Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

Kinder Delays 2 Bcf/d Permian Highway Pipeline to Early 2021; GCX Running Full

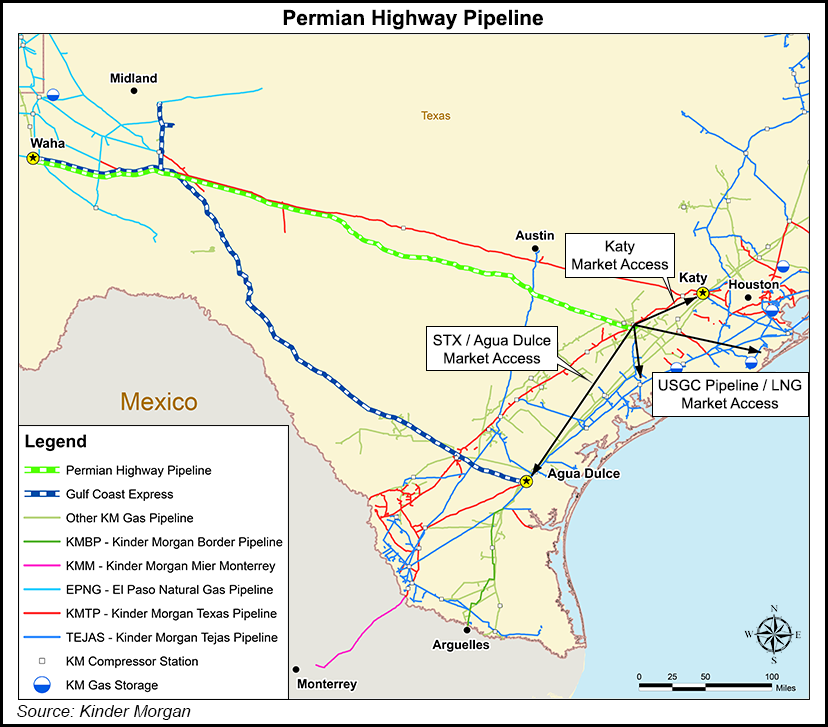

Start-up for the 2 Bcf/d Permian Highway Pipeline (PHP), the next major project backed by Kinder Morgan Inc. (KMI) aimed at uncorking associated natural gas flowing out of the Waha hub in West Texas, will slip to early 2021 from late 2020, management revealed late Wednesday.

PHP is “progressing well,” and KMI has acquired about 85% of the right-of-way for the project, but the regulatory approval process “has progressed a little more slowly than what our project plan contemplated,” CEO Steven Kean said during a conference call to discuss the 3Q2019 financial results.

“That means in order to do efficient construction, we’ll kick off the construction a little bit later, and that means instead of a 4Q2020 in-service, we currently anticipate early 2021.”

PHP, a joint venture of Kinder Morgan Texas Pipeline and EagleClaw Midstream Ventures, is fully subscribed and would run roughly 430 miles to deliver West Texas gas to markets on the Gulf Coast and to Mexico.

PHP, not subject to the Federal Energy Regulatory Commission review process that similarly sized interstate projects might undergo, received a favorable ruling in Travis County District Court in June. The pipeline has encountered local pushback, particularly in the iconic Hill Country, and some landowners and environmental groups are seeking to sue under the Endangered Species Act (ESA).

This summer, commissioners in Hays County joined the Travis Audubon Society and three private plaintiffs in filing a notice of intent (NOI) to sue KMI, the U.S. Army Corps of Engineers and the U.S. Fish and Wildlife Service. Under the ESA, plaintiffs must wait for 60 days to file a lawsuit after filing an NOI.

On Wednesday, lawyers representing the cities of Austin, San Marcos and Kyle, as well as other groups, filed an NOI, claiming “many federally endangered and threatened species (as well as essential habitat for those species)” fall “within the vicinity” of PHP’s proposed route, “including birds, salamanders and aquifer-based species.”

At a minimum, according to the NOI, KMI should obtain an incidental take permit under the ESA and develop a habitat conservation plan before moving forward with construction.

News of the PHP delay might feel like a case of the Texas two-step — one step forward and two steps back — for Permian producers operating in a basin where associated gas output has outstripped the available takeaway capacity.

KMI placed its Gulf Coast Express (GCX) project, another 2 Bcf/d pipeline designed to tap Permian gas, into service last month, ahead of schedule. That project has given Permian gas sellers, which faced sustained negative pricing in the spot market earlier this year, a little bit of room to stretch their legs, but all indications are that even more takeaway will be required to meet the demand.

Case in point, GCX is at full capacity, according to Kean.

“We need another one,” he said. “The market needs another one.”

KMI is also working on a third 2 Bcf/d Permian takeaway pipeline, Permian Pass, which has not yet made it into the company’s backlog, management said.

“Since we reported on this on the second quarter call, the commercial activity has slowed, but it continues,” Kean said. “It slowed as a result of some producer retrenchment in their Permian activities. We believe the pipeline is needed, but it may not be needed quite as soon as we were expecting three months ago.”

According to analysts at Tudor, Pickering, Holt & Co. (TPH), the PHP delay should further tighten an “already tight U.S. natural gas supply/demand balance” in the second half of 2020, thus serving as an “incremental positive for the gas market, particularly through winter 2020/21.

“…Prior to the announcement, we were already expecting the market to move toward marginal undersupply through 2Q2020 and 3Q2020, exiting the year with inventories at 3.34 Tcf, or a 3% surplus to the five-year average,” TPH said.

“Modeling in the delay, our revised base forecast sees incremental tightening, with the undersupply persisting through 4Q2020, driving exit inventories to 3.26 Tcf (1% above five-year norms) as the delay amounts to an incremental 72 Bcf draw versus prior estimates.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |