Shale Daily | E&P | NGI All News Access | Permian Basin

Callon Adds Second Permian Rig, Could Add Third by 2017

Permian pure-play Callon Petroleum Co. is planning for growth as it looks ahead to 2017.

The Natchez, MS-based exploration and production company has added a second horizontal rig for 2016 and could potentially a third rig next year, management said during a call with investors Tuesday to announce second quarter results.

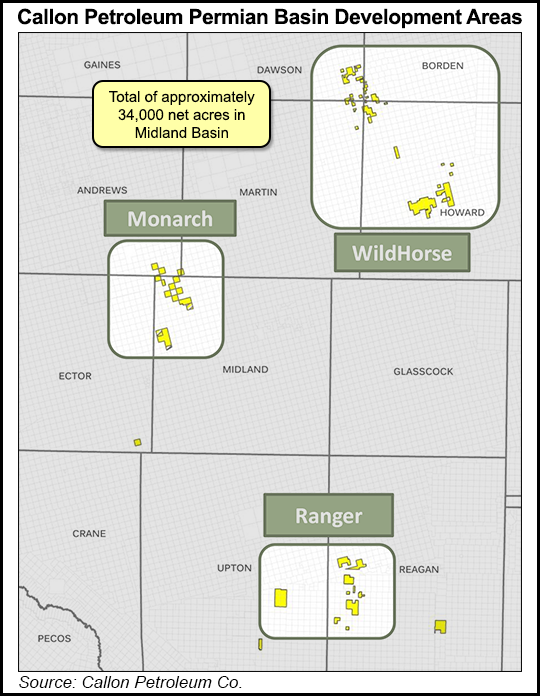

Callon Petroleum also nearly doubled its Permian running room during the quarter (see Shale Daily, April 20), closing on a pair of acquisitions in the Midland sub-basin totaling $362.6 million that allowed the independent to establish a new core operating area in Howard County, TX.

The second rig, added earlier this month, will focus on developing the company’s WildHorse acreage in Howard County. The company reported promising results Tuesday from its first operated completion targeting the Wolfcamp A, the Silver City A 1H, located in northern Howard County.

With a lateral length of close to 7,400 feet, the well produced roughly 48,600 boe in its first 30 days, 90% weighted to oil, management said.

CEO Fred Callon said the company is “very encouraged” by the early returns from the Silver City A 1H, saying the production “supports our technical views” of its Howard County acreage.

“This area will be a key focal point for our second horizontal rig…although we don’t expect to see much production contribution from our second rig this year, we are increasing our production guidance to midpoint of 15,000 boe/d on the continued strength of our base program,” Callon said.

“We recognize the challenges that still face the oil markets, but we believe the returns offered by Callon’s deep well inventory, combined with a solid financial position, more than warrant an increase in activity in 2016 as well as a planned incremental increase in early 2017 if we continue to see signs of rebalancing and stability in the oil market.”

Senior VP Gary Newberry said Callon Petroleum’s delineated drilling locations across its three operating areas “are forecast to generate wellhead returns in excess of 25% at [West Texas Intermediate] prices under $55/bbl, with 700 locations meeting that hurdle at a benchmark oil price under $45/bbl. This is a solid starting point that provides long-term visibility with production growth in a rebalancing global oil market.”

The company raised its 2016 capital expenditure budget to $140 million from a previous budget of $95-$105 million. The new budget includes the cost of its drilling program and investments in facilities and infrastructure in its WildHorse development area, among other items.

Callon Petroleum grew its net second quarter production to 13,451 boe/d, 77% weighted to oil, compared with production of 12,440 boe/d (79% oil) in the first quarter and 9,516 boe/d (79% oil) in the year-ago period.

In 2Q2016, the operator drilled six gross (3.7 net) horizontal wells, completed five gross (3.4 net) wells and placed five gross (3.4 net) wells into production.

Production during the quarter was impacted negatively by an unplanned outage in June in its “Monarch” development area. Management said the outage was caused by hydraulic interference from two offsetting completions by other operators, exacerbated by weather-related power outages that made it more difficult to de-water the wells and restore normal production.

The outage was offset in part by a month of production from the Howard County acquisition, management said.

Total revenues for the quarter, excluding hedges, were $45.1 million. Sales prices before hedging averaged $42.78/bbl for oil and $2.77/Mcf for natural gas, for a cumulative price of $36.88/boe. Prices excluding hedges in the first quarter averaged $27.12/boe, with the company realizing an average sales price of $45.31/boe in the year-ago quarter.

Lease operating expenses for the quarter averaged $5.97/boe, compared with $7.59/boe in the year-ago quarter. Depletion, depreciation and amortization costs averaged $13.31/boe, compared with $20.31/boe in the year-ago period. General and administrative costs averaged $5.15/boe in the quarter, compared with $6.65 in the year-ago period.

Callon Petroleum posted a net loss for the quarter of $70.1 million (minus 61 cents/share), compared with a net loss of $5 million (minus 11 cents/share) in the year-ago quarter.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |