NGI The Weekly Gas Market Report | Markets | Mexico

Experts Suggest Handling NAFTA Negotiations With Care

Natural gas industry experts last week warned that efforts to renegotiate the North American Free Trade Agreement (NAFTA) should be handled delicately, but early fears that the Trump administration had a disruptive, protectionist slant that could roil gas markets appear to be unfounded.

During a panel discussion on infrastructure projects and cross-border trade at the North American Gas Forum in Washington, DC, former FERC Commissioner Tony Clark indicated that the Trump administration got off to a strange start with the Federal Energy Regulatory Commission lacking a quorum until mid-September.

“They couldn’t act on any new applications that were before it,” Clark said. However, “it’s fair to say that the administration has sent a lot of the right signals in terms of being pro-infrastructure development. The types of people that they have nominated for agencies, like FERC and other agencies that have something to say about the permitting, have generally fallen into that particular vein.”

Strong Industry Signal

Clark said the Trump administration made several decisions early on that indicated it would be supportive of energy development, including development related to international trade.

“I had some fear early on in the administration that some of the economic protectionism arguments that you heard might have drifted over into things like LNG [liquefied natural gas] permitting, and might have been susceptible to some of those arguments,” Clark said.

But when Trump issued an executive order in March calling for, among other things, expedited approval of permits to export LNG to countries that do not have a free trade agreement with the United States, that sent “a strong signal to the industry that American energy is something that is important not just for the U.S., but in terms of our own economic and global positioning in the rest of the world,” Clark said.

Guillermo Ignacio Garcia — chairman of Mexico’s energy regulatory commission, the Comisión Reguladora de EnergÃa — said the 18-page document that outlined the NAFTA agreement between Mexico, the United States and Canada made mention of energy just once, and in only one sentence.

“In terms of the NAFTA negotiation, energy can be the line which we all agree upon,” Garcia said. “In terms of the energy sector, we have more [areas of agreement] than differences.

According to Garcia, the regions of Mexico with access to natural gas have a different rate of growth and development than other regions of the country. “You cannot explain the automotive [industry], let alone [other industry in] the center of Mexico, without natural gas,” he said. “The companies that weren’t coming to Mexico were asking for the supply of gas for them to make their decisions into the investment in the country. Natural gas provides this development ingredient into the mix.”

Exports More Important

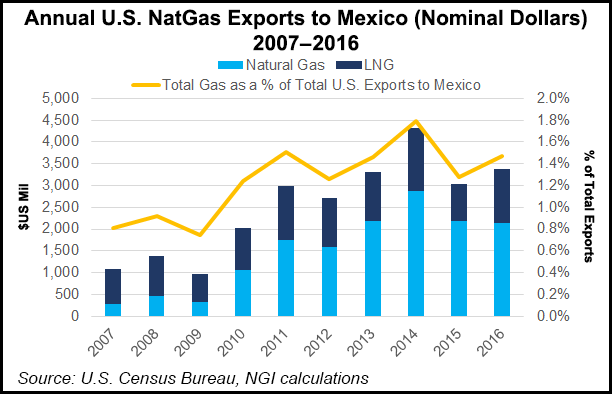

Interstate Natural Gas Association of America CEO Don Santa said natural gas exports are a growing part of the “demand pie” for gas produced in the United States.

“Exports are very important because if you think about the surplus of gas that we’ve got in the U.S., it is those export markets that really are keeping the price in balance,” Santa said. “If you didn’t have the growing LNG exports, you’d see far lower commodity prices and less E&P activity. It is a major part of maintaining a very robust industry in terms of production, and if anything we’re in a situation in the U.S. where supply has outstripped demand.”

That said, renegotiating NAFTA will be a tricky proposition.

“Whatever happens coming out of NAFTA or other trade agreements that suppresses international demand, or makes this nation less able to export its surplus of natural gas to worldwide markets, is going to have an impact in the U.S., and it’s not going to be positive,” Clark said. “Whatever potential short-term benefit that you get from a little bit lower natural gas price leads into the endemic problem with the natural gas industry in the past, where very low prices can’t support the infrastructure…and then you get into some of that ‘boom and bust’ cycle.

“One of the very positive things about the shale gas and oil revolution is that it becomes more of a manufacturing process and less of a wildcatting process, where you know the price point at which you can produce this natural gas and you know where the formations are. It becomes a much more reliable source of energy, [especially considering] the degree that our electricity and natural gas markets are now linked at the hips.”

Santa added that NAFTA “has been a huge success story from an energy perspective.”

“If you think back to when NAFTA was first negotiated and ratified in the late 80s and early 90s, you recognize that led to great integration in U.S. gas markets, both in terms of pipelines and in terms of the commodities markets,” Santa said. “For many years during the 80s and 90s, it was in fact Canadian gas imported into the U.S. that made up the difference. Now we’re starting to see in eastern markets U.S. shale gas going into eastern Canada, and we’ve talked about announcing the emergence of the Mexican market for U.S. natural gas.

“I hope that as they enter into negotiations they be mindful of the fact that this has been such a tremendous success story, and not to upset it. If you were to do things that frustrate the energy trade or frustrate the creation of that demand for American energy, it will come back to the detriment of the U.S. energy industry. Ultimately, U.S. energy consumers would start to see gyrations in price and the impact that that has in upsetting that stability has been so great in terms of taking the volatility out of gas as a commodity so we can rely on it.”

Garcia said he was optimistic, and used the agriculture sector as an example where the three countries work together well.

“The agriculture sector in the U.S. has been very clear that the relationship between Mexico and the U.S. is unique,” Garcia said. “We are buying our corn from the U.S., and the U.S. is buying our fruits. There are a lot of people that would lose among the three countries [if NAFTA fails].”

Clark said he believes there will be a strong market for LNG in the future.

“Does that mean that every project that’s been proposed or is in front of FERC is going to get built? No, it won’t,” Clark said. “The market will shake some of those things out. But I know some of them will probably get built. It’s going to depend on some of the location attributes, how [export applicants] are able to sell themselves into the marketplace, their own design and engineering concepts. Some will become profitable and make their way through the process, and some are probably a much bigger reach. But if you look at the overall [LNG picture], it’s quite strong.”

Santa concurred, adding “in terms of the pipeline capacity associated with LNG, interstate gas pipe does not get built on speculation. It gets built when there’s a shipper who [agrees] to a long-term firm contract that supports the ability to finance that infrastructure and also the ability to demonstrate need for it legally. I think that will discipline things in terms of not seeing pipe get built to serve facilities that will not come to be.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 1532-1266 |