Markets | LNG | LNG Insight | NGI All News Access | NGI The Weekly Gas Market Report

Pakistan Moves Closer to Five More LNG Import Projects

Pakistan selected several groups of companies last week to build five new liquefied natural gas (LNG) import terminals in the country.

The groups include Tabeer Energy, a unit of Tokyo-based Mitsubishi Corp., oil major ExxonMobil Corp. and UK-based Energas; Trafigura Group and Pakistan GasPort; Royal Dutch Shell plc (the world’s largest buyer and seller of LNG) and Engro Corp; as well as Gunvor Group and Fatima.

Pakistan’s minister of power and petroleum Ayub Khan said the terminals could be operational within two or three years, but no details were given on whether or not the companies have reached final investment decisions. Liquefaction capacity of the proposed projects has also not been given. However, they “could triple the country’s current capacity and make a significant dent in the gas shortage,” Khan said.

Pakistan currently has two operational LNG import terminals with a combined total capacity of 1.2 Bcf/d. A third terminal is slated to become operational next year, adding another 600 MMcf/d of capacity. “Pakistan has sought bids for a 10-year LNG supply tender for the current terminals and the results will be announced in two to three weeks,” Khan said.

The cost of building the terminals and finding buyers for the gas will be up to the groups, and they will pay the Pakistani government a royalty based on gas volume, he said.

“The groups of companies are now required to submit technical and financial details to the government by Nov. 5, in addition to a $2 million concession fee,” Pakistan’s minister for maritime affairs Ali Zaidi said. The groups will pay an additional $8 million on the signing of implementation agreements.

“It’s a great opportunity for private investors to set up their own terminals, import their own gas and develop their own markets,’’ Zaidi said. “The groups of operators will also be required to pay a royalty of $1.90 per ton. Additionally, they will also be required to disclose if they’re being investigated by any government authority.”

Pakistan’s announcement comes amid a turbulent time for the country’s energy sector. In August, Pakistan’s anti-graft agency, the National Accountability Bureau (NAB), arrested former finance minister Miftah Ismail in Islamabad for alleged corruption in giving an LNG contract.

Sheikh Imran ul Haque, the former head of state-owned fuel retailer Pakistan State Oil Ltd, was also arrested in the same case. Earlier this month, the NAB arrested a businessman, Iqbal Zaid Ahmed, in its ongoing LNG fraud case. The arrests are part of Pakistani Prime Minister Imran Khan’s crackdown on political and business leaders allegedly involved in corruption.

Referring to the ongoing LNG corruption case, Khan said the interest of five investment groups speaks for itself. “That is a ringing endorsement that [Pakistan’s] policies are clear and transparent,” he said. “It’s a competitive market.”

Pakistan must secure energy in order to reduce power blackouts and outages that have hindered economic growth, and LNG imports provide an appealing opportunity. As such, the country’s ambitions to procure LNG is encountering headwinds from not only the ongoing corruption scandal, but the government is facing a mounting debt problem and dwindling foreign reserves, all making it harder to pay for necessary imports.

Last week, the International Monetary Fund (IMF) approved a $6 billion financial bailout for Pakistan. The IMF said that large deficits in the country in the past, the high cost to buy a Pakistani rupee, and lack of reforms have undermined the growth of the cash-strapped economy. Pakistan has also been stepping up efforts to raise funds from several Arab nations as well as China.

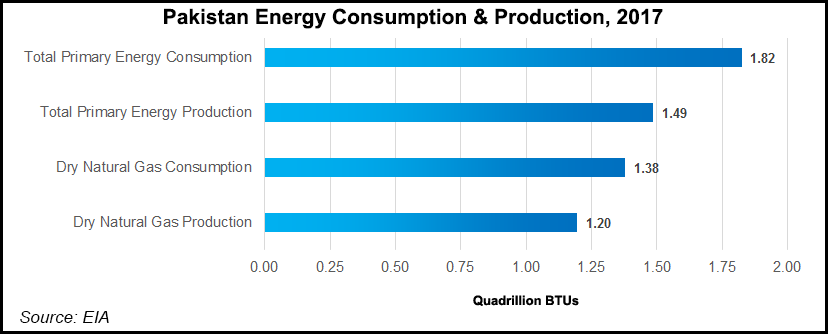

Pakistan holds considerable natural gas reserves, around 105 Tcf, according to U.S. Energy Information Administration data. But companies in the country face significant challenges to develop these resources because of complex geography, environmental constraints and low natural gas prices in Pakistan, which have been subsidized by the government for years.

However, the government increased the cost of gas in the country by 200% this summer as the IMF was considering its loan package. The government said the gas price increase would help ease a deficit of over $1 billion at the state-owned natural gas suppliers Sui Northern and Sui Southern, both burning cash and subsidizing consumers and industries.

Another restraint for Pakistan’s gas development is that it still does not have the infrastructure in place to adequately connect supply with demand. In effect, the country needs to coordinate the timing of the investments for pipelines and future LNG regasification terminals with the growth of supplies.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |