Bakken Shale | E&P | NGI All News Access

Midcontinent E&Ps Zeroing In on Bakken, Oilier Parts of Oklahoma

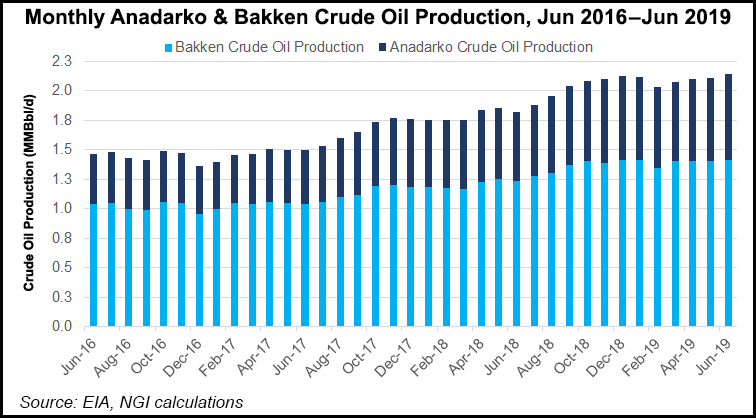

Oil and natural gas producers with assets across the Midcontinent are tailoring capital spending to the Bakken Shale in North Dakota, as well as parts of the Anadarko Basin in Oklahoma that are higher in oil content.

An ability to market oil in the two formations in international markets could close the gap between West Texas Intermediate crude pricing and Brent crude, said Continental Resources Inc. CEO Harold Hamm at a recent conference.

“We have better oil,” said Hamm at the Enercom conference in Colorado.

Amid volatile commodity prices, the Midcontinent operators are honing in on assets with lower breakeven prices and higher oil cuts.

Continental added $55 million to its capital expenditure (capex) guidance for the remainder of 2019 because of additional oily assets acquired in the South Central Oklahoma Oil Province (SCOOP). Continental divested some water handling assets and acquired SCOOP assets as part of its 2019 capex plan.

Marathon Oil Corp. management also said during its second quarter conference call that it was directing its Oklahoma focus to the SCOOP, citing the Springer formation in particular.

“Over the second half of the year, our Oklahoma activity will be overwhelmingly concentrated in the oilier areas of the plain,” said Marathon Oil CEO Lee Tillman. Marathon has been been building on that strategy since last year.

Marathon’s well mix in the SCOOP could allow it to further expand its oil cut, which would be a key metric in the second half of the year.

In Oklahoma, Marathon Oil has “a well mix that is going to allow us to drive a little bit more oil cut,” said Tillman. Acreage like the Bakken, to some extent, has an oil cut that “is relatively fixed regardless of the well mix.”

The migration of operators to parts of the SCOOP is accompanied by others reining in capex from the more gassy Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties, aka the STACK.

Devon Energy Corp. CEO Dave Hager said during the quarterly conference call the Oklahoma City-based independent plans to redistribute capital previously reserved for Oklahoma to the Permian Basin’s Delaware sub-basin and to the Powder River Basin. Encana Corp. also reported in its 2Q2019 earnings results that it had “level loaded” its STACK activity, once a key part of Newfield Exploration Co., which it has since acquired.

Ramping up in the SCOOP and tapering down in the STACK is part of a broader chase for higher oil cuts, summed up by Chesapeake Energy Corp. “We expect to allocate more capital to oil growth areas with less capital going towards our gas assets,” said CEO Doug Lawler. “We project our 2020 oil volumes will show double-digit percentage growth over 2019 while our gas volumes will show a double-digit percentage decline.”

“The Bakken is seeing a bit of a growth revival, as operators are increasing their plans,” said NGI’s Patrick Rau, director of strategy and research. Crude, gas and natural gas liquids (NGL) infrastructure is expanding in the Bakken to accommodate production growth.

Dallas-based Energy Transfer LP’s (ETP) recently held an open season for Dakota Access Pipeline (DAPL), which has the potential to boost the current capacity of 570,000 b/d to 1.1 million b/d, Rau noted.

DAPL has faced dogged opposition from the Standing Rock Sioux Tribe, which sought another court remedy in August.

“All the extra production could create demand for a new pipeline in two-to-four years,” he said, citing the 2Q2019 earnings calls for Oneok Inc. and updates on the Bison Pipeline by TC Energy Corp.

TC Energy’s management team said earlier this year it was considering reversing the flow of the 477 MMcf/d Bison, which moves gas from Gillette, WY, across the southeastern corner of Montana and into southwestern North Dakota where it interconnects with Northern Border Pipeline Co. Bison secured customer agreements in 2018 to pay out its future contracted revenues and terminate some contracts, which could help pave the way for a reversal.

Oneok should bring its much ballyhooed Elk Creek NGL pipeline fully into service in the fourth quarter, with current shipments already underway at 30,000 b/d, management said in its second quarter call.

“This has also freed up rail capacity, which can be used to address continued NGL growth in the Williston Basin until Elk Creek is fully in service in the fourth quarter,” said Oneok COO Kevin Burdick.

Oil and natural gas production in North Dakota both reached new output highs during June, according to the latest data from the state’s Department of Mineral Resources (DMR). June crude production reached 1.42 million b/d, up by roughly 2% from May and by 16% year/year. Gas production, mostly associated with crude production, reached 2.88 Bcf/d, also up by 2% on the month and by 25% on the year.

Despite impressive production growth amid capital discipline, Bakken production is complicated by North Dakota’s mandates to reduce gas flaring. The state only allows 12% of produced gas to be flared. Statewide gas capture performance in June rang it at 76%, according to the DMR.

The Elk Creek pipeline should help reduce the processing bottleneck that contributes to flaring, alongside other plant expansions, but only temporarily. Until then, producers are forced to wrestle with production curtailments to try and limit gas flaring.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |