NGI The Weekly Gas Market Report

Markets | Forward Look | NGI All News Access

More Losses for Natural Gas Forwards as Unimpressive Summer Heat Wanes

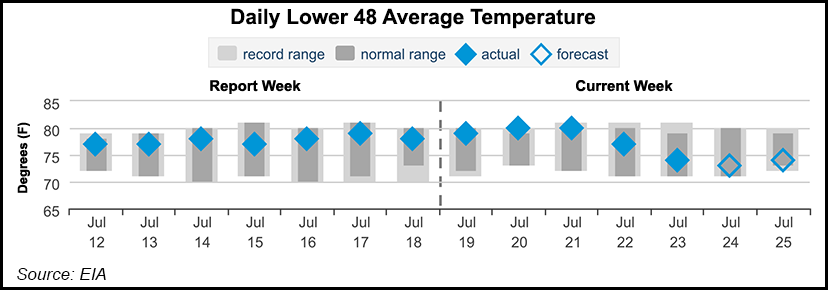

With the core of summer quickly winding down, natural gas forward prices continued to decline during the July 19-24 period as an intense heat wave that had blanketed the U.S. Northeast earlier in the week moved out of the region. August prices shed 6 cents on average, as did balance-of-summer (August-October) prices, according to NGI’s Forward Look. The prompt winter was down an average 7 cents, while next summer (April-October) was down just 3 cents on average.

The downward spiral comes on the heels of a dramatic move lower the previous week, when most U.S. markets posted double-digit losses across the front of the curve. At the core of the recent drop-offs is summer weather that has yet to prove intimidating enough to stand up to continued production growth.

Weather data overnight Wednesday didn’t move much in terms of projected gas-weighted degree day (GWDD) totals over the next couple of weeks. However, the upper level pattern in the 11- to 15-day outlook looks weaker, raising concern that the models are too warm based on the depiction of another upper level trough moving through the eastern half of the nation, according to Bespoke Weather Services. As a result, the firm adjusted its 11- to 15-day forecast cooler.

“Total forecast GWDDs remain above normal overall when totaled up over the next 15 days, but again, the 11- to 15-day pattern poses additional cooler risks,” Bespoke chief meteorologist Brian Lovern said. “Our long-term weather view remains the same, that the pattern’s bias overall for the balance of summer is to the hotter side amidst any variability mixing in, but we need to make sure this 11- to 15-day cooler shift is just another short window of cooling before going back hotter than normal once again, so confidence is a little lower today.”

Radiant Solutions also had lower confidence on the diverging solutions upstream over the eastern Pacific. Models early Thursday were favorable to a trough settling over the East, and while on its own could offer additional cool risk, the forecast takes a conservative approach with normals from the Midwest toward the East given the general warm forcing associated with the global wind pattern.

As for risks to the 11- to 15-day outlooks, “cooler risks are from the Midwest toward the East, where the Global Forecast System model projects a deeper trough. However, the South could turn hotter per pattern correlations associated with the negative North Atlantic Oscillation,” Radiant said.

Given the uncertainty over returning heat, Nymex futures prices settled most days between July 19 and 24 in the red. The August contract ended Wednesday at $2.22, the balance of summer hit $2.216 and the winter 2019-2020 strip reached $2.517.

“With cash prices already in the low $2.20s at a time when natural gas prices often are at seasonal peaks, steep further declines are possible before summer ends,” EBW Analytics said.

Early indicators for weather later in August illustrate the likelihood of above-normal warmth along both coasts and temperatures in line with 30-year normals across gas-intensive Texas and in the South Central region, according to EBW. Weather forecast DTN’s Week 4 preview forecasts 80.0 cooling degree days (CDD) for the Energy Information Administration (EIA) storage week ending Aug. 15, which is 7.7 CDDs above normal but a week/week decline of 8.5 CDDs relative to Week 3.

Forecasts risks are relatively balanced, with chances for the central United States to warm and carry the forecast in a bullish direction largely offset by the risks of a hurricane bringing cooling rains to the Gulf and Atlantic Coasts, according to EBW.

“Absent a strong bullish weather signal, shorts are likely to remain in control of Nymex natural gas as spot market demand wanes seasonally and bearish market catalysts await in the fall,” the firm said.

Indeed, Thursday’s price action reflected little hope for bulls to stage any meaningful comeback as Nymex futures fluctuated in a tight, less than 5-cent range throughout the session. After starting off the day a penny higher, August prices dropped as low as $2.222 before going on to settle at $2.242, up 2.4 cents. September rose 2.5 cents to $2.225.

The modest gain occurred as the latest EIA storage report fell in line with market expectations, even while coming in below the five-year average. The EIA reported a 36 Bcf injection for the week ending July 19, which compares with last year’s 27 Bcf injection and the 44 Bcf five-year average build.

Prior to Thursday’s report, estimates had been pointing to an injection in line with the actual figure, although several analysts had projected a build in the low 40s Bcf. A Bloomberg survey had showed a median 37 Bcf, while Intercontinental Exchange futures had settled at 35 Bcf. NGI’s model predicted a 33 Bcf injection.

By region, the Midwest injected 23 Bcf, while the East reported a 14 Bcf injection. Farther west, the Mountain region refilled 4 Bcf, and the Pacific grew its inventories by 3 Bcf. In the South Central, a 17 Bcf withdrawal from salt stocks was partially offset by a 9 Bcf injection into nonsalt, EIA data show.

The South Central was the one region market analysts on Enelyst, an energy chat room hosted by The Desk, had been eyeing given strong wind production in Texas during the reporting week. Several analysts had pegged a much smaller draw of around 10-11 Bcf in salt facilities, while others called for an even stronger pull of more than 20 Bcf.

Regardless, the overall storage report was viewed as neutral, according to Bespoke, “doing very little to move the needle in terms of end-of-season projections”, especially having been lower than it may have been had there been no Hurricane Barry-induced shut-ins.

Looking ahead, NatGasWeather said the market will facing a return to above-average storage injections next week thanks to the mild set-up across the eastern half of the country this week.

Permian Basin prices have been hammered for months as a lack of takeaway capacity out of the region has stranded robust associated gas supply. But forward curves offered a glimmer of hope that a rebound was imminent after Kinder Morgan Inc. (KMI) confirmed last week that its Gulf Coast Express (GCX) Pipeline would enter service by late September.

Rumors had been circulating for months that the 2 Bcf/d pipeline would go online earlier than its scheduled October start date, with aerial observations by Genscape Inc. indicated an early start.

Waha cash prices had curiously strengthened by $1.20 from July 8-15, which the firm attributed to packing of the GCX line. This idea had been validated by the firm’s aerial observations, infrared monitoring of compression and, ultimately, KMI in its latest earnings call.

“We have conducted aerial flight analysis over the past several months that indicated pipeline construction was proceeding ahead of schedule,” Genscape analyst Colette Breshears said. “Recently, our proprietary infrared monitors at the Waha Header System indicated several compression units had been activated. While this location is shared with three pipelines that export to Mexico, we saw no increases in flows to Mexico on these systems, suggesting compression was needed because the demand on free-flowing gas (either for the Mexico pipes or GCX) exceeded field pressures.”

The increased consumption of Waha-area gas for Waha Header pressurization before and during GCX linepack correlates well with the change in general cash price dynamics between the Waha and El Paso-Permian hubs, according to Genscape. Waha cash traded similarly to below Permian cash for most of June, but on July 5, overtook El Paso-Permian and has stayed above ever since.

“This relationship shows a strength of demand specifically at Waha versus the larger Permian area, which supports heavy GCX linepacking activities between July 11-15, when Waha cash prices peaked,” Breshears said.

Meanwhile, KMI management said that full GCX in-service was expected as early as Sept. 21, but declined to confirm firm plans or volumes for early service on GCX. Executives, however, indicated they would “be delivering what gas we can deliver” through the new pipeline until full operations commence.

The expected increase in outbound capacity tightened forward basis prices at Waha, with September basis climbing a nickel between July 19-25 to reach minus $1.023, according to Forward Look. For comparison, August basis slipped 3 cents to minus $1.464.

Fixed prices for August settled Wednesday at 75.6 cents, while September hit $1.179. The balance of summer hit $1.14 and the winter landed at $1.79.

Over in California, forward prices moved opposite of most other U.S. markets, surging on the news that the return of Line 235, expected to occur last Sunday, was being postponed for the seventh time in seven months.

After news of the postponement broke Tuesday, SoCal Border Avg. prices for August shot up about 6 cents day/day, with smaller gains seen through the front of the curve. For comparison, the Nymex Henry Hub contract settled Tuesday about a penny lower.

Over the entire July 19-24 period, August fixed prices jumped 19 cents to $2.661, and the balance of summer climbed 9 cents to $2.31. The winter strip, meanwhile, fell 6 cents to $2.65, Forward Look data show.

No change in actual firm import capacity is expected when this line returns, because Southern California Gas (SoCalGas) is expected to take down the adjacent L4000 for additional tests, according to Genscape.

“The earliest date when increased flows might occur is now Oct. 18,” Genscape analyst Joe Bernardi said. “This date was also pushed back with this most recent maintenance delay, as actual flows were previously expected to increase at the end of August.”

Despite the price increases seen this week, there is downside risk ahead for Southern California prices as new withdrawal rules have been enacted for SoCalGas’ Aliso Canyon storage facility, representing a significant change in the region’s supply picture.

The California Public Utility Commission (CPUC) announced Tuesday that a revised Aliso Canyon Withdrawal Protocol would go into effect immediately, substantially lowering the barrier to withdrawals from that facility. The previous protocol, enacted in November 2017, described Aliso as an “asset of last resort.” That language is absent from the new protocol.

The CPUC expects that more flexibility to withdraw from Aliso will increase inventories at SoCalGas’ other three storage fields and help prevent price volatility. The Commission is conducting a separate proceeding “to determine the feasibility of minimizing or eliminating the use of” Aliso Canyon by modeling price and reliability scenarios from 2020 through 2030.

“The results of that study were initially expected in February 2019 but were postponed earlier this year to a publication date of August 2020,” Bernardi said.

The supply picture over in the Pacific Northwest also was expected to improve soon. A new maintenance calendar posted this week by Westcoast Transmission shows southbound flows beginning to ramp up during late August, earlier than previously expected.

Station 4B southbound flows are currently limited to just under 900 MMcf/d for hydrostatic testing following the explosion that occurred last October near Prince George, British Columbia.

“This current restriction represents a considerable cut versus normal flow, roughly 500 MMcf/d below the previous four-year average,” Bernardi said.

Flows were expected to remain in the 850-1,000 MMcf/d range through the end of August, but the most recent calendar posted by Westcoast shows expected flows at the end of August ramping up as high as 1,293 MMcf/d. The 200-300 MMcf/d increase versus previous expectations begins on Aug. 23.

Northwest Sumas forward prices barely budged, however. August prices rose a penny from July 19-24 to reach $2.177, while September slipped a penny to $1.786, according to Forward Look. The rest of the curve also posted modest losses of only a few cents at best.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 | ISSN © 1532-1266 |