Hurricane Barry Impact Aside, U.S. Crude Oil Production Increasing, Says EIA

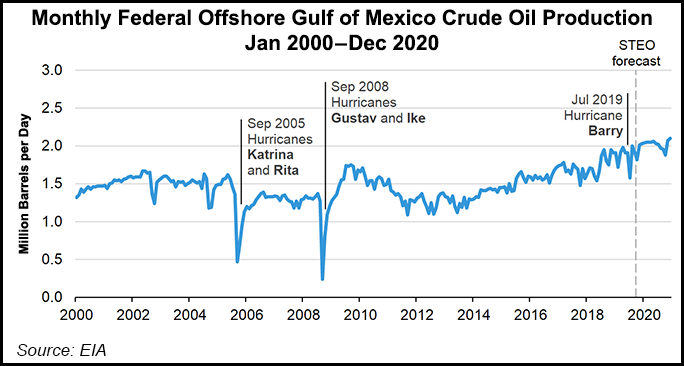

Hurricane Barry took a 276,000 b/d bite out of U.S. crude oil production in July, the largest decline in monthly production in more than a decade, but that decline was temporary and geographically isolated to the Federal Offshore Gulf of Mexico (GOM), according to the Energy Information Administration, which expects production to increase through the end of the year.

Crude oil production in the GOM fell by 332,000 b/d in mid-July as 283 offshore oil and gas production platforms were evacuated in anticipation of Hurricane Barry. The Bureau of Safety and Environmental Enforcement said about 70% of GOM crude oil production was shut in at the peak of the disruption. At the same time, crude oil production from the rest of the United States rose by a combined 56,000 b/d in July.

EIA expects crude oil production to increase in each remaining month of 2019, reaching 13 million b/d in December, according to the agency’s latest Short-Term Energy Outlook (STEO), which was released Tuesday. Domestic production is expected to average 12.3 million b/d in 2019 and 13.2 million b/d in 2020.

The U.S. onshore continues to lose rigs, too, with five sidelined in the week ended Oct. 4, including three oil-directed rigs, according to data from Baker Hughes, a GE Company (BHGE). The U.S. rig count, in a steady decline since April, now lags its year-ago total by nearly 200 units, BHGE data show. The GOM rig count remained steady at 22 rigs.

While the oil rig count has fallen dramatically in the U.S. onshore over the past year, domestic oil exports have climbed to record levels. U.S. oil exports this year through June averaged 2.9 million b/d, up 966,000 b/d from the first half of 2018, according to EIA. What’s more, exports set a record high monthly average at 3.2 million b/d for June, according to the agency.

“Historically, many of the largest monthly declines in U.S. crude oil production were the result of hurricanes,” EIA said. “Hurricanes Gustav and Ike led to crude oil production falling by more than 1 million b/d in September 2008. Hurricanes Katrina and Rita led to a similar month-on-month decline in September 2005.

“By comparison, Hurricane Barry’s disruption occurred relatively early in the hurricane season and had less of an effect on total U.S. crude oil production. As onshore U.S. crude oil production has grown, the Gulf of Mexico’s share of the national total has fallen from a high of 29% in 2009 to 16% in 2018.”

Also in the STEO, EIA said that the strong supply growth that enabled natural gas inventories to build faster than average during the April-October injection season forced prices down during 2019, and is expected to limit them to an average $2.52/MMBtu in 2020. That price forecast is down 3 cents from EIA’s previous STEO.

“The Henry Hub natural gas spot price averaged $2.56/MMBtu in September, up 34 cents/MMBtu from August, which was the first monthly price increase since March,” EIA said. Still, prices are expected to average $2.43/MMBtu in 4Q2019, a decrease of more than $1.00/MMBtu compared with 4Q2018.

EIA reported a 112 Bcf injection into storage for the week ending Sept. 27, which trimmed the deficit to the five-year average to only 18 Bcf. Total Lower 48 storage stood at 3,317 Bcf, compared with the five-year average of 3,335 Bcf and the year-ago total of 2,852 Bcf. EIA is forecasting storage levels will total 3,792 Bcf by the end of October, which would be 2% above the five-year average and 17% above October 2018 levels.

“Natural gas storage injections in the United States have outpaced the previous five-year average so far during the 2019 injection season as a result of rising natural gas production,” EIA said.

Dry natural gas production is expected to remain strong, reaching an average 91.6 Bcf/d for 2019, a 10% increase from the 2018 average. However, production growth has been slowing in the United States, EIA said.

“The year-on-year increase of 7.0 Bcf/d in September is down from the year-on-year increase of 10.8 Bcf/d in January 2019. EIA expects U.S. natural gas production to slow further in the coming quarters as the lagged effect of falling prices through much of 2019 reduces natural gas-directed drilling. EIA forecasts dry natural gas production to be relatively flat from December 2019 through December 2020.”

The front-month natural gas futures contract for delivery at Henry Hub settled at $2.33/MMBtu on Oct. 3, a decrease of 3 cents from Sept. 3.

“Natural gas futures prices increased through the first half of September, reaching the highest level in five months on September 16. In September 2019, total natural gas consumption as well as natural gas consumption for power generation established new monthly records, which provided some support for futures prices. U.S. cooling degree days were 27% higher than normal in September, contributing to the increased natural gas consumption for power generation,” EIA said.

The number of futures short positions between Aug. 13 and Sept. 17 that money managers reported holding for New York Mercantile Exchange gas contracts declined by 44%, and money managers held the largest short position on Aug. 13 since Mar. 8, 2016, according to EIA.

“Money managers increased their short positions through the summer concurrently with declining natural gas prices, which reached their lowest level in more than three years on Aug. 5, 2019. Prices then began increasing and rose to their highest level in five months by the middle of September. The higher prices encouraged many money managers to purchase offsetting contracts to get out of their short positions, which may have contributed to some of the increase in futures prices during this time,” EIA said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |