E&P | NGI All News Access | NGI The Weekly Gas Market Report

Contracts Awarded Under Mexico Energy Reform Showing Steady Output Growth

Although Mexican president Andrés Manuel López Obrador has said the country’s 2013 constitutional energy reform failed to bring new investment and production to the local oil and gas industry, figures published last week by upstream hydrocarbons regulator Comisión Nacional de Hidrocarburos (CNH) tell a different story.

CNH has so far approved 133 work plans, requiring investment of $35.9 billion, derived from exploration and production (E&P) contracts awarded to operators between 2015 and 2018. The contracts were awarded under the framework of the reform, which ended the upstream monopoly of state oil company Petróleos Mexicanos (Pemex).

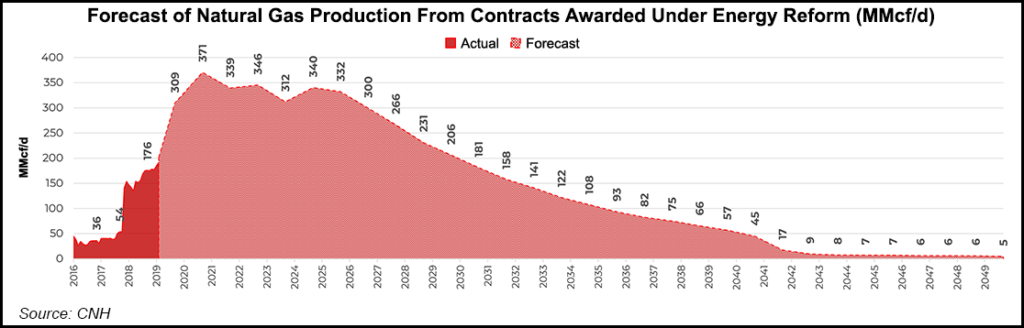

As of May, crude oil and natural gas production from the contracts totaled 74,000 b/d and 176 MMcf/d, respectively. These figures are up from 43,000 b/d and 54 MMcf/d averaged in 2018.

Oil production from these same contracts is expected to peak at 341,000 b/d in 2026, while gas output is seen reaching 371 MMcf/d in 2021.

Production growth from the contracts belies a steady drop in Mexico’s countrywide hydrocarbon output in recent years, which analysts attribute to the natural decline of Pemex’s legacy fields, and underinvestment by the state-owned giant.

A total of 112 upstream contracts were signed with operators under the reform’s framework from 2015-2018, of which 111 remain in effect. Bid rounds account for 105 of the contracts awarded. Another five resulted from the migration of oilfield services (OFS) contracts to equity stakes in areas that previously were 100% operated by Pemex. Another two contracts were the result of farmout tenders through which Pemex sought bids for operating stakes in select areas in its portfolio.

Migrated OFS contracts currently account for most of the oil and gas production from the 112 contracts. However, by 2026, projects awarded via the round 1.2 tender in 2015 will hold this distinction.

López Obrador, who took office last December, has suspended indefinitely new bid rounds, contract migrations and farmouts. Pemex’s 2019-2023 business plan, which was published last week, instead stakes its production goals on the OFS contract model typically used by Pemex prior to the reform. The contracts are known as integrated exploration and extraction contracts, or CSIEEs.

The 112 upstream contracts awarded comprise 52 onshore, 32 in shallow waters and 28 in deep waters.

Of the $35.9 billion in approved investments, $1.88 billion have been carried out so far. The approved plans include 64 exploration plans requiring $4.65 billion, 24 development plans calling for $29.5 billion and 37 appraisal plans for $1.64 billion.

A total of $4.28 billion, or 11.9% of the approved investments, are expected for full-year 2019.

A total of 638 wells have been approved via the work plans, including both exploration and development wells.

In full-year 2019, 154 wells from the approved contracts are slated to be drilled, comprising 100 development wells and 54 exploration wells. Another 124 wells are scheduled to be spudded in 2020.

Recent milestones for the awarded contracts include the conclusion of an appraisal campaign at shallow water block 7, which is operated by Talos Energy Inc. Block 7, which was awarded to a Talos-led consortium through the inaugural round 1.1 tender in 2015, was the site of the Zama discovery made in 2017. The Zama project, for which Talos and its partners plan to make a final investment decision in 2020, is thought to contain 400-800 million boe of recoverable hydrocarbons.

Italy-based Eni SpA also announced this month the start of production at the area 1 offshore project, making Eni the first international operator to produce offshore Mexico since the reform. The area 1 contract was awarded through round 1.2.

CNH in May also approved the drilling of a second appraisal well at the Trion discovery in the Perdido fold belt deepwater formation in the Gulf of Mexico.

Australia’s BHP Billiton obtained a 60% operating stake in Trion through a Pemex farmout tender in 2016, and became the first international operator to drill a deepwater well in Mexican territory in 2018.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |