Bakken Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Abraxas Bolting On in Permian Delaware, Scrutinizing Value of Bakken

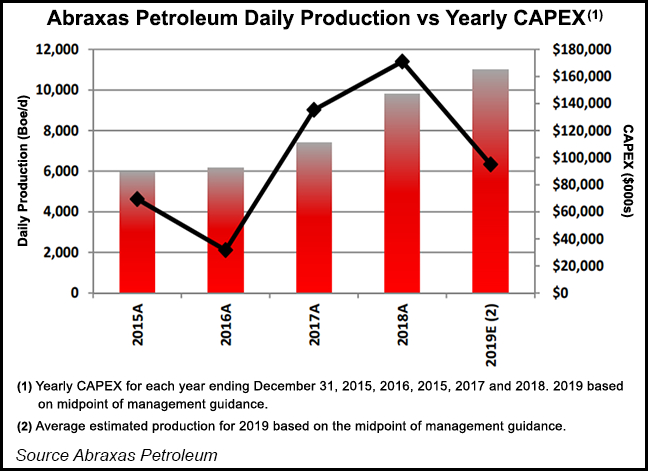

Lower 48-focused independent Abraxas Petroleum Corp. late Monday revised its 2019 capital budget to $95 million, down from previous guidance of $108 million, based on the “current commodity price environment and the company’s focus on capital efficiency.” However, there are plans to bolt on more acreage in the Permian Basin.

The San Antonio, TX-based explorer, whose focus today is the Permian and Williston basins, said the revised budget is designed to produce free cash flow (FCF) under current commodity prices, with limited impact on future production growth. The FCF would be used to pay down debt. The budget for 2019 also includes $10 million for additional leasing and infrastructure in the Delaware sub-basin of the Permian.

Spending this year would be sharply down from 2018 when Abraxas spent $171 million, above original guidance of $140 million. More was spent than planned because of bolt-on acquisitions in the Delaware. In addition, the planned sale of Eagle Ford Shale assets did not close in 2018, and the anticipated proceeds had been included as a credit in the original net $140 million budget.

In the Bakken, an asset that is under review to possibly sell, 2018 sales averaged 9,811 boe/d, with 4Q2018 sales averaging 10,498 boe/d and December sales averaging 11,427 boe/d. The yearly average, while 33% higher than in 2017, was slightly below the low end of guidance of 10,000 boe/d, in part because of operational issues.

During 4Q2018 production was off by an estimated 1,085 boe/d because of fracture protection and gas flaring in the North Dakota leasehold.

“The fracture protect protocol is behind us, but the flaring is unacceptable,” management said. “We have begun a high priority project to find an alternative to conserve this currently flared gas.” One drilling rig has been shut down until spring “to not only conserve our budget, but also to give us time to resolve the flaring issue.”

In anticipation of future offset fracture operations, Abraxas has incorporated into 2019 production guidance an estimate of production shut-ins, as well as an estimate for future gas flaring, with average output estimated at 10,500-11,500 boe/d. At the midpoint, production would be 12% higher year/year.

All wells in the Bakken are on production except for one recently completed well, which is waiting on equipment and weather. The newer wells in the Bakken continue to produce under voluntary choke restrictions, management said, because differentials improved from $21-plus in December, to under $9 for January and to under $6 for February.

Plans this year are to drill and complete 4.3 net wells and complete one net well in the Bakken.

Abraxas has engaged Petrie Partners LLC to assist in identifying and assessing options for the Bakken holdings, which management said could lead to a sale.

“Operations are running very well despite challenging weather this time of year,” CEO Bob Watson said. He noted that one of his highest priorities “is to crystalize the value of our Bakken assets in our share price…We are willing to consider a wide range of options for this asset.

“If the process results in an outright sale for cash, the proceeds would be used to significantly pay down or fully retire our debt, to fund our Raven rig in the Delaware until it reaches free cash flow status, and to possibly buy back shares.”

Meanwhile, Abraxas is building its portfolio out in the Delaware, where net acreage now is about 11,130 acres, nearly all held by production.

Plans are to drill and complete 4.75 wells this year and complete 1.9 other wells.

Specifically in the West Texas counties of Ward and Winkler, Abraxas is drilling in the lateral on the initial well on its Hackberry pad, and the rig moves next to the two-well Woodberry pad. Fracture operations also are scheduled to begin by mid-February on the two-well Creosote pad.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |