Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report

NOV Not Calling Bottom, Moving to Capture Shale Work as Offshore Collapses

Houston-based National Oilwell Varco Inc., which provides drilling support services worldwide, sees no relief in sight for its bread-and-butter offshore business, but it is seeing potential opportunities in the U.S. onshore, management said Thursday.

Although drilling contractors still are “not pulling the trigger” on purchase orders, many are talking about new rig building, CEO Clayton Williams said during a conference call to discuss second quarter performance. “So I think you’re going to see our mix shift in the coming quarters a little more toward land.”

The move could not come too soon. NOV reported a net loss in 2Q2016 of $217 million (minus 58 cents/share), compared with a year-ago profits of $289 million (75 cents). Revenue slumped 56% year/year and 21% sequentially to $1.72 billion. Operating losses mounted to $270 million, 15.7% of sales. Minus the writeoffs, operating losses totaled $153 million 8.9% of sales.

“Like others in our space, we believe we are seeing some isolated green shoots of activity, and we are encouraged that the North American rig counts have begun to increase,” Williams said. “We have seen demand rise in recent weeks for certain products and services for North America: rod guides for artificial lift, solids control jobs in West Texas, drilling motor rentals and other items.

“On the other hand, our rig equipment business in many international markets continued to decline. At or near the bottom of the cycle, we see considerable crosscurrents, price pressure, and shifting mix within our business. And, frankly, we’re not ready to call bottom yet.”

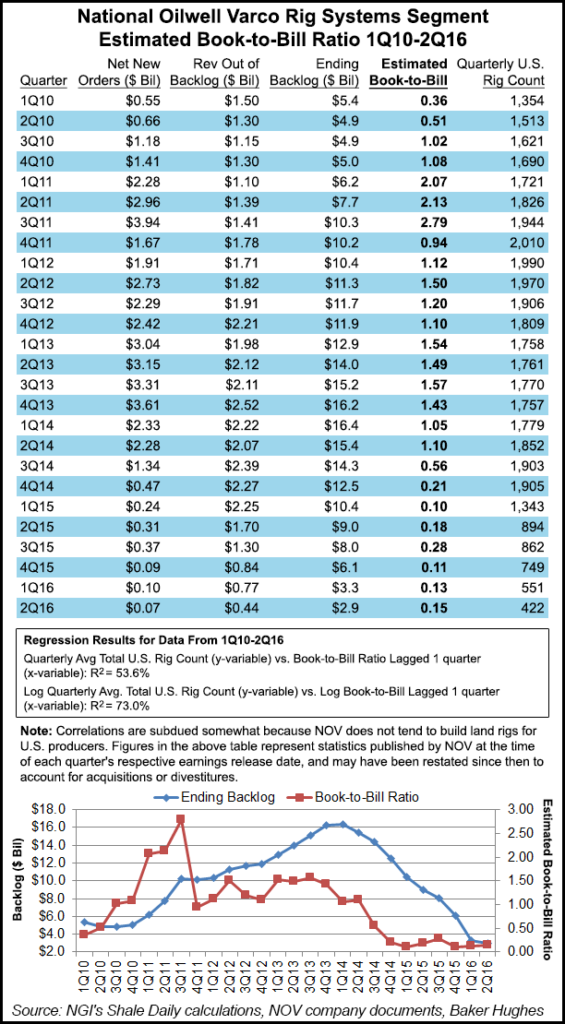

NOV’s book-to-bill came in at only 0.15 for 2Q2016, in line with the 0.11 and 0.13 figures from the prior two quarters, and marking eight consecutive quarters that the ratio has been below 1.0. The backlog has declined from $15.4 billion to only $2.9 billion over that period.

Book-to-bill is the ratio of net new orders to revenue out of backlog for a particular quarter, and is widely regarded as an indicator of forward looking business conditions. Readings above 1.0 are generally considered to be bullish, while those under 1.0 suggest a contraction may be in store. Or, as in the current case, that one is well under way.

“Eight consecutive quarters of a B-to-B less than 1, and seven straight with a B-to-B less than 0.3 is about as bad as I’ve seen for any industry,not just for rig manufacturing,” said Patrick Rau, NGI director of strategy and research.

NOV’s near-term outlook “calls for modest revenue improvements in the wellbore technologies and completion and production solutions segments, offset by another quarter of declines in our rig systems segment, which we expect to flatten thereafter,” Williams said. “We expect rig aftermarket third quarter to be down only slightly from the second quarter.”

A “laser focus on efficiency is part of our DNA, and cost savings measures evolve continuously with our market outlook,” he said. The energy industry “has been decimated by a generational downcycle, but record low levels of rig activity will inevitably lead to production declines, higher oil prices and higher activity. In the meantime, we plan for this to be a slow grind, and we still have a lot of swamp to traverse until we get to full recovery.”

NOV is using the downturn to improve efficiencies and advance new initiatives for the industry.

“We believe recovery will drive higher demand for completion tools and hydraulic fracture stimulation and pressure pumping equipment where NOV occupies market-leading positions,” Williams told analysts. “Our outlook for technology proven by the share revolution is robust. Shale technologies will migrate to new basins on new continents, requiring new sophisticated Tier 1 land rigs, bits, downhole tools and new drill pipe designs.”

However, rig system orders declined further in the second quarter, “and we expect orders to remain depressed for the foreseeable future. With no new offshore rig builds on the horizon, we are investing in new products to enhance efficiency and safety of existing rigs, products that will enable drilling contractors to differentiate their rigs in a crowded marketplace.”

The rig systems business unit generated revenues of $564 million, down 71% from 2Q2015 and off 39% sequentially, while operating profit was $7 million, or 1.2% of sales. The backlog for equipment was $2.94 billion at the end of June. New orders in 2Q2016 totaling only $66 million — down $31 million sequentially and representing a 10-year low. That represents a book-to-bill of 15% when compared to the $441 million shipped out of backlog.

“Sharp revenue declines were anticipated in the second quarter,” because of reduced backlogs in rig systems and more projects approaching completion, CFO Jose Bayardo said during the conference call. “However, the falloff in revenue was stronger than expected as customers who lack contracts or face pressures from operators to delay projects do what they can to defer deliveries…For the third straight quarter, we received no new rig orders. Near-term demand for offshore remains almost nonexistent outside of replacement equipment” and no orders are expected to materialize for special items this year.

“The land markets appear much more promising, as conversations with customers in North America, the Middle East and certain other international markets are increasing regarding equipment upgrades and new field opportunities,” Bayardo said. “More and more, operators are demanding modern, pad optimal, Tier 1 alternating current rigs for potential upcoming projects, and contractors are seeking to upgrade and expand their capabilities in order to position themselves to capture incremental market opportunities.”

Offshore opportunities are expected to remain “limited for the foreseeable future,” but “we believe our land business will bottom in 3Q2016 and begin to recover as we enter 2017.”

One issue will be rebuilding the workforce, Williams told analysts.

“Labor will be a challenge, certainly. Obviously, this is a very painful time for this industry and for this company to lose so many talented people. Attracting those folks back…and grow with us is going to be challenged. But look, this is nothing new in the oilfield. This is a cyclical business…One of the critical skillsets you’ve got to have is the ability to reduce quickly in markets like this, but also the ability to grow quickly when it goes the other way. So frankly, we’re looking forward to solving the challenges that the upturn are going to bring us.”

In NOV’s rig aftermarket business, revenues were $364 million, off 45% from a year ago and down 7% sequentially, while operating profit was $62 million, or 17% of sales. Wellbore technologies generated revenues of $511 million, down 47% from 2Q2015 and 19% from the first quarter, and it recorded an operating loss of $146 million, or 28.6% of sales.

Completion and production (C&P) solutions revenues were down 38% year/year and 4% sequentially to $538 million. Operating losses totaled $33 million, or 6.1% of sales. The backlog for capital equipment orders for C&P was $947 million, a 20% decline from a year ago and 5% lower than in the first quarter. Revenues out of backlog were $333 million. New orders totaled $269 million, achieving a book-to-bill of 81%.

For a full listing of 2Q 2016 industry earnings calls, including links to NGI coverage, see NGI2Q16 Earnings Call PDF.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |