Infrastructure | LNG | NGI All News Access | NGI The Weekly Gas Market Report

Anadarko-Led Mozambique Project Inches Forward as More LNG Purchasers Step Up

Three top global natural gas buyers, including Royal Dutch Shell plc, have signed on as foundation customers for the proposed Anadarko Petroleum Corp.-led Mozambique liquefied natural gas (LNG) export project, moving it closer to a final investment decision (FID) this year.

Shell International Trading Middle East Ltd. in its sales and purchase agreement (SPA) agreed to take 2 million metric tons/year (mmty) from Mozambique LNG1 Company Pte Ltd. for 13 years. Tokyo Gas Co. Ltd., the largest city gas provider in Japan, and Centrica LNG Co. Ltd., a subsidiary of UK-based Centrica Ltd., agreed to jointly purchase 2.6 mmty from the startup of production until the “early 2040s.”

Tokyo Gas and Centrica had previously signed a nonbinding heads of agreement to take gas from the project.

The twin deals announced Tuesday follow last week’s SPA with CNOOC Gas and Power Singapore Trading & Marketing Pte. Ltd., which agreed to buy 1.5 mmty for 13 years, also making it a foundational customer.

The new SPAs build upon “previously announced deals and takes our total long-term sales to more than 7.5 mmty, with additional deals expected in the near future,” said Anadarko Executive Vice President Mitch Ingram, who oversees international, deepwater and exploration.

Shell’s deal, “combined with Mozambique LNG’s significant resource and favorable geographic location, create a unique opportunity to provide customers with a long-term, reliable supply of clean energy,” Ingram said. “We are confident that through this deal, LNG from Mozambique will find its way to a diverse number of markets across the globe.”

Of the Tokyo Gas-Centrica agreement, Ingram said it helps with the “Japanese government’s desire for competitively priced and flexible long-term supply of LNG to proactively manage demand fluctuations in their home markets and enhance the nation’s energy security.

“We expect to announce additional SPAs in the near future, as we continue to make demonstrable progress toward taking a FID in the first half of this year.”

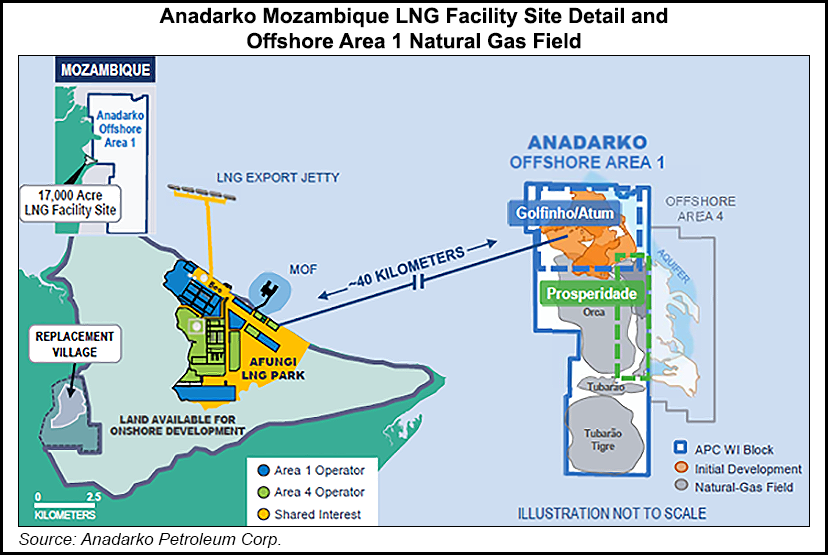

Mozambique LNG would be the country’s first onshore LNG development, initially consisting of two trains with total nameplate capacity of 12.88 mmty to support developing the Golfinho/Atum fields that are within Offshore Area 1.

Eni SpA and ExxonMobil Corp. last year sanctioned the separate Coral South LNG export project in Mozambique, which together with Anadarko’s could make the southeastern African nation the world’s fourth-largest gas exporter.

The deal “represents the first long-term LNG procurement contract in Africa for both Tokyo Gas and Centrica in line with ongoing efforts to further diversify their respective portfolios of LNG sources” to improve the liquidity and further develop the global LNG market,” Anadarko noted.

“This first-ever joint procurement between Tokyo Gas and Centrica is supported by the long-term mutual relationship to strive for flexible and innovative LNG transactions between the European and Asian markets,” Tokyo Gas CEO Takashi Uchida said. “This joint procurement represents the significant progress we are making toward securing the most competitive LNG.” He noted that this year marked the 50th anniversary of when Tokyo Gas received Japan’s first LNG cargo from Alaska in 1969.

Centrica Group CEO Iain Conn said the co-purchase agreement “deepens our strategic partnership with Tokyo Gas and provides a flexible LNG supply source able to serve the needs of our combined customer base. With strong energy marketing and trading capabilities we are ideally placed to work with Mozambique LNG, and this agreement will complement our existing positions as we continue to develop this valuable growth area of our business.”

Anadarko Moçambique Ãrea 1 Lda operates Offshore Area 1 with a 26.5% working interest. Co-venturers include ENH Rovuma Ãrea Um SA (15%), Mitsui E&P Mozambique Area1 Ltd. (20%), ONGC Videsh Ltd. (10%), Beas Rovuma Energy Mozambique Ltd. (10%), BPRL Ventures Mozambique BV (10%) and PTTEP Mozambique Area 1 Ltd. (8.5%).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |