Mexico’s Natural Gas Plans Include Unconventional, Deepwater Projects

The 2019-2023 business plan presented by Mexico’s state oil company Petróleos Mexicanos (Pemex) this week includes designs to develop deepwater and unconventional fields as a way to increase natural gas production.

Pemex says the Lakach deepwater gas field in the Gulf of Mexico is once again being analyzed for development. Lakach contains proved and probable resources, i.e. 2P reserves, of close to 1 Tcf. It was discovered in 2008 and saw development halted for budgetary reasons ahead of the 2013-2014 energy reform.

The business plan also includes development programs that would use horizontal and directional drilling at fields in Chicontepec, in the Tampico-Misantla Basin. Chicontepec has also seen previous development dating back to 2003, with underwhelming success.

The pillar of Pemex’s natural gas plans is the Ixachi field in Veracruz state. In June, Pemex said it would spend $6.4 billion developing the onshore, gas-rich field, with production expected to peak in 2022 at 638.5 MMcf/d.

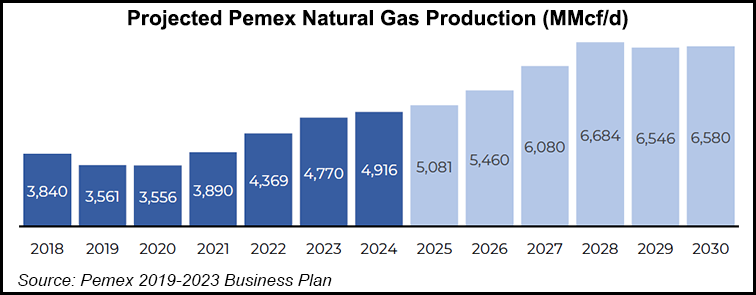

The Pemex business plan sets a production goal of 4.916 Bcf/d for 2024, from an expected average of 3.561 Bcf/d this year. Analysts however are skeptical that the plan pays enough attention to natural gas.

“My sense of the plan is that natural gas is playing second fiddle to oil once again,” Dwight Dyer, an independent energy consultant and former Energy Ministry official, told NGI’s Mexico GPI. “The Lakach deepwater project has been tried and went nowhere. Pemex is thinking of reactivating the project, but it’s a long shot. Service contracts have also been tried, and failed before.”

The Pemex business plan does not mention farmouts or new oil and gas rounds, central components of the opening of the hydrocarbons sector under the previous administration, instead favoring oilfield service contracts.

GMEC energy consultancy’s Gonzalo Monroy told NGI’s Mexico GPI that Pemex will “need to change these contracts or there won’t be any bidders. If service firms have to put down capex and opex, without access to production, it just won’t work.”

Pemex CEO Octavio Romero Oropeza said earlier this week that the business plan reduces the profit sharing tax on the company to 54% from 65% by 2021. The change should amount to savings of around $7 billion for Pemex over the course of the next two years.

But the plan also includes construction of the $8 billion Dos Bocas refinery in President Andrés Manuel López Obrador’s home state of Tabasco, along with investment in the country’s six existing refineries, which will divert resources away from exploration and production (E&P).

“What’s interesting is that the whole strategy is being driven by downstream, not upstream,” Monroy said. “This is a new strategy by Pemex.”

Monroy added that the Pemex business plan failed to detail the development of a floating storage and regasification unit (FSRU) to serve the gas-starved southeast of the country, “though we now know that is going to happen.”

Pemex attributes the shortage of gas in Mexico’s southeast to declining production and the fact that about one-half of domestic production is used for its operations and for pressure at fields. Imports, principally from Texas, currently account for around 80% of Mexico’s dry gas requirements.

Many suggest that the only way to reverse the natural gas decline in the country is by developing Mexico’s unconventional deposits. Mexico boasts 141.5 Tcf of prospective unconventional gas reserves, according to upstream regulator Comisión Nacional de Hidrocarburos (CNH), compared to 76.3 Tcf of prospective conventional reserves.

Although López Obrador has been adamant that Mexico will not allow hydraulic fracturing (fracking) in the country, the Pemex business plan includes unconventional projects.

“Unconventionals are moving forward with seven pilot projects in different basins,” Monroy said. “But all these hopes reside in relaunching Chicontepec. This could really be a make or break situation. What we do know is that the first effort there didn’t work out.”

Even if domestic production does increase to around 5 Bcf/d by 2024, “new production will only cover new consumption and imports will remain practically the same,” Commissioner Héctor Moreira of the country’s CNH said earlier this year. “We expect a big increase in production but not enough to change the import picture.”

Monroy doesn’t think the Pemex business plan was a sign that the current administration would dismantle the energy reforms of 2013-2014, as some analysts have suggested.

“I think the new administration will keep things in place, just in case they have to revert back to some of the market openings to meet their production goals,” he said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |