Black Hills Suspends Push for Cost-of-Service NatGas Reserves

Black Hills Corp. executives said Thursday efforts have ended to establish a multi-state, multi-utility cost-of-service natural gas reserve program as they wind down their oil and gas business.

Stubbornly low commodity prices kept the reserves proposal from gaining traction with state regulators, the Rapid City, SD-based executives said during a briefing with Wall Street analysts in New York City.

“The odds of getting a cost-of-service gas program approved right now, when gas prices are so cheap…pretty low,” said CEO David Emery. “When customers are worried about the size of their bills, it is much easier to get the attention of regulators for new and innovative programs; when they are not, it is very difficult to get their attention. That’s just the reality of the situation.”

For the foreseeable future, the reserves program doesn’t have a realistic chance of being approved by state regulators, Emery said.

During the analysts briefing, Emery said Black Hills is “exploring several options” to convert its gas reserves in the Mancos Shale to capture more value for shareholders, including monetizing the reserves and using the cash to acquire another utility company. In August, Emery indicated the Mancos program would not move ahead this year, and its ultimate fate remains uncertain.

“I think over the course of the next three to four months we will have a lot more information we can share about what options we’re pursuing” as the oil and gas business winds down, he said. “We’re exploring several options right now, and we’re not comfortable talking about any of them at this point.”

Last year the Colorado Public Utilities Commission rejectedBlack Hills’ proposal for a utility ratepayer-backed gas reserves acquisition program. It was the first of up to six state approvals being sought for similar programs where Black Hills has utility operations. The rejection caused the holding company to re-think its approach, and at one point earlier this year it considered a partner for the program.

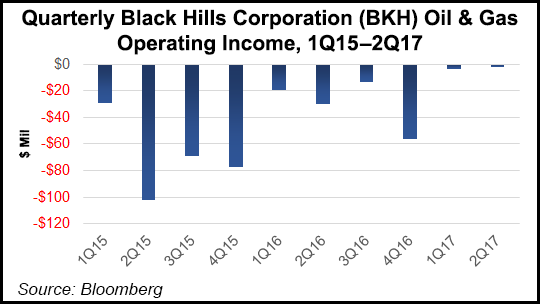

COO Linn Evans said Black Hills is not waiting for oil and gas prices to rebound significantly before selling off more of its exploration and production (E&P) business, which the company already had planned to exit.

Oil and gas contributions to earnings are “getting pretty negligible,” Emery said, with Black Hills “working its way out of the E&P business.”

As it shifts focus to the utility operations, he said Black Hills has strong cash flow that give it the ability to provide added capital without having to tap into the debt or equity markets.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |