CNX Plans to Stay Nimble in Case Natural Gas Outlook Improves

CNX Resources Corp. on Thursday signaled a cautious approach for its operations this year, laying out a flexible plan for “minimum” activity that could increase if the outlook for natural gas improves in the coming months.

CNX is the latest of the Appalachian crop to exercise restraint as the broader market is again expected to be flooded with gas this year. That dynamic is weighing on longer-term prices. Shareholders too are keeping a close eye out for better returns and capital discipline. So far, EQT Corp., Antero Resources Corp., Gulfport Energy Corp. and Chesapeake Energy Corp. are among the leading Appalachian operators that have responded with plans to reduce activity or spending.

For its part, CNX’s management team said the company would keep both spending and production volumes relatively flat. Drilling and completion spending has been set at $575-625 million, while overall spending, including land, water and midstream costs are pegged at about $1 billion. That figure is roughly in line with 2018 spending. CNX Midstream Partners LP is also responsible for more than $200 million of this year’s consolidated budget.

Production for the year is forecast at 495-515 Bcfe, or a 5% year/year increase based on the midpoint when compared with 2018 volumes of 480 Bcfe from retained assets. The company divested shallow oil and gas assets along with some Utica Shale joint venture acreage last year.

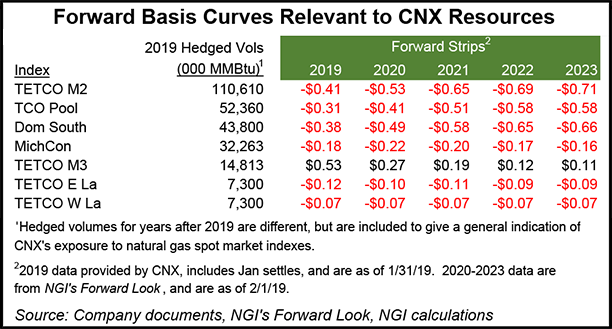

Management stressed, however, that their plans for the year are merely a floor to work from. “We have a solid minimal level of activity, which is largely hedged,” said CEO Nicholas Deluliis, who added that “we consciously set up the business so we don’t commit ourselves beyond that, and we’ve got the flexibility to do more if and when we deem it appropriate.”

Andrea Passman, senior vice president of engineering and operations, told analysts during a call to discuss year-end earnings on Thursday that the company would continue utilizing the four rigs and three completion crews that it had working at the end of 2018. She said CNX would employ that fleet as needed, but indicated for now that the company sees no need to pursue additional activity.

Production jumped again in the fourth quarter to 136 Bcfe, up 14% from both the year-ago period and 3Q2018. CNX also set a new daily volume record during the quarter when production reached 1.64 Bcfe/d The Marcellus Shale drove the period’s volumes, accounting for 87 Bcfe, while the company produced 34.1 Bcfe in the Utica Shale.

For the full year, some of which included volumes that have now been divested, CNX produced 507 Bcfe, up 25% from 2017.

Deluliis also said this year’s plans would depend on how Utica development evolves. CNX, the CEO reminded analysts, could potentially allocate billions of dollars in capital to the play over the coming years. The company has been increasingly focused on the formation. Deluliis cautioned that developing the company’s 652,000 acre position on a wider scale in a way many others have not — in both Ohio and Pennsylvania — carries with it a risk.

“We’ve seen that with pioneers in other shale fields like the Barnett, as well as, frankly, in our basin, with the Marcellus,” he said. “So, we want to be judicious and astute in how we allocate capital from the get-go.”

Management also has previously talked at length about the “stacked pay factory” it envisions for the future. In particular, CNX has discussed how well pads that target both the Marcellus and Utica, or even the Upper Devonian shales and the Point Pleasant formation in places like southwest Pennsylvania, may redefine field economics and its priorities.

Passman described a “methodical and steady” program in the Utica that continues driving the company up “the learning curve” as 2019 gets underway.

At the Shaw pad in Westmoreland County, PA, the company experienced a pressure anomaly during hydraulic fracturing on a well there earlier this week that forced crews to stop all operations and evaluate the cause. While it’s not the first time the company has hit snags in the Utica in either state, the incident demonstrates the challenges ahead in the deep, dry Utica of Pennsylvania, where the company drilled its first Utica well in 2014.

To the south of the Shaw pad is the Bell Point 6 deep Utica well, which Passman said is performing in line with the company’s type curve, holding steady at 21 MMcf/d since October, which she said is “bigger than any well that I ever saw when I worked onshore in the Gulf of Mexico.”

CNX drilled its longest lateral ever in the Marcellus during the fourth quarter at a length of 15,000 feet. The company also laid out plans on Thursday to construct a 24-mile water pipeline that would deliver 120 barrels per minute from the Ohio River in West Virginia to its Richhill area in southwest Pennsylvania. The project would help further reduce costs associated with truck transport if it comes online in 4Q2019 as anticipated.

The company reported net income of $102 million (50 cents/share) for the fourth quarter, compared to net income of $277 million ($1.21) in the year-ago period. Revenue came in at $435.4 million, compared to $477 million over the same time.

Full-year net income was $799.5 million ($3.71), compared with $380.7 million in 2017. Revenue was $1.7 billion versus $1.5 billion for the same period.

CNX said its average sales price during 2018 was $2.97/Mcfe, compared with an average sales price of $2.66/Mcfe in the prior year.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |