced plans last November to buy the facility from Columbia Energy LLC.

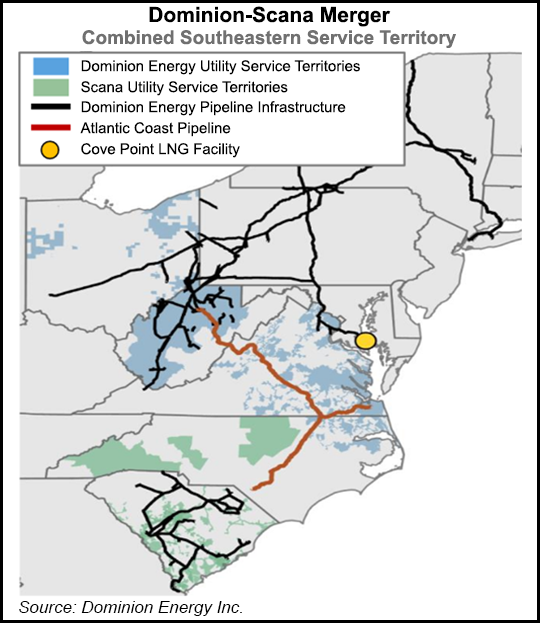

Cayce, SC-based Scana provides electricity and natural gas to close to 1.6 million residential and business customers in South Carolina and North Carolina with 5,800 MW of generation capacity. Post-merger, the combined company would operate in 18 states from Connecticut to California, and deliver electricity and natural gas to 6.5 million customers in eight states, with a natural gas pipeline network totaling 106,400 miles and with 1 Tcf of storage capacity, making it one of the nation’s largest natural gas storage systems.

“Scana is a natural fit for Dominion Energy,” Dominion CEO Thomas Farrell said during a conference call Wednesday to discuss the merger. “Its utility operations are a complement to our existing electric operations in North Carolina and our natural gas pipeline business in South Carolina.

“This combination can open new expansion opportunities including the Atlantic Coast Pipeline that is now under development, bringing lower cost of natural gas to the region. The combination with Scana would solidify Dominion Energy’s position among the nation’s largest and fastest-growing energy infrastructure companies by adding to our presence in the southeast markets.”

Farrell added that Dominion has been looking at several natural gas opportunities in South Carolina.

“They have very good economic development programs there,” Farrell said, adding that it was important to South Carolina Gov. Henry McMaster and other state leaders “to have a healthy utility, and there’s going to be a lot of gas opportunities. There’s an obvious need for 2,000 MW of new nuclear which is not going to come online. So, there’s going to be a continuing need for power generation growth that will be fueled almost certainly by natural gas and renewables.”

The new nuclear power plant referenced by Farrell could be an obstacle to a Dominion-Scana merger.

Under the merger agreement, Dominion would write off more than $1.7 billion of existing capital and regulatory assets from SCE&G’s abandoned efforts to expand its Virgil C. (VC) Summer Nuclear Generating Station in Jenkinsville, SC. The agreement would eliminate all SCE&G customer costs from the aborted expansion over a 20-year period, versus a previously proposed 50-60 years.

Dominion would also make a $1.3 billion cash payment within 90 days of closing to all SCE&G electric customers, which equates to about $1,000 for the average residential electric customer. Dominion also promised to enact a 5% rate cut, equal to more than $7 a month in savings for a typical SCE&G residential customer. The rate cut would be funded by a $575 million refund of amounts previously collected from customers, as well as lower federal corporate taxes brought about by the Trump administration’s successful tax reform.

But a report by a Charleston, SC newspaper, The Post and Courier, said the entire deal could be contingent upon keeping a state law that allows Scana to continue collecting payments for the two unfinished reactors at VC Summer, which collectively cost $9 billion. South Carolina regulators are reportedly considering whether SCE&G customers should continue making $37 million in monthly payments for the abandoned project, while state lawmakers are to consider legislation next week to cut the payments, which make up 18% of customers’ electric bills.

The merger must also be approved by Scana shareholders and pass the scrutiny of federal regulators, specifically, the Federal Trade Commission, the Department of Justice, the Nuclear Regulatory Commission and the Federal Energy Regulatory Commission. State regulators in Georgia, North Carolina and South Carolina must also approve the deal, which is expected to close this year.

Farrell hinted that Dominion could ultimately walk away from the deal if lawmakers or regulators insist on making too many changes.

“[We] can’t make any changes that have adverse consequences on the economics of the deal,” Farrell said, later adding “we spend a great deal of time talking to legislators and regulators in the state to understand what their concerns are. And we have shaped this transaction in order to meet those concerns. We think it is a very fair proposal. If it’s something that is insufficient for South Carolina, then we won’t transact.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |