Regulatory | NGI All News Access | NGI The Weekly Gas Market Report

To Avoid Penalties, Mexico Natural Gas Shippers Must Adapt to New Rules

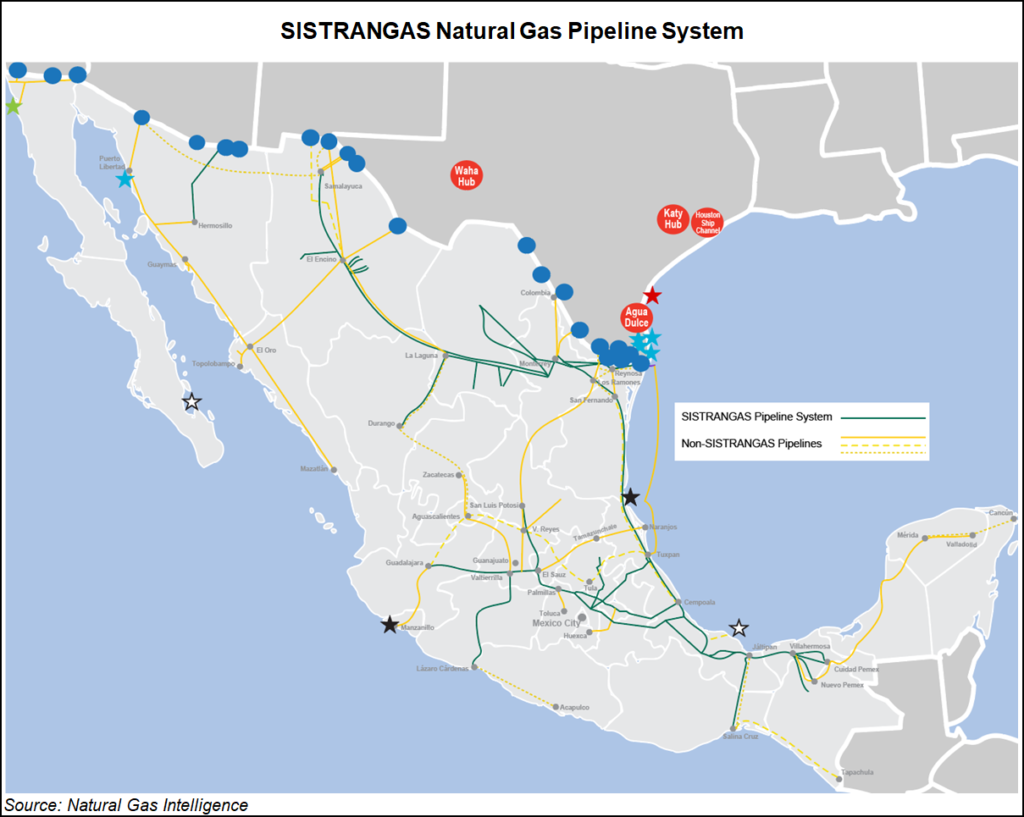

Natural gas shippers in Mexico will need to tighten up their operations to avoid penalties under newly approved rules governing the Sistrangas national pipeline network, according to Talanza Energy Consulting’s David Rosales.

The rules, authored by Sistrangas operator Centro Nacional de Control del Gas Natural (Cenagas) and approved by the Comisión Reguladora de EnergÃa (CRE), are meant to ensure “operational discipline” on the system and reduce losses incurred by Cenagas.

The rules allow Cenagas to identify with greater precision which users are causing system imbalances, either by consuming more gas than they’ve requested, or injecting less gas into the system than they committed.

Since large-scale natural gas storage is not yet a reality in Mexico, Cenagas must correct system imbalances by purchasing liquefied natural gas (LNG) via the Altamira and Manzanillo regasification terminals, and injecting it into the Sistrangas.

Under the new rules, if a user causes a system imbalance great enough to require an injection of LNG, the user must reimburse Cenagas at LNG cost, which is higher than the price of gas produced in Mexico or imported by pipeline from the United States.

Under the previous rules, the user could reimburse Cenagas by simply injecting the amount of gas equal to what that the user had overdrawn or under-injected.

To minimize their exposure to cash penalties under the new framework, users will need to stabilize their consumption as much as possible, Rosales told NGI’s Mexico GPI.

The challenge, he said, is that Cenagas often does not reveal how much gas it has confirmed for a given user on a given flow day until two or three days after that day has passed.

In other words, users have no way of knowing whether they have exceeded their allotted consumption until after the fact, Rosales said, making it “impossible to react.”

“This is an issue that is still pending,” Rosales said, explaining that he would have liked the new rules to mandate same-day confirmations by Cenagas of gas volumes requested by users.

“Then you can lower your consumption a bit,” Rosales said. “You can correct something.”

But without this stipulation, the new rules lack the proverbial carrot for users, Rosales said, instead treating them “only with the stick.”

To mitigate this risk, he said, users may want to request slightly more gas than they expect to use, at least in the beginning, since penalties for under-consumption are less severe than those for over-consumption.

Users also must learn to recognize the variables published by Cenagas, namely line pack and pressure, that will impact them, Rosales said.

All users will need to have personnel dedicated to monitoring their consumption and identifying system conditions, “with capacity to react and to make intraday purchases when necessary,” Rosales said, adding that users may want to line up suppliers of complementary services such as park and loan (PAL) to mitigate these risks.

The new rules present an opportunity for firms that can provide these services, as well as those who can provide in-line metering technology.

In the resolution approving the new rules, CRE mandated that Cenagas must guarantee by February 19, 2020, that all system users have access to meters in order to determine their injections and extractions in real time.

Rosales said that the new rules include steps in the right direction, such as incentivizing more meters, and a more accurate, precise, and transparent methodology for calculating and assigning the costs of LNG.

However, he said, authorities have yet to properly address the root causes of the chronic system imbalances, namely delayed midstream infrastructure projects and declining domestic gas production.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |