Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report

E&Ps Pushing Proppant Intensity Ever Higher, Say Frack Sand Operators

Commodity prices may not encourage too many rigs to rise in North America in the near-term, but as oil and gas producers experiment with longer laterals and increased fractures, there’s a bit more optimism among sand operators.

U.S. Silica Holdings Inc., Hi-Crush Partners LP, Fairmount Santrol Holdings Inc. and Superior Silica Sands LC, while cautious about the near-term, all see higher proppant intensity among their onshore customers.

The reasons became clear during 2Q2016 conference calls. For example, Chesapeake Energy Corp. CEO Doug Lawler proclaimed a new era in completion technology, which the company has dubbed “proppant-geddon” (see Shale Daily, Aug. 5). Chesapeake’s largest completion in history, drilled in the Haynesville Shale, used more than 30 million pounds of sand. It plans additional tests up to 50 million pounds “in the back half of the year,” CEO Doug Lawler said.

Stay up to date on 2Q16 earnings and projections for the remainder of the year with NGI‘s Earnings Call and Coverage sheet.

”Few Green Shoots’ at U.S. Silica

U.S. Silica is expecting the upside — but not immediately, CEO Bryan Shinn said during the recent 2Q2016 conference call.

“Several industry experts have predicted a coming surge of demand for frack sand,” Shinn said. “While we also expect to see significant increases in sand used per well, to date our demand has not picked up significantly. We are, however, beginning to see a few green shoots, which may be signs of an impending market recovery.”

For example, he cited “numerous conversations recently with customers who’ve indicated a renewed interest in securing long-term supply contracts. In addition, we’ve seen activity levels in our 30-day open order book begin to tick up in the last few weeks, indicating the potential for an incremental increase in demand.” Oil and gas sand pricing also appears to have stabilized in the last couple of months following an “epic downturn,” Shinn said.

“In fact, we’ve begun to test the waters for potential price increases in specific parts of certain markets. So have we hit the bottom of the cycle? Well, our largest customers believe that we have. Our view is that we have to continue to do the things we’ve done over the past several quarters to position our company for success…”

U.S. Silica appears to be laying plans for a surge in sand proppant. In July it agreed to pay $210 million for New Birmingham Inc. affiliate NBR Sands (see Shale Daily, July 19). Plans are to more than double operations at the Tyler, TX, facility to 2 million tons/year.

The Frederick MD-based commercial silica producer only a few days ago also agreed to pay $218.3 million to buy Sandbox Enterprises LLC, a frack sand logistics company, to help manage the proppant supply chain.

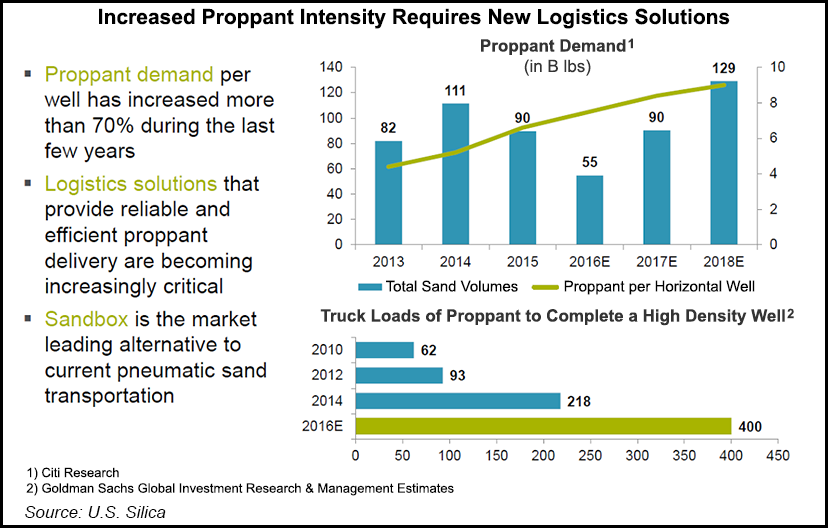

“Increasingly, wells are demanding greater levels of proppant,” Shinn said of the purchases. “Since 2013, the per-well demand for proppant has increased more than 70% and is estimated to rise further in the coming years.

“This trend has created significant logistics challenges for energy and frack service companies, as more proppant means more deliveries, more trucks, and more congested jobsites.” High-intensity completions, he said, “often require 400 truckloads of sand or more, creating delivery delays, noise and dust at the well site. Many service companies are citing last-mile proppant logistics as a major barrier when energy markets recover.”

While U.S. Silica management is encouraged by recent customer conversations, Shinn stressed that contracts signed going forward would be designed to recover margins as the market recovers.

“Finding ways to peg the contracts to market indicators like the West Texas Intermediate prices or number of rigs, things like that, is where we’re going. And I feel like that’s where the industry is going to go as well. I think everyone is looking to make sure that as things get tight again, which it feels like they will…you just do the math on completion intensity, and the amount of sand that’s now needed per rig, or per 100 rigs…It’s almost certain that things will tighten up, and the challenge is to structure the contracts in a way that are fair to both parties.

The “more confident customers” that have a feel for what’s going to happen in the market with sand are signing up for volume commitments, but most remain “leery.”

U.S. Silica’s frack sand demand in April was relatively slow, while May business picked up before tailing off in June.

“As we rolled into July, our volumes were up versus 2Q2016 exit. And… for the first time in a while, our 30-day advance order book is up pretty substantially. So it feels like there could be some green shoots out there. I’m feeling better about 3Q2016 volumes” versus 2Q2016.

As far as demand, Shinn said generally the finer grades of sand are tighter than coarser products, “driven by the move to more slickwater fluid systems, which tend to use the finer products.”

U.S. Silica has about 2,600 railcars in storage today, down about 200 from 1Q2016.

“There are somewhere between 25,000 to 30,000 cars in storage across the country, based on our estimates,” Shinn said of the industry. “And just based on that, and sort of the reality, our partners are showing a fair amount of flexibility in working with us…”

Hi-Crush Seeing ”Greater Sand Intensity’

“We entered the second quarter with the same headwinds as we experienced throughout the first quarter, but did see a gradual yet steady improvement in activity and volumes throughout the second quarter following a low in April,” Hi-Crush CFO Laura Fulton said during the recent quarterly call.

The company’s northern white sand volumes were lowest in April, while May was sequentially better, with a further increase in June, Fulton said. While activity and volumes may not increase every month for the rest of the year, the second quarter trend was finally to the positive, and represents an encouraging dynamic for the partnership.”

The “improving pattern is the direct result of the continuation of greater sand intensity,” she said. “We’ve had continued discussions with our customers on the benefits of higher-intensity completions, and we hear the same commentary from producers discussing the positive impacts of more sand on their quarterly investor calls.

“The trend of more sand per lateral foot is real. It’s impactful. It’s rig-count-neutral and, along with the completion of the drilled but uncompleted wells, it’s one of the most important drivers of support for our business.”

Hi-Crush CEO Robert Rasmus was cautious about the recovery, however.

“While the rig count has slowly started to stabilize and even increase in certain areas, the higher well completion activity that comes from increased rigs may take some time to surface in the sand industry” because of “the normal and expected time lag between rig activity and completions,” Rasmus said.

“We continue to see some frack sand producers selling sand at what we consider to be unprofitable and unsustainable prices, even for those with industry-leading cost structures. As demand for sand picks up, we expect to see pockets of short supply, which will help shore up pricing, moving to overall tight supply as demand increases with greater completion activity and sand intensity.”

He also likes what he is hearing from the exploration and production (E&P) companies about increasing proppant.

“We’ve all heard in recent months and more recently on the latest round of earnings calls that more sand used per stage and per well equates to better well results. We have corroboration of that statement from recent pronouncements from E&Ps…” More sand per frack is a prevalent message, but for the proppant providers, the drilled but uncompleted (DUC) wells also are an avenue for profit.

Whittling down the DUC backlog represents “pent-up sand demand that is rig count-neutral and offers E&Ps attractive returns on new capital, even at current hydrocarbon prices,” Rasmus said. “These sand intensity and DUC trends are tailwinds specific to sand demand. When combined with new activity across the U.S., this supports our view that the frack sand industry will lead the energy sector recovery.”

The Permian is the go-to area for more proppant today, which is why Hi-Crush invested in more silos, Fulton said.

“But with the natural gas prices where they are right now, we can see the Marcellus and Utica coming back,” she said. “We don’t have an owned and operated terminal in the Midcontinent, but we’re seeing activity levels increase, and we have third parties that we can work with.

“But I think it’s along the lines of what most analysts are expecting, is that you would see the Permian and the Eagle Ford coming back and then the Marcellus and Utica, then Midcon, Denver-Julesburg…The Bakken is probably the last one to come back…”

More sand going into gas wells in the Marcellus and Utica is a boon for Hi-Crush, Rasmus said.

”We’ve seen some wells, three in particular that we know of, that have used over 60 million pounds of proppant on those wells, and those wells have been absolutely gangbusters in terms of their performance results. It’s just almost shocking in terms of the production results relating from that…We are seeing similar results by increased sand usage and increased number of stages on the natural gas wells in addition to the oil-based wells.”

Intensity Seen 20-25% Higher in 2016, Says Fairmount

At Fairmount Santrol, July proppant volumes rose from the second quarter and “proportionately more so” on resin-coated proppant (RSP) CEO Jenniffer Deckard said during the quarterly conference call.

“We have also seen a market shift in our conversations and actions with our customers, which have largely turned to a focus on assurance of future supply of quality products and in quantities that will be necessary for them as the cycle turns upwards,” she said.

As commodity prices recover, “operators are expected to accelerate completion of wells from existing DUC inventories. That’s in advance of and in addition to rig count increases. And second, proppant intensity continues to grow and could increase by 20-25% on average for the full year 2016.”

Pricing for RCP, a premium proppant, has begun to stabilize along with prices for brown and white sand, Deckard said.

“It really does feel that the industry is recognizing that pricing just reached unsustainable levels for the sand industry” she said. “We are seeing a stabilization there, both in coated products and in sand. And the increase is definitely being driven 100% by customers bringing resin-coated sand back into their well design and starting to think about productivity and long-term estimated ultimate recoveries.”

Still, some customers are walking away from orders, given the recent pullback in oil prices, she told analysts.

“But that’s really not something new to the industry. You definitely do have jobs, sometimes they pull out and sometimes they push…But we certainly understand that our customers are out bidding jobs and that they are going to need a little bit of flexibility and we just try to work together to minimize the cost to both of us for shifting projection…”

No Saturation Point Yet, Says Emerge CEO

Proppant intensity per well showed a big gain in the first half of the year for Superior Silica Sands LC, an affiliate of Emerge Energy Services LP. Preliminary data suggested intensity is up 20-30% versus exit rates in 2015, said Emerge Chairman Ted Beneski during a recent conference call.

Like U.S. Silica, Superior is seeing higher demand for finer grade sand than for coarser grades — for now.

“While this trend is a severe divergence from patterns just 12 months to 24 months ago, we think that operators will ultimately migrate back to coarser grades,” he said. “In fact, an informal survey of our customer base indicates a unanimous opinion that coarse sand demand will return. It is simply a matter of time…

“We continue to believe that demand from northern white sand will return to much healthier levels when operators convert back to a more quality focused long-term mindset when evaluating their well designs compared to the current short-term, low-cost mentality we see from the industry.”

CEO Richard Shearer said customers “are moving forward very cautiously because of the price of oil. There was more consensus of optimism in the marketplace as oil was in the high $40s, even tipping $50/bbl… More recently, however, with oil having dipped back down to around $40/bbl, I think some customers, not all by any means, but some customers have now had second thoughts about how they should move forward in the second half.” It’s likely to be a “mixed bag” to the end of the year with some customers committing to new crews and more drilling in certain basins, while others hold steady.

“We are, like everyone, seeing proppant intensity as a real driver and another reason for our optimism in the frack sand space,” Shearer said. “Even in the first half of this year, it looks as though the proppant intensity has increased 25-35%, just made around with a couple major customers of ours who attest to that fact that they’ve seen a 30% increase in the first half of this year. They’re continuing to add more and more sand downhole because of the yield from the well certainly continues to improve based on proppant intensity.”

Depending on the basins, the well and the sand intensity vary, he said. “But on average, you’re probably looking at 3,800 tons to 4,000 tons per well. I know we were bragging just 12 months, 14 months ago about a well that was known to take 10,000 tons of frack sand, that was a huge number.

“That’s getting more and more common now,” Shearer said. “I literally just did hear about a well that took 25,000 tons of frack sands. So, it’s a reason for optimism for sure. We think that we’ll continue to see that proppant intensity go up.” If Shearer had to guess about what’s ahead for 2017, he said it would be “reasonable” to assume proppant intensity will increase 15-20% at least.

“Nobody is talking in the market about a saturation point being achieved as yet.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |