Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Devon Shifting to Development Mode, Focused on Returns From STACK, Delaware

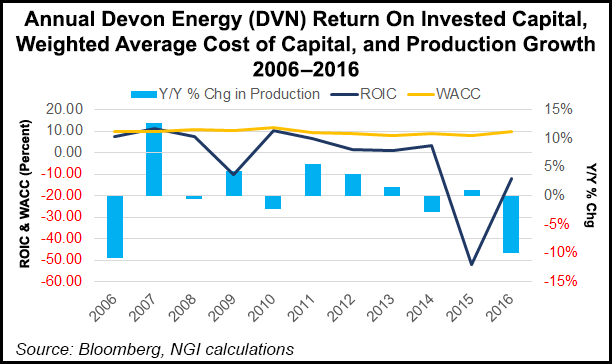

Oklahoma City-based Devon Energy Corp. is shifting to development mode in its core in the STACK (aka, the Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties) and the Permian’s Delaware sub-basin in 2018 as the company continues to focus on returns over growth, management said Wednesday.

Outlining the exploration and production (E&P) company’s recently branded “2020 Vision,” CEO Dave Hager said during a conference call to discuss 3Q2017 results that Devon expects a 2018 capital expenditure (capex) budget in the $2-2.5 billion range and that the independent will lean on efficient execution and the quality of its asset base in the STACK and Delaware to achieve production growth.

“We expect to deliver this capital spend within operating cash flow at” $50/bbl West Texas Intermediate and $3/MMBtu Henry Hub. “With current strip pricing above this base planning scenario, we have no plans to modify our capital range, and we would expect to generate free cash flow,” Hager said.

“And I cannot emphasize this enough: this disciplined plan will represent a major inflection point for Devon due to a step-change in improved capital efficiency as we shift to full-field development in the STACK and Delaware, and as we leverage technology to lower our cost structure.”

Hager said Devon plans to allocate more of its 2018 E&P capex to development drilling, “and we’re drilling the best-return wells…we feel really good about the program not just in 2018, but well beyond 2018. We’re getting in development mode, quite simply, and that’s going to continue for a long time.”

COO Tony Vaughn said the E&P began production on 50 new wells during the third quarter that yielded 30-day initial production (IP) rates above 2,100 boe/d while limiting capex to $548 million, below the low end of guidance.

“To maximize the value of these stacked-pay reservoirs” in the STACK and Delaware, “our capital activity is shifting towards low-risk, multi-zone developments to increase capital efficiencies and recoveries on a per-section basis,” Vaughn said.

Vaughn pointed to early results from Devon’s Anaconda project, its first multi-zone development in the Delaware, where “drilling times have improved 55% compared to historic results in this area. We also attained significant efficiencies due to less move times, more repetitive operations, improved productivity from zipper fracks, and we achieved supply chain savings by de-bundling our completion work,” Vaughn said.

Combining these improvements, Devon saved $1 million per well at Anaconda versus traditional pad developments while achieving a spud to first production time of 5.8 months, he said.

Devon plans to have “several multi-zone projects under development across the STACK and Delaware” by the end of the year, Vaughn said.

Company-wide production for the third quarter averaged 527,000 boe/d (44% oil), above the midpoint of its guidance after adjusting for impacts related to Hurricane Harvey. The company reported storm-related curtailments of around 15,000 boe/d (65% oil) for the quarter, mostly attributable to its Eagle Ford Shale assets in South Texas. Devon produced 577,000 boe/d in the year-ago quarter.

Devon saw the strongest asset-level performance for the quarter in the STACK, which increased 26% year-to-date to 111,000 boe/d for the quarter. That’s versus 105,000 boe/d in the second quarter and 92,000 boe/d in the year-ago quarter. STACK activity in the quarter included 14 new wells brought online targeting the Meramec formation that achieved 30-day IP rates of 2,300 boe/d (55% oil), management said.

For its U.S. assets, Devon realized prices for the quarter of $47.12/bbl for oil, $15.15/bbl for natural gas liquids and $2.45/Mcf for natural gas. That’s compared with year-ago realized prices of $42.51/bbl, $9.80/bbl and $2.24/Mcf, respectively.

Revenues for the quarter totaled $3.156 billion versus $4.233 billion in the year-ago quarter.

Devon reported a quarterly net income of $228 million (43 cents/share) versus net income of $993 million ($1.90/share) in the year-ago period.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |