Infrastructure | LNG | NGI All News Access | NGI The Weekly Gas Market Report

Freeport LNG Delays First Cargo to Late August After Gasket Failure

After a recent mechanical issue, the Freeport liquefied natural gas (LNG) terminal on Quintana Island off the upper Texas coast now expects to ship its first export cargo late this month, the company said Friday.

Efforts to wrap up commissioning work on the terminal’s first liquefaction train were complicated this past Tuesday when a flange gasket failed, spokesperson Heather Browne told NGI.

“The failure resulted in the release of a small amount of refrigerant to the atmosphere. No injuries occurred, and the community was not impacted,” Browne said. “Repair work on the failed flange gasket is progressing. Freeport LNG now anticipates first cargo to be loaded in late August.”

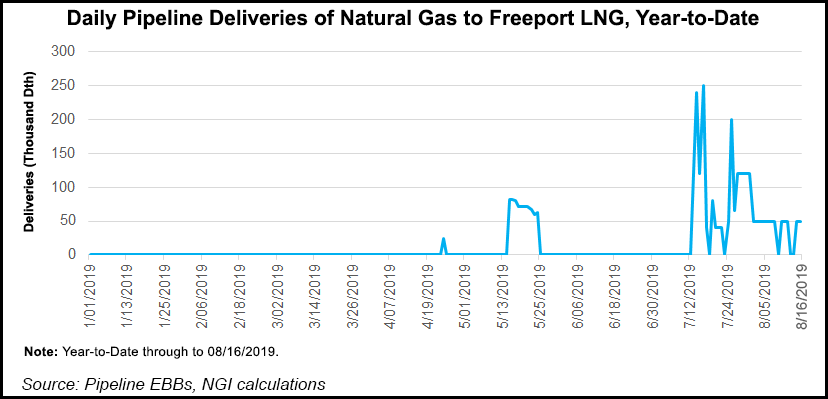

According to NGI estimates, the Freeport terminal received 50,000 Dth in deliveries on Friday.

Freeport LNG is designed to export around 15 million metric tons per year (mmty) through its first three trains, with a fourth train under development.

Meanwhile, Houston-based NextDecade Corp. has pushed back the timeline for a final investment decision (FID) on its Rio Grande LNG export terminal proposed for the Port of Brownsville in far South Texas.

In a recent investor presentation, NextDecade said it expects to make a FID on the proposed 27 mmty facility during 4Q2019, with the second half of the year focused on completing commercial contracts to support up to three trains. That represents a slight delay from the previous target of a September decision.

Management expects a final FERC order for the project by the end of September, and if all goes to plan, the company is targeting 2023 to start commercial operations.

NextDecade in April announced a long-term deal for Rio Grande LNG to supply 2 mmty to a Royal Dutch Shell plc subsidiary.

As envisioned, the export terminal would entail six liquefaction trains, each with a nominal capacity of 4.5 mmty, four LNG tanks (each with a capacity of 180,000 cubic meters), two marine jetties for ocean-going LNG vessels (with capacities of 125,000-185,000 cubic meters), one turning basin, as well as four LNG and two natural gas liquids truck-loading bays.

Like fellow next-wave U.S. LNG export developer Tellurian Inc., NextDecade projects significant growth in global gas demand over the next several years, telling investors it expects demand to outstrip supply by up to 150 mmty by 2025.

“Two-thirds of this shortfall will be served by North American sources of LNG, primarily U.S. Gulf Coast projects including Rio Grande LNG,” NextDecade management said.

As Tellurian CEO Meg Gentle alluded to during a podcast to review 2Q2019 financial results, recent supply growth has put downward pressure on near-term global LNG prices. She expects the “inflection point” for prices to come this winter or in 2020.

Potentially complicating matters further for next-wave developers are the retaliatory tariffs China has placed on U.S. LNG exports. Moody’s Investors Service warned earlier this year that tariffs “could slow development of incremental LNG export facilities, because any reluctance on the part of Chinese energy companies to contract with U.S. exporters as a result of higher costs will reduce the number of global counterparties seeking additional U.S. capacity.”

As evidenced by recent volatility in the stock market, trade tensions between Washington and Beijing continue to fuel economic uncertainty.

Elsewhere in the LNG world, BP plc has published a master sales and purchase template for LNG contracts, claiming it is the first major oil and gas business to do so. The master sale agreement (MSA) template allows either party to buy or sell physical LNG cargoes on a free on board, or FOB, basis.

Because it is a “major LNG portfolio player,” BP said it developed the FOB MSA to be “both a balanced and fair transaction route between buyers and sellers.”

The FOB MSA follows BP’s publication in April of a delivered ex-ship (DES) MSA template, which allows either party to buy or sell physical LNG cargoes on a DES basis.

“BP publishing the DES MSA helped simplify industry processes,” said BP’s Jonty Shepard, head of LNG for Supply and Trading. “We hope the publication of the FOB MSA will build on that momentum as the LNG industry looks for opportunities to drive greater standardization.”

Both publications are designed to inform the “broader discussion around standardization and liquidity in LNG markets.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |