NGI Mexico GPI | Infrastructure | NGI All News Access

Mexico Surveys NatGas Shippers to Gauge Demand for Capacity on Sistrangas

The operator of Mexico’s main pipeline system, Sistrangas, is conducting a public consultation with natural gas shippers to gauge the market’s appetite for transport capacity and other services, such as storage.

The Centro Nacional de Control de Gas Natural (Cenagas) launched the voluntary, nonbinding consultation in late September to survey Mexican natural gas market shippers. The study is a first for Cenagas, allowing it to collect data that would, among other things, serve as the groundwork for the next revision of its pipeline expansion plan and the planned 2018 open season on Sistrangas.

“This exercise of going out and asking the market has come out of some ideas we’ve had on our own, as well as from meetings with other operators,” said Cenagas’ Emmanuel Silva, associate director of technical analysis. “The challenge is to plan in a more orderly fashion since, up to now, we have simply done it through in-house studies.”

Silva and other Cenagas officials spoke Monday at a public forum in Mexico City that was organized to answer questions about the study, which wraps next week (Oct. 18). Cenagas plans to publish the results on Oct. 27, although data from specific respondents would remain confidential.

The consultation is open to marketers with capacity on Sistrangas or private pipelines, local distribution companies and large industrial consumers. Participants are asked to provide demand forecasts for three timeframes, one-to-five years, six-to-10 years and 11-to-15 years. It also asks for anticipated shipping routes and injection/extraction points.

Cenagas would use the data collected to model future demand on Sistrangas and identify potential new markets that are not currently served by the integrated system.

The operator plans to incorporate the results into its five-year expansion plan, which it is required to update each year in conjunction with the Mexican Energy Ministry (Sener) and the energy regulator, Comision Reguladora de Energia (CRE).

The 2015-2019 plan is now in its third revision, due next March, which outlines key pipelines and other infrastructure needed to serve natural gas demand on Sistrangas and in other parts of the country.

“We want to know what your needs are, locate them geographically and, based on this information, determine the timeframes needed to execute this planning,” said Paola Vazquez, associate director of project tenders.

Mexico is in the midst of a historic buildout of its pipeline infrastructure, which is expected to reach 22,000 kilometers (13,670 miles) by the end of 2019, from about 13,700 kilometers (8,512 miles) currently.

Second Open Season Prepped

All of the pipelines now under construction in Mexico are privately owned. The projects are being developed outside of Sistrangas and are anchored by long-term transportation agreements with state power company Comision Federal de Electricidad (CFE) to supply its growing fleet of gas-fired power plants. As the private pipelines come into service, the CFE is expected to release some of its capacity on Sistrangas.

“For Cenagas as an operator, it is very important — and this is one of the goals in this consultation — that we know how much capacity currently reserved on Sistrangas will be released by CFE and made available to other users,” said Cenagas’ Eduardo Prud’homme, head of the technical and planning unit.

The Sistrangas network is comprised of the national pipeline system, known as the SNG, and six privately owned pipelines. The 10,212-kilometer (6,345-mile) integrated pipeline network is Mexico’s largest, spanning 21 of its 32 states, including the federal district. Cenagas is the technical operator of Sistrangas and the direct owner of SNG.

Cenagas currently has allocated 97% of the 6.4 Bcd/d capacity available on Sistrangas. CFE and its independent power producers have reserved about 38%. In an open season earlier this year, private shippers won rights to 16% of Sistrangas’ capacity, while Petroleos Mexicanos (Pemex) and its subsidiaries hold the remainder.

The capacity reservations on Sistrangas from that open season took effect July 1. These one-year agreements are all timed to expire when the contracts from a planned second open season come into effect next July.

Cenagas has said it expects to allow longer-term contracts in the upcoming open season. To facilitate this, the operator plans to redesign its transportation rates, incorporating the demand data captured by the ongoing study.

“Once we have the results from the consultation, we will work with the CRE the design a new tariff scheme that will come into force as of July 1, 2018, so that the contracts signed by that time can be for longer terms, knowing what the new tariffs will be,” Prud’homme said.

Sistrangas currently charges postage stamp rates across six different geographic zones. Prud’homme said the new transport tariff structure would be more “market-oriented” and would probably entail a mix of zone-based and route-specific rates. The end goal is to offer more competitive rates on the Sistrangas.

“Now the challenge for Cenagas is to charge sufficient tariffs in order the cover the approximately $70 million we pay month to month to the owners of the systems that make up Sistrangas,” Prud’homme added.

Market Appetite For Storage

In addition to demand forecasts, the public consultation asks participants to describe which ancillary services they may require to operate and also quantify their anticipated demand for natural gas storage.

Currently, Mexico lacks underground storage facilities for natural gas. Earlier this year, a Mexican Energy Secretariat official said the ministry would release the draft of a policy to promote natural gas storage by September, but no document has been forthcoming so far.

Cenagas is working to determine an optimum storage capacity for supply redundancy and backup, according Prud’homme. Through the current consultation, the operator also wants to measure the commercial appetite for storage.

“We need to take advantage of economies of scale to develop storage facilities,” he said. “It’s important that we aggregate both the operator’s reliability needs and the commercial requirements that various users may have for other reasons, be they speculative or operational.”

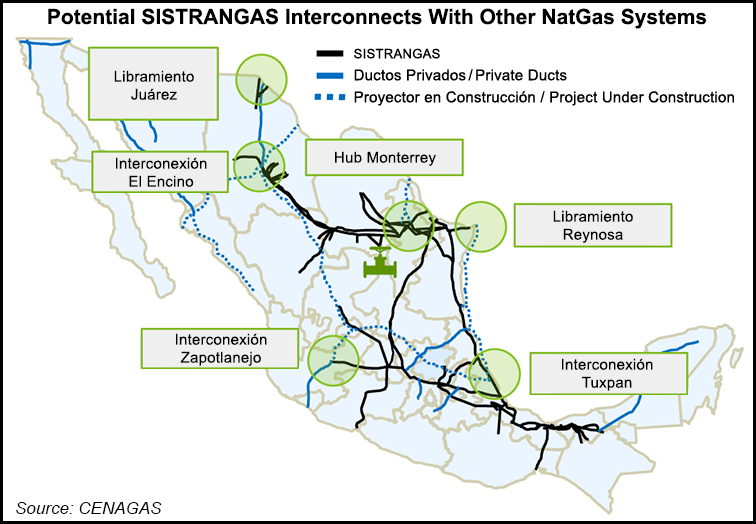

The consultation is also intended to gauge market demand at proposed interconnections between Sistrangas and private systems, as well as potential interest in shipping routes that could emerge as a result of those interconnects.

Cenagas has identified several places where it would like to develop interconnections and is in talks with private pipeline operators. These points include El Encino in northwest Mexico, at the convergence of several private pipelines carrying gas from the Waha region in West Texas; Zapotlanejo in central Mexico, near the city of Guadalajara; and in the port city of Veracruz, where the underwater Sur de Texas-Tuxpan pipeline terminates.

“We are doing our own sizing in terms of redundancy and operational flexibility, but we are expecting that the bulk of capacity at those interconnections is derived from shippers who are going to utilize them for commercial purposes,” Prud’homme said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |