‘Good Rocks’ Swaying Chevron’s Push in Permian, Says CEO

Chevron Corp.’s executive team laid out a broad strategy for global oil and natural gas prospects for the next few years, but the biggest draw remains close to home, the Permian Basin.

During the annual analyst security meeting in New York City Tuesday, CEO Mike Wirth held court with his coterie of executives to discuss what’s ahead for the California-based supermajor.

“We’ve refocused our investment priorities,” Wirth said, “and expect 70% of this year’s spend to deliver cash flow within two years.”

Chevron in December earmarked $20 billion for 2019 organic capital and exploratory (C&E) spending, a near-$2 billion boost year/year, with $7.6 billion specifically targeting the U.S. upstream. Between 2021 and 2023, annual C&E now is set at $19-22 million.

The ratable investment should deliver steady growth, according to upstream chief Jay Johnson. “We expect to deliver a 3-4% compound annual production growth rate through 2023. Our strong resource base gives us the flexibility and choices that allow us to fund the projects we believe will yield the best returns.”

Chevron’s best returns are in the Permian, Wirth said. Asked why, he had a simple explanation.

“It’s good rocks.”

The company’s position in the Permian Basin “just continues to get better and underpins the depth of our resource base. Today, we are updating our assessment of resource to 16.2 billion unrisked boe, up about 75% from a little over 9 billion boe just two years ago.

“Continued appraisal success, improved drilling and completion performance, ongoing land optimization and ever improving technology have allowed us to characterize more benches and increase our inventory of resource. The same drivers have also increased the economic value of our acreage.”

Based on Chevron’s valuation models, its Permian position has more than doubled using the same price assumptions, Wirth said. Based on what Chevron has determined to date, he expects to see other operators also find more compelling value from their Permian leaseholds.

“I believe you will see a dramatic re-rating of this asset,” Wirth told analysts.

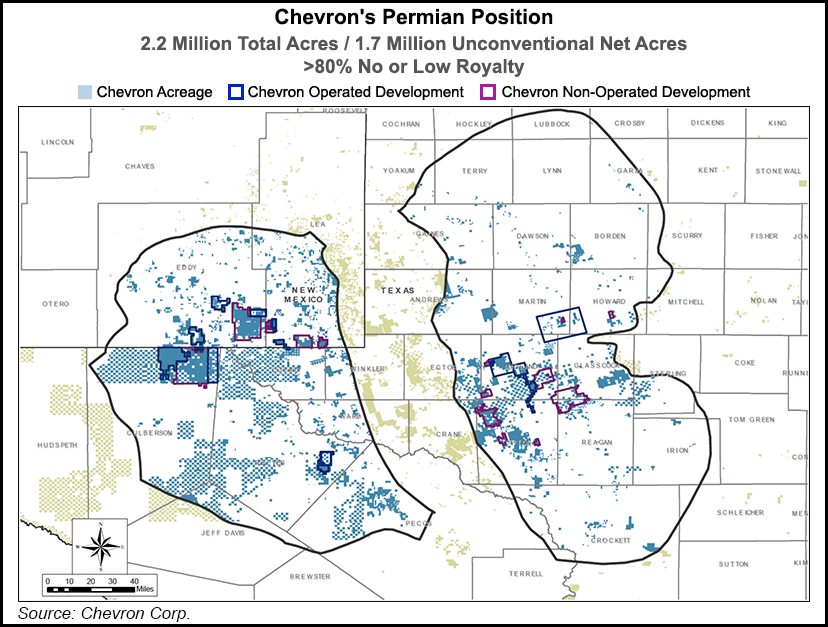

The company’s unique position in the Permian is “characterized by long-held acreage, zero-to-low royalty on more than 80% of our land position, and minimal drilling commitments,” Johnson said. These attributes, as well as deploying better technologies, are driving higher returns, stronger cash flows, and increased value.

Last year Chevron gained 150,000 more acres to its Permian leasehold through swaps, joint ventures and farmouts, which provided room to add 1,600 long-lateral wells.

In the Delaware sub-basin, the average estimated ultimate recovery for wells put online last year was 2 million boe, while in the twin Midland it was 1.3 million boe.

Chevron is guiding for a fleet of 20 operated rigs in the Permian, as well as seven to 10 net nonoperated rigs over the period.

As a side note, ExxonMobil Corp. on Tuesday said it plans to produce more than 1 million boe/d from the Permian by as early as 2024, an increase of nearly 80%, by running 48-55 rigs. Its annual investor day is scheduled for Wednesday.

In addition to the Permian, Chevron also is working on shale and tight assets in Canada, Appalachia and Argentina, using learnings from the Permian to reduce costs.

LNG In Australia…And Beyond?

A major natural gas endeavor is centered in Australia, where its two mega-liquefied natural gas (LNG) projects, Gorgon and Wheatstone, are moving gas to Asia Pacific markets. Gorgon and Wheatstone now have five trains between them. By using a systematic approach to increase the reliability, utilization and plant capacity, an initial 2% increase was made in capacity at Gorgon and 6% at Wheatstone. The two facilities in the final three months of 2018 produced just under 400,000 boe/d, he noted

In addition, Chevron has an estimated 50 Tcf-plus of discovered equity resource offshore Western Australia, Johnson said.

“Ultimately, we see an interconnected basin with shared infrastructure as the best development option for all stakeholders, much as we see in the U.S. Gulf of Mexico.”

Chevron has other projects that could be put into the queue as well, including quiet progress underway on the long-held export proposition in Kitimat, which would be sited in British Columbia.

In the deepwater portfolio of the U.S. offshore, Chevron last year ramped production from the Stampede facility, the Tahiti Vertical Expansion, Jack, St. Malo Stage 3 and Big Foot. The domestic operations increased almost 10% from 2017, Johnson noted, with operating costs today less than $10/boe — about half of what they were in 2014.

“For new opportunities such as Anchor, Ballymore and Whale, we’re targeting $16-20 unit development costs, which is roughly a third lower” than previous greenfield deepwater investments, he said. Technologies in the deepwater also are proliferating, along with subsea tiebacks, which use existing infrastructure to tie into new discoveries.

What the executives made clear is that Chevron does not need to sanction any major capital projects for the next five years, but it has many options to do so if it wants. By the end of 2023, resources in hand are forecast to contribute around 1.5 million boe/d of new production.

“With the majority of our new production coming from shale and tight assets, our growth is disciplined and ratable with lower risk,” Johnson said.

Chevron expects to reach $30 billion of cash generation at $60/bbl Brent oil prices in 2019, which would be used to fund C&E, as well as a 6% annual dividend increase and $4 billion in share repurchases.

“Chevron is operating from a position of strength,” Wirth said. “The balance sheet is strong. Our dividend breakeven is low. We’re disciplined with capital. And we’re generating strong free cash flow. Chevron has an extremely compelling investment proposition that is going to continue over the long-term.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |