Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Halliburton, Baker Hughes See Rocky, i.e. Shale, Road Leading Recovery

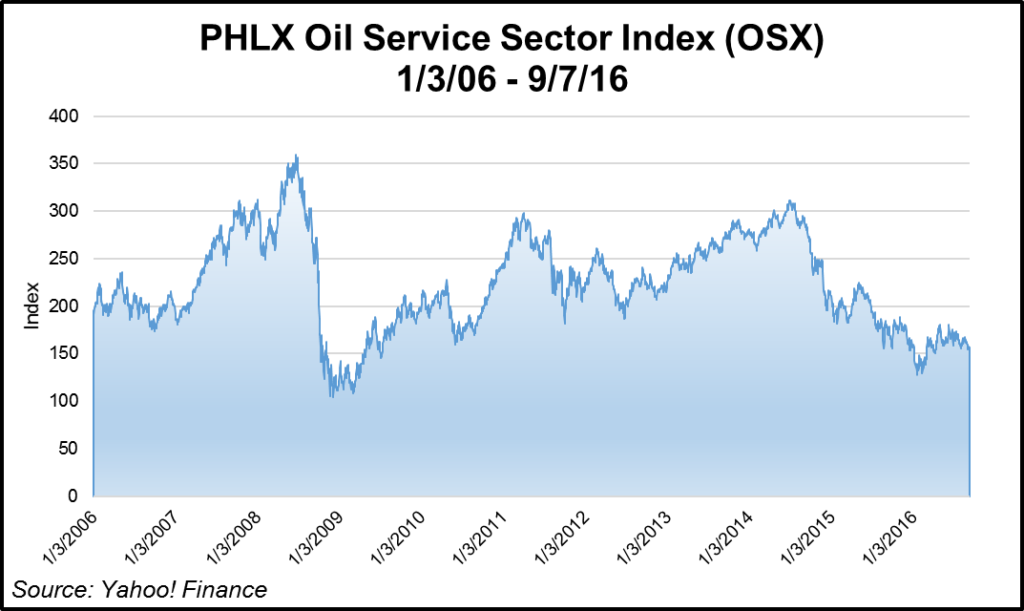

The oil and gas services industry has begun to pick itself up from the muck and mire from a “100-year low in activity,” but it has found its bottom, according to top Halliburton Co. and Baker Hughes Inc. executives.

Oilfield services are “on the road to recovery,” Halliburton President Jeff Miller said at this week’s Barclays CEO Global Energy-Power Conference in New York City. “But at the same time, I would describe this as sorting through the wreckage of the worst downturn that we’ve ever seen. We see the after-effects just about everywhere that we look. There have been more than 350,000 layoffs in the industry, mostly weighted toward oilfield services, some companies laying off as much as 80% of their workforce.” Halliburton has laid off about 40% of its global staff.

“So fundamentally, we’ve found bottom…We are in the early innings of a recovery.” The starting point “is from a 100-year low in activity. But nevertheless, that’s ‘Step Zero.’ That’s what it looks like as we begin to climb back.”

Schlumberger Ltd.’s operations chief Patrick Schorn in late August said the global oil supply was tightening, trending to balance by the end of this year, but North American basin pricing remained unsustainable (see Shale Daily, Aug. 31).

If current global oil production decline rates are conservatively at about 3%, a 14 million b/d gap will grow over the next five years, Miller predicted. “What this model does not consider is what I like to describe as almost capex starvation, which would only serve to exacerbate that gap, meaning more than 14 million b/d.” Meanwhile, global oil demand remains steady, growing at a rate of 1-1.5% a year.

Outlook for Strong Demand Increase

“If we roll that out over the next five years, what we see is about 6 million b/d in growing demand by 2020,” Miller said. “All of this, when added up, adds up to about 20 million b/d in terms of gap…That’s what I believe is out ahead of us. To put 20 million b/d in perspective, that’s the equivalent of adding two Saudi Arabias between now and the year 2020.”

The takeaway is that the market will recover, “but what may be a more important question than whether the market recovers…is where does that happen first?” In Halliburton’s view, unconventional drilling will lead the recovery, followed by mature field development overseas and finally the most expensive endeavor of all, deepwater.

“The unconventional barrel is simply put, the fastest incremental barrel of oil to market,” Miller said. “That means it will be the first to fill demand, to fill the imaginary supply bucket…In addition though, the unconventional barrel is the shortest cycle return barrel, which makes it an attractive barrel, not only for filling demand, but from a return standpoint.

“And finally, that unconventional barrel has what I like call the best glide path. I say that because we continue to see efficiency gains in terms of lowering cost. But even more important is the potential gains to be had with respect to recovery factors, which we’re in the very early innings of understanding how much can be produced if we consider recovery factor is around 8%. Just moving to 10% is a dramatic move…And we’re right in the middle of how to improve recovery factors from a technology perspective.”

Mature fields, the lowest risk opportunities and the largest market in the world, already are well understood. However, they are difficult to ramp up at scale similar to low-cost unconventionals.

Halliburton views North America’s onshore as a mixed bag, as the relationship between the rig count and fracture (frack) crews has changed. The rig count is up about 10% since the beginning of July, “but it’s not sufficiently significant to change the underlying market dynamics…It’s still a brawl in the market place…The bottom line is, it just doesn’t take as many rigs as it used to, to drive frack activity.”

Rigs v. Horsepower

Improved drilling efficiencies mean it takes more frack crews to keep up with the rigs now running, Miller said. Increasing completion intensity is about three times higher than three years ago too, which means each frack stage uses more horsepower, and in general, there’s more horsepower per job.

“We estimate that there’s 3 million to 7 million hp that’s leaving the marketplace, either because of attrition or cannibalization, but in both cases increasing demand on remaining horsepower. The point is, it doesn’t take 1,900 rigs to get to equilibrium. In fact, there’s probably a path toward equilibrium that happens well before that just because of the demand on equipment and the activity.”

As to when OFS pricing might increase, or when more equipment will need to be added, Miller said it’s questionable before 2017.

“Bringing new horsepower into the marketplace for the industry is going to require better pricing than we see today just because it’s unsustainable,” he said. “The supply of equipment is about where it is until something changes.”

Meanwhile, the oil and gas business in the rest of the world is going to get tougher before it gets better, according to Miller. “The slowest recovery will be deepwater…That’s really a duration question. It’s seven to 10 years from discovery to barrels in the tank…And from an efficiency perspective, we just don’t get as many at-bats in deepwater…We get a lot of at-bats onshore, and we’re able to drive efficiency quickly.”

Baker CEO Martin Craighead during his presentation at Barclays this week said oil prices would need to be sustainable “in the upper $50s” for a recovery to begin in North America. Current North America activity growth has become limited to the “tier one,” or core acreage for most producers. Meanwhile, price recovery is being “dampened by shale producers’ ability to quickly ramp up production.”

2017 Outlook “Opaque”

Craighead elaborated in detail during an investor dinner in New York hosted by Evercore ISI. It’s been four months since a mega-merger with Halliburton was terminated, and Baker has since begun to simplify its global organization (see Shale Daily,May 27). The Houston-based operator has moved swiftly to reduce costs and is ahead of an initial $500 million target, in part by shrinking the workforce (see Shale Daily,Sept. 2;July 28). The company expects to achieve more cost savings by flattening the organization, muscling up the core portfolio and developing trade secrets/intellectual property on new business channels.

“Notably, the company’s technology agenda did not slow during the merger process,” Evercore analysts led by James West said in a note. “While much recent attention has focused on the ‘era of mega-completions’ and the increase in fracking horsepower on the well site, the massive increase in sand usage per well and continued increases in lateral lengths and the number of stages, there has been little emphasis on the potential for increases in artificial lift.

“Transitioning to longer laterals can produce dramatic increases in workover costs, gas processing abilities and chemical demands. As a result, the lift demand is improving significantly…This shift is clearly in Baker’s favor.”

The current operating environment may underwhelm, but it pales in comparative importance to the 2017 outlook, which remains “opaque” with respect to when the ramp up may begin, said West. For constructive customer conversations to transition into higher activity levels, commodity pricing needs to improve further, while exploration and production (E&P) spending needs to respond in kind.”

Reports that members of OPEC, the Organization of the Petroleum Producing Countries, may freeze output have dominated the headlines, while rampant merger activity has governed E&P discussions.

“It’s only a matter of time before these conversations shift toward improving oil fundamentals and necessary increases in E&P spending,” West said. “We continue to preach patience in this market, as unsustainable market dynamics continue to pave the way for an elongated upcycle.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |