E&P | NGI All News Access | NGI The Weekly Gas Market Report

Mexico’s CNH Approves $339M Pemex Oil, Gas Development Plan in Campeche Bay

Mexico’s Comisión Nacional de Hidrocarburos (CNH) has approved a development plan submitted by the upstream unit of national oil company Petróleos Mexicanos (Pemex) for the Cheek shallow water field in Campeche Bay.

Discovered in 2015, Cheek (pronounced check) is one of 20 fields, comprising 16 offshore and four onshore, in southeastern Mexico that Pemex is prioritizing in order to increase hydrocarbon output in the short-term.

The Cheek plan calls for investing $339 million starting this year through 2030. Pemex expects the project to produce 18.68 million bbl of oil and 14.89 Bcf of natural gas over that span.

The twist is that most of the output is seen occurring in the project’s first few years, according to a presentation shown to CNH commissioners last Thursday. Oil production from Cheek is forecast to surpass 18,000 b/d by 2020, then plunge to 2,000 b/d by 2024.

Discovered in 2015, Cheek is “not considered a very large field, but it can contribute toward rapidly increasing production,” CNH commissioner Alma América Porres Luna said.

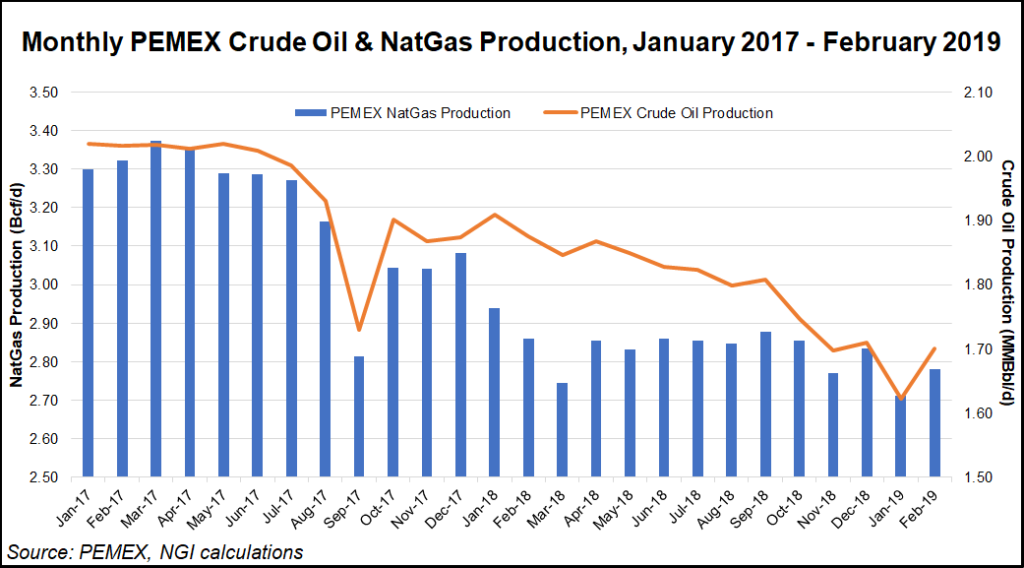

President Andrés Manuel López Obrador campaigned on a pledge to “rescue” the heavily indebted Pemex, which in January reported its lowest monthly oil output since at least 1990. The decline in both oil and associated gas production has been driven mainly by the once-mighty Cantarell offshore field, also located in Campeche bay.

CEO Octavio Romero Oropeza said in December that Pemex expects the 20 high-priority fields to add 73,000 b/d of oil production by December 2020. To date, Pemex has submitted development plans for four of these fields, all of which obtained approval. These four comprise Xikin, Chocol, Esah and Cheek.

Xikin and Esah, which Pemex said in October were transitioning to the production phase, are expected to supply peak natural gas production of 91 MMcf/d and 9 MMcf/d, respectively.

The most important of the 20 fields from a natural gas perspective is the onshore Ixachi field in Veracruz state, which contains estimated 3P (proved, probable and possible) hydrocarbon reserves of more than 1 billion boe and is expected to supply peak natural gas output of 700 MMcf/d.

Romero Oropeza said last month that Pemex had stabilized its oil and gas output slide, and that it expected production to begin rising again this year. He and López Obrador have said that oil production is expected to reach 2.4 million b/d by 2024, up from 1.68 million b/d averaged in February.

Experts have expressed skepticism about the viability of this goal, especially given that López Obrador has suspended oil and gas bid rounds for three years. The suspension of the rounds is especially critical from a natural gas perspective, since Pemex’s upstream plans for the coming years prioritize crude oil, a more profitable business for the firm, especially given Mexico’s proximity to the highly competitive U.S. gas market.

CNH awarded Pemex the rights to develop Cheek via the Round Zero process in August 2014, a process through which Pemex was awarded 83% of Mexico’s 2P (proved and probable) oil and gas reserves.

Under the law, Pemex must fulfill minimum work requirements at each allocated area or return it to the state.

In an op-ed published recently by local paper El Economista, Pablo Zárate of the Pulso Energético think tank pointed out that as of September 2018, Pemex only had activity at 142 of its 417 allocations.

In August 2014, Pemex’s Round Zero acreage contained 20 billion boe of 2P hydrocarbon reserves, and was producing 2.5 million b/d of crude, Zarate said. By last November, those figures had fallen to 14 billion boe and 1.6 million b/d, respectively.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |