E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Encana Adds Anadarko Basin to ‘Core Three’ with Montney, Permian

Encana Corp. has trimmed its total workforce by 15% and reduced its executive ranks by 35% only one week after completing its takeover of U.S. rival Newfield Exploration Co., the CEO said Thursday.

The Calgary-based independent is on track to keep its vow to improve annual savings by $250 million following the estimated $7.7 billion stock-and-debt takeover, CEO Doug Suttles said during a conference call to discuss quarterly results. The transaction was completed last week.

“Eight days — once again, eight days — after closing, we completed reorganizing the combined company,” Suttles said. “The senior team of the combined company today is smaller than Encana’s senior team was before the merger.”

No exact figures were provided about how many people lost their jobs. Newfield last year reported it had 1,010 employees, almost all U.S.-based, while Encana had 1,160 based in Canada and 950 in the Lower 48. A 15% reduction in staff would equate to nearly 470 layoffs.

Suttles said the employee cost reductions would account for about one-half of the annual savings, with the other half to come by reducing at least $1 million from the cost of each future unconventional well drilled in the Anadarko Basin of Oklahoma, which was Newfield’s playground.

The streamlined organizational structure is designed to surpass an original target of $125 million in annual general and administrative cost savings.

“Encana delivered in 2018, posting another strong year of performance,” Suttles said. “Our results demonstrate the strength of our portfolio and the ability of our people to continually innovate to drive industry leading performance in all areas where we operate. Our business model is sustainable and capable of generating a unique combination of profitable liquids growth and free cash flow that can be returned to shareholders in today’s commodity price environment.”

Total production in 4Q2018 was 403,400 boe/d, a sharp increase from 335,200 boe/d in 4Q2017. Liquids output climbed more than 25% to 192,700 b/d.

During 2018, Encana produced 361,200 boe/d, with liquids output up 30% to 168,100 b/d.

The plan this year is to increase liquids output by another 15%. Newfield was not included in the results, but Encana said average production was around 200,000 boe/d in 4Q2018, including liquids production of 125,000 b/d-plus. Newfield’s full-year production averaged nearly 195,000 boe/d, 62% liquids.

Combined Encana/Newfield full-year 2018 production averaged more than 555,000 boe/d, including liquids production of 290,000 b/d.

Encana has set its targets using mid-to-low $50/bbl West Texas Intermediate prices.

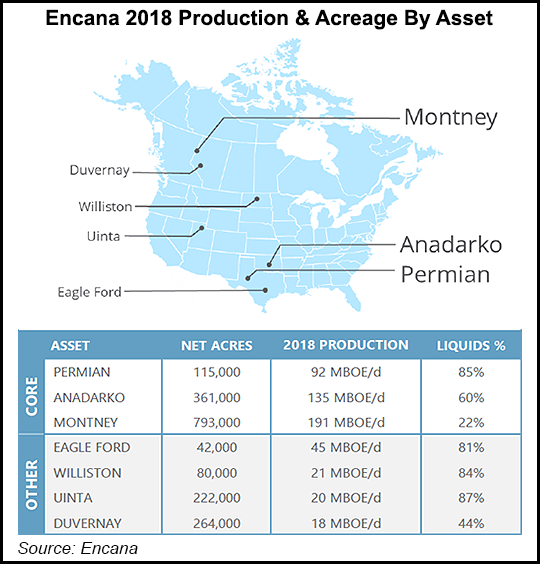

The exploration priorities have been adjusted with the Newfield purchase. The Anadarko has been bumped into a “core three,” with he Permian Basin and Montney formation in Western Canada, Suttles said, as those three areas produce more oily liquids and less natural gas than other prospects in the portfolio.

Nearly 75% of total capital spending this year — $2.7-2.9 billion — is to be directed to the three plays.

Encana of late had been focused on a “core four,” which included Canada’s Duvernay. The producer also still holds a bundle of opportunities across Canada and the Lower 48 from which it may select to develop or sell.

The three new core plays, including Newfield’s production, during 4Q2018 averaged 465,000 boe/d, 49% liquids. For the full year, pro forma output from the three plays comprised 75% of total production for Encana-Newfield, averaging 418,000 boe/d (48% liquids).

Even without Newfield, however, Encana output grew in the Permian, Montney and the Anadarko portfolios.

Permian production in 4Q2018 averaged 98,500 boe/d, 85% weighted to liquids. For the year, Permian production increased 19% over 2018. Encana has now drilled and completed more than 500 net wells and nearly tripled production since entering the Permian in late 2014.

In the Montney, Encana produced 220,000 boe/d on average in 4Q2018. For the year, Montney liquids production grew 116% to 41,700 b/d. Thirty-nine net wells were turned to sales in the final quarter and have since averaged more than 500 b/d for the first 90 days of production.

Fourth quarter production from Encana’s Anadarko holdings averaged more than 146,000 boe/d, 60% liquids. Full-year production increased 35% from 2017 to nearly 135,000 boe/d.

“Our focus today has moved to operations where we are applying our core competencies in cube development, optimized completions and using our proven supply chain management practices to rapidly reduce Anadarko well costs by at least $1 million per well,” Suttles said.

Using Canadian protocol, Encana said its 2018 proved and probable reserves, i.e. 2P, climbed 64% year/year to 3.1 billion boe, and it replaced 1,063% of full-year production, excluding sales. Using U.S. protocol under Securities and Exchange Commission (SEC) rules, proved reserves (1P) grew 53% from 2017 to 1.2 billion boe, replacing 437% of full-year production, excluding sales.

Proforma 2P reserves at the end of 2018 totaled 4.4 billion boe, while pro forma (56 percent liquids) and proforma SEC reserves (1p) were 2.0 billion boe.

Under the 2019 pro forma outlook, liquids are expected to comprise more than half of total production. Full-year liquids output is forecast at 300,000-320,000 b/d, with total production estimated at 560,000-600,000 boe/d.

Encana’s net profits climbed to $1.03 billion ($1.08/share) in 4Q2018, turning around from a year-ago loss of $229 million (minus 24 cents). Operating earnings totaled $305 million (32 cents/share) versus $114 million (12 cents) in 4Q2017. Revenue nearly doubled to $2.38 billion from $1.21 billion.

For 2018, Encana earned $1.07 billion ($1.11/share), versus $827 million (85 cents) in 2017. Revenue climbed to $5.94 billion from $4.44 billion.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |