Williams Targeted by Activist Investor as Energy Transfer Fallout Continues

Williams said Monday it is “unfortunate” that Corvex Management LP has mounted a proxy fight to nominate a slate of 10 directors to the Williams board following news that Williams earlier this year rejected a takeover bid from Enterprise Products Partners LP.

Williams recently failed to hold Energy Transfer Equity LP to a merger agreement between the two companies (see Daily GPI, June 29; May 16; May 5). According to recent press reports, Williams then rejected a takeover offer from Enterprise. An Enterprise spokesman declined to comment last week on any offer.

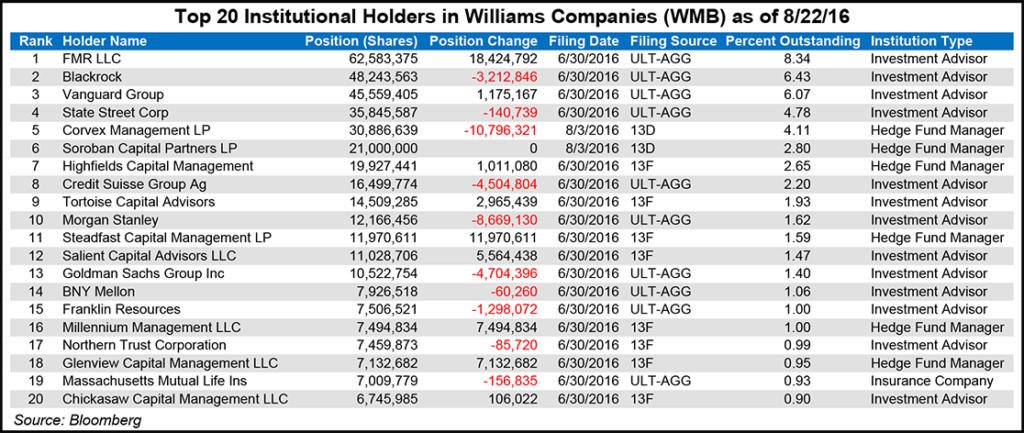

Corvex is led by activist investor Keith Meister, who told news media that his plan to nominate his own directors gained urgency after he learned that Williams had rejected an offer from Enterprise. Meister is a major Williams shareholder and is one of six former Williams directors who stepped down after an unsuccessful attempt to oust CEO Alan Armstrong over the failure of the Energy Transfer tie-up (see Daily GPI, July 1).

According to documents filed with the U.S. Securities and Exchange Commission, all six of the board members to resign were part of a bloc that voted in favor of the Energy Transfer merger. Armstrong opposed the merger. Meister said he wants a Williams board that is accountable to shareholders as opposed to Armstrong.

“Given the events of the last year, it is unfortunate that Corvex intends to launch a distracting and costly proxy contest while Williams is moving forward with its plan to identify new, highly qualified and independent directors,” Williams said Monday.

“…[A]fter discussions with Corvex and other Williams stockholders, Williams intends to appoint three new, independent directors to its board of directors prior to the company’s 2016 annual meeting…Williams expects to announce new board appointments in the coming weeks.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |