Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Three Top North American Drilling Contractors Encouraged by E&P Momentum

A trio of contract drillers that work in North America’s onshore — Helmerich & Payne Inc. (H&P), Patterson-UTI Energy Inc. and Pioneer Energy Services — said Thursday the oil and gas environment remains challenging, but each reported encouraging signs that an upturn may be in the works.

H&P CEO John Lindsay said it’s been a stark wake-up call for the industry, but he said of late, the news has been a bit better.

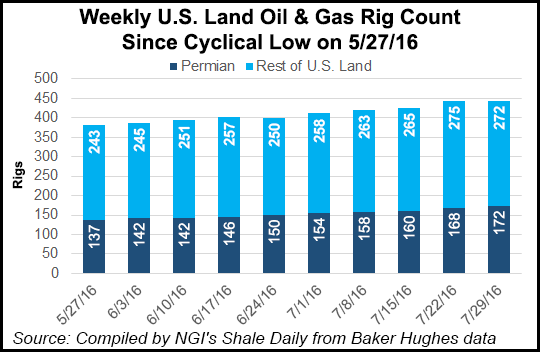

“Even though oil prices have pulled back over the past several weeks, it is encouraging to still see signs of optimism in the market,” he said. The U.S. land rig count “troughed” in May at 380 rigs, “and has since increased from what everyone hopes was the absolute bottom of this market cycle.” Some exploration and production companies “have announced budget increases and rig count additions. It is a positive sign, but many still remain on the sidelines.

“This has been an extraordinary downturn and it is having a pervasive effect on every enterprise within the industry. While H&P remains very strong and has been proactive and effective in adjusting to this new environment, the declines in activity levels and spot pricing that we have experienced have significantly impacted our bottom line and the size of our organization…

“Time will tell whether momentum is truly building in the market; a few data points do not make a trend,” Lindsay said. “However, regardless of the timing, we are making every effort to emerge from this as a stronger company for customers, employees and shareholders.”

The Tulsa-based contracted reported a net loss of $21 million (minus 20 cents/share) in fiscal 3Q2016, versus net income a year ago of $91 million (83 cents).

H&P’s U.S. land operations earned $26 million, compared with year-ago profits of $122 million. The number of quarterly revenue days decreased sequentially by 22% to 7,483 days, and average rig revenue/day decreased sequentially by $1,247 to $24,684. Rig utilization was 24% down, 47% year/year and 31% sequentially.

At the end of June, H&P’s domestic land segment had 89 contracted rigs generating revenue and 259 idle rigs.The 89 contracted rigs included 84 rigs generating revenue days.

For fiscal 4Q2016, H&P expects its U.S. land segment revenue days (activity) to increase by roughly 3-7% sequentially.

“As of today, the U.S. land segment has approximately 91 contracted rigs that are generating revenue, including 72 under term contracts, and 257 idle rigs,” H&P management said. The 91 contracted rigs include 86 rigs generating revenue days.

As of Thursday, H&Ps existing fleet included 348 land rigs in the United States, 38 international land rigs and nine offshore platform rigs. In addition, the company is scheduled to deliver another two H&P-designed and operated FlexRigs during this fiscal year, both under long-term contracts with customers. Once they are completed, the global fleet is expected to have a total of 388 land rigs, including 373 alternating-current drive FlexRigs.

North American onshore contract driller and pressure pumping specialist Patterson-UTI said rig activity fell sharply from the first three months of the year, but it too is seeing signs of life. The Houston-based contractor reported a net loss of $85.9 million (minus 58 cents/share) for 2Q2016, versus a year-ago net loss of $19 million (minus 13 cents). Revenue plunged to $194 million from $473 million.

“In contract drilling, our rig count during the second quarter averaged 55 rigs in the United States and less than one rig in Canada, compared to the first quarter average of 71 rigs in the United States and three rigs in Canada,” CEO Andy Hendricks said. “Activity levels stabilized for both our drilling and pressure pumping businesses during the second quarter.

“Since reaching a bottom in late April of 52 rigs, our rig count in the United States has improved to 58 rigs. For the month of July, we expect our average rig count will be 56 rigs in the United States and two rigs in Canada.”

Almost $5.4 million of revenue during the latest period was linked to early contract terminations in the drilling business, which positively impacted total average rig revenue/day of $23,070 by $1,080. Without that extra revenue in the first six months of 2016, the total would have been $21,980 on average in 2Q2016, compared to $22,820 in the first quarter, Hendricks said.

At the end of June the operator had term contracts for drilling rigs that provided about $507 million of future dayrate drilling revenue. Signs of growth for contracts aren’t evident, however.

“Based on contracts currently in place, we expect an average of 45 rigs operating under term contracts during the third quarter, and an average of 42 rigs operating under term contracts during the second half of 2016,” Hendricks said.

The pressure pumping activity stabilized between April and June, “but pricing remains unsustainably low,” he said. “In this low price environment, we continue to be disciplined in the use of our assets, and we have not activated idle spreads.” The lower activity led to pressure pumping revenue decreasing sequentially in 2Q2016 by 23% to $74 million. Gross margin as a percentage of revenues decreased to 6% during the second quarter from 8.8% in the first quarter.

“We are encouraged by the recent increase in our rig count and optimistic about a continued recovery in the U.S. rig count, assuming commodity prices remain at or above recent levels,” said Chairman Mark S. Siegel.

San Antonio-based Pioneer Energy, which also provides onshore contract drilling services, reported a net quarterly loss of $30 million (minus 46 cents/share), versus a year-ago loss of $27.7 million (minus 43 cents). Revenue fell 54% year/year and 17% sequentially to $62.3 million.

Drilling services revenue slumped by half from 2Q2015 and by 16% in 1Q2016 to $28 million. Drilling rig utilization was 39%, down 46% from 1Q2016 and 63% from a year ago.

“As expected, industry conditions remained challenging during the second quarter, but we were pleased to see some early signs of improving activity levels,” said CEO William Stacy Locke. “Opportunities in the drilling segment finally began to emerge in the second quarter. A rig that came off of a long-term contract in the first quarter has continued working and is expected to remain contracted through the end of the year in the Permian.

“In addition, an earning-not-working rig was relocated from the Bakken to the Permian and is expected to remain busy all year as well. In Appalachia, a one-year term contract expired and was renewed for an additional year, and we expect to contract up to two additional rigs from the Bakken into other markets by the end of the third quarter of 2016.”

Pioneer is “receiving a modestly higher level of inquiries for our drilling services,” he said, but “pricing remains very competitive and current dayrates remain depressed.”

Pioneer now has 11 U.S. rigs earning revenue, seven under term contracts. Since late 2014, term contracts for 19 of its rigs were terminated early, including three that were terminated this year. The company recognized early termination revenue of $7.1 million in 1Q2016 and $4.4 million during 2Q2016. The remaining balance of $1.8 million is to be recognized in the third quarter.

Revenue for the production services segment was $34.3 million in 2Q2016, down 18% sequentially and 55% year/year. Segment margin as a percentage of revenue was 16%, versus 17% in the first three months and 31% a year ago. Well servicing rig utilization was 40%, compared with 73% a year ago, while coiled tubing utilization was 20%, down from 24%. Higher than normal levels of rain with associated flooding impacted operations in April and May.

“In our production services segment late in the second quarter we saw bidding and activity pick up in our wireline business, and to a lesser extent, our well servicing business,” Locke said. “Our coiled tubing business remained soft in the quarter. We expect to see continued bidding and utilization increases with an improvement in commodity prices. July has been softer given the July 4 holiday and the recent pullback in oil prices, but customers are indicating an uptick in activity in the coming months.”

For a full listing of 2Q 2016 industry earnings calls, including links to NGI coverage, see NGI2Q16 Earnings Call PDF.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |